Liberty Health Sciences (CSE: LHS) last night announced that it has entered into a memorandum of understanding in connection with a class action lawsuit filed against the firm in 2019. The memorandum has resulted in the company agreeing to pay out US$1.8 million to settle the claims alleged in the class action, with the company making no admission or finding of liability in relation to the settlement.

The lawsuit believed to have been settled is a class action lawsuit filed by Rosen Law Firm in January 2019 alleging violations of federal securities laws. Specifically, Rosen Law stated the following in connection with the class action lawsuit that it filed.

“According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (1) Liberty Health, in conjunction with Aphria Inc., was involved in a scheme whereby numerous fraudulent acquisitions and transactions were made to provide undue benefits to both companies’ insiders; and (2) as a result, Liberty Health’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.“

The lawsuit sought to recover damages for investors whom purchased securities in the company between June 28, 2018 and December 3, 2018.

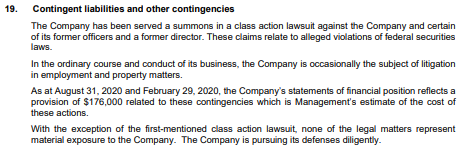

Notably, the company indicated within its financial statements for the period ended August 31, 2020 that it filed at the end of October that it had only made provisions related to contingencies of $176,000. In layman terms, it means the company underestimated the likelihood of being required to issue a payout related to the claims. However, it did refer to the class action as a “material exposure.”

The bright side for current shareholders, is that while under-accounted for by the company, the degree of the material exposure is now known. The ompany held a cash position of $17.1 million as of August 31, so it appears to have ample funds to pay off the obligation.

Liberty Health Sciences last traded at $0.46 on the CSE.

Information for this briefing was found via Sedar and Liberty Health Sciences. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.