In its 2023 financial report, Kazakhstan-based Kazatomprom, the world’s leading uranium miner, has revised its production and sales guidance for the year 2024 due to various challenges affecting its operations.

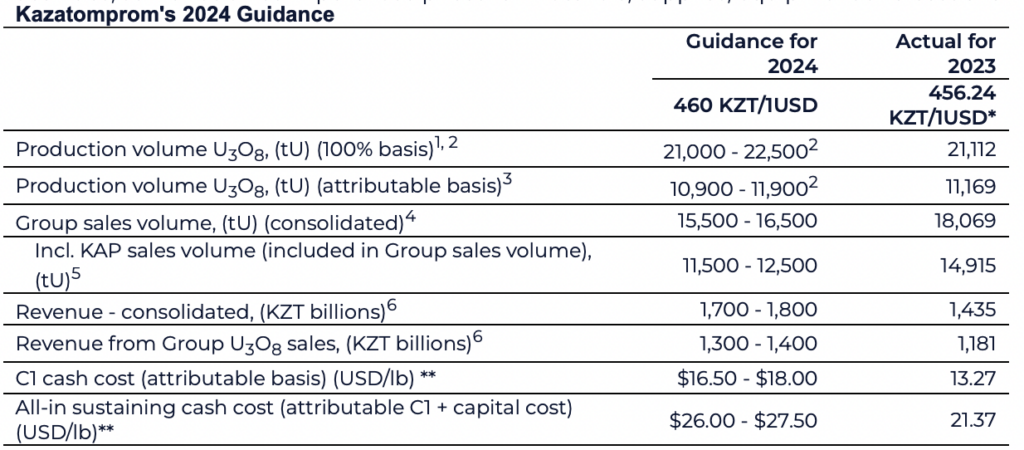

The company initially announced intentions to produce between 25,000 and 25,500 tonnes of uranium on a 100% basis in 2024. However, it now expects production to fall within the range of 21,000 to 22,500 tonnes on a 100% basis, with 10,900 to 11,900 tonnes on an attributable basis. Delays in construction at newly developed deposits and challenges related to the availability of sulphuric acid have prompted adjustments to these projections.

Just listening to the Kazatomprom $KAP #uranium telephone conference. It becomes clear that the problems with sulfuric acid are expected to continue, the market is very insecure. Theor own production faces delays, and it seems also Uzbekistan has problems, at least KAP cannot… https://t.co/YuPgWcr643

— Anders (@Swedish_uranium) March 15, 2024

Earlier this year, the uranium firm disclosed that its 2024 production plans are expected to face adjustments due to challenges related to the availability of sulphuric acid, a critical operating material.

Back in August 2022, Kazatomprom’s board of directors approved an ambitious plan to increase production volumes in 2024 to 90% relative to subsoil use agreements. However, throughout 2023, the company consistently highlighted the risks associated with ramping up production, citing challenges related to global supply chains and the limited availability of key operating materials and reagents. Despite their best efforts to secure supplies, the situation around sulphuric acid in Kazakhstan and the region is evolving.

To address the sulphuric acid supply issue, Kazatomprom has secured relevant volumes to meet its 2024 production guidance, albeit at levels around 20% below Subsoil Use Contract levels. However, uncertainties stemming from construction delays may impact the company’s forecast operating performance for the year.

In terms of sales volume, Kazatomprom’s guidance for 2024 aligns with its market-centric strategy. The company expects group sales volumes to be between 15,500 and 16,500 tonnes of uranium, including sales of between 11,500 and 12,500 tonnes by Kazatomprom itself. This decrease in sales volume guidance compared to 2023 is attributed to higher sales of enriched uranium products to Ulba-FA LLP, aimed at ensuring sufficient inventory levels for future periods.

Kazatomprom also anticipates potential fluctuations in revenue and cash costs due to factors such as exchange rate fluctuations, spot market price increases for U3O8, and procurement and supply chain issues. The company will update its guidance if uncertainties persist throughout 2024.

Furthermore, Kazatomprom’s total capital expenditures for 2024 are expected to increase significantly compared to 2023, covering various expenses including purchase prices for materials, supplies, equipment, drilling costs, and development costs for mining infrastructure.

AISC and capex both guided up 25%. A chunk of the AISC is from increased taxes to be clear. But anyway you slice it that doesn't look like they're gonna close the 2025 delta between planned production and actual.$KAP

— Nick Jones (@Grainjones) March 15, 2024

“Another Kazatomprom-sized supply source will be needed”

CEO Meirzhan Yussupov emphasized the company’s robust standing in the global uranium market amidst significant volatility in 2023. The chief executive highlighted a notable increase in demand for nuclear power as a stable, low-carbon energy source, underscoring uranium’s critical role in achieving global sustainability goals.

“With Kazakhstan accounting for about 40% of the world’s uranium production on an annual basis, we’re proud that at least every third nuclear reactor in the world runs on Kazakh uranium,” he said in a statement.

Throughout 2023, the company said it constantly monitored sanctions updates and developed action plans to minimize potential negative impacts on its operations. Despite the geopolitical landscape, events in Ukraine have not significantly affected Kazatomprom’s financial position, according to the firm.

“The majority of the Group’s revenues are received in US dollars, and financing is also raised in US dollars, creating a natural hedging effect against currency risks,” the firm said.

Measures were also taken to avoid engagement with sanctioned Russian banks, ensuring financial stability. The company’s contract for uranium processing with Uranium Enrichment Center JSC, a Russian entity, remains under scrutiny.

“The Group exports goods through Russia, which creates risks associated with both transit through Russia and the delivery of goods by sea; logistics restrictions may also increase the cost of imports… At the date of the Group’s financial statements, there are no restrictions on the Group’s activities related to the supply of the Group’s products to end customers,” the company claimed.

Moreover, Kazatomprom said it holds permission to transit uranium via the Trans-Caspian International Transport Route, mitigating risks associated with alternative routes.

In late December, the US House of Representatives passed legislation prohibiting the import of Russian enriched uranium products starting from 2028. The company said this development is unlikely to affect it, given its primary focus on natural uranium production.

“Whether shipped by Kazatomprom or its JV partners, Kazakh-origin uranium retains its origin until its arrival at a conversion facility,” the firm added.

However, looking ahead, Yussupov highlighted the need for additional supply sources to cover uranium requirements post-2030, especially amid geopolitical uncertainties, inflationary pressures, and supply chain challenges. He highlighted that “decisions to restart idled capacity and launch new production… will not be sufficient.”

“In the current pricing environment another Kazatomprom-sized supply source will be needed to cover future market needs,” the chief executive said.

As a national operator, Kazatomprom remains focused on exploring new uranium deposits and replenishing its resource base to meet growing market needs and ensure reserve replenishment.

2023 results

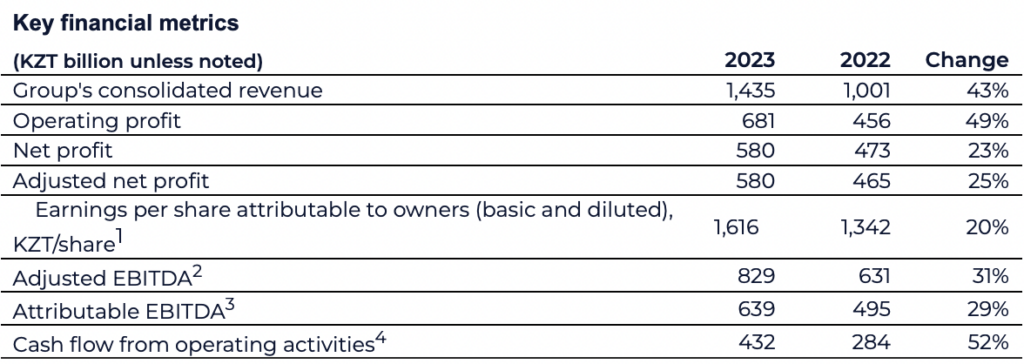

Reflecting on the financial performance of 2023, Yussupov pointed out Kazatomprom’s exceptional resilience. Despite a modest year-on-year increase of slightly more than 20% in the average annual uranium price, the company’s consolidated revenue reached KZT 1,434,635 million in 2023, marking a substantial increase of 43% compared to 2022.

“These impressive results reflect the considerable improvement in the uranium market over the past year as well as the company’s strong position of the largest seller and lowest cost producer globally,” the chief executive said.

Operating profit saw a significant boost, reaching KZT 680,812 million, up by 49% from 2022. This increase was primarily driven by higher revenue. Net profit also experienced notable growth, reaching KZT 580,335 million, an increase of 23% compared to the previous year.

Adjusted EBITDA and attributable EBITDA showed increases of 31% and 29% respectively, compared to 2022. These improvements were mainly driven by higher operating profit on the consolidated level and increased EBITDA of joint ventures and associates.

Operating cash flows surged to KZT 432,225 million, a substantial increase compared to KZT 283,859 million in 2022. This increase can be attributed to higher cash receipts from customers, although it was partially offset by decreases in VAT refunds and increases in other taxes paid.

On the expenditure side, the cost of sales totaled KZT 671,862 million, up by 41% compared to 2022. This increase was primarily due to higher production costs, increased sales volumes of U3O8, and higher costs for purchased uranium.

Selling expenses increased significantly to KZT 28,851 million, mainly due to higher sales volumes and increased shipments through the Trans-Caspian International Transport Route. General & administrative expenses also increased, including compensation payments to the government and provisions for compensation payments related to certain agreements.

In terms of liquidity, Kazatomprom maintained strong financial flexibility with total cash at KZT 211,920 million and undrawn borrowing facilities totaling KZT 115,004 million at the end of 2023.

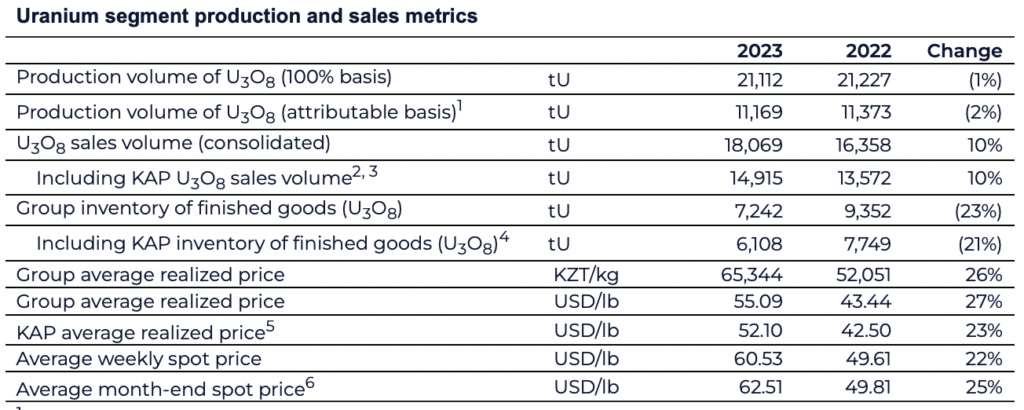

Production volumes, both on a 100% and attributable basis, remained slightly lower throughout 2023 compared to 2022, ending at 21,112 uranium tonnes compared to last year’s 21,227 tonnes on 100% and 11,169 tonnes compared to last year’s 11,373 tonnes on attributable basis. This was attributed to a marginal decrease in the production plan for 2023.

In contrast, sales volumes increased in 2023, primarily due to additional requests from customers within existing contracts and new long-term contracts. Uranium sales volume came in at 18,069 tonnes for the year compared to last year’s 16,358 tonnes.

The company’s consolidated inventory of finished U3O8 products decreased by 23% compared to 2022, largely due to increased sales volumes, ending at 7,242 tonnes from last year’s 9,352 tonnes.

Average realized prices in 2023 saw a notable increase, reaching KZT 65,344 per kg (US$55.09 per pound), up by 26% compared to 2022. This increase was attributed to the rise in the average spot price for uranium products.

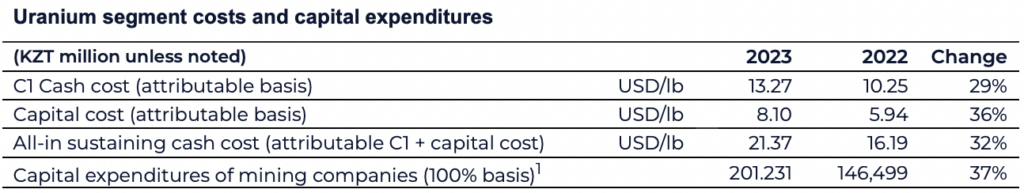

However, production costs also increased in 2023, with C1 Cash cost (attributable) rising by 29% and all-in-sustaining cash costs (AISC) increasing by 32% compared to 2022. These increases were primarily due to changes in MET tax expenses calculation methodology, inflationary pressures, and rises in capital costs.

Capital expenditures for mining companies totaled KZT 201,321 million in 2023, marking a 37% increase compared to 2022. This increase was driven by shifts in wellfield development activities and rising purchase prices for materials, supplies, equipment, and drilling costs.

As the national atomic company in the Republic of Kazakhstan, Kazatomprom’s primary customers are operators of nuclear generation capacity. The principal export markets for the group’s products include China, South and Eastern Asia, Europe, and North America.

Information for this story was found via the sources mentioned within the article. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.