FULL DISCLOSURE: This is sponsored content for Lithium Chile.

A major European mining group apparently has interest in Chilean lithium. Lithium Chile (TSXV: LITH) this morning has signed a farm-in agreement with Eramet, a global leader in metal extraction and transformation, for four of its properties in Chile.

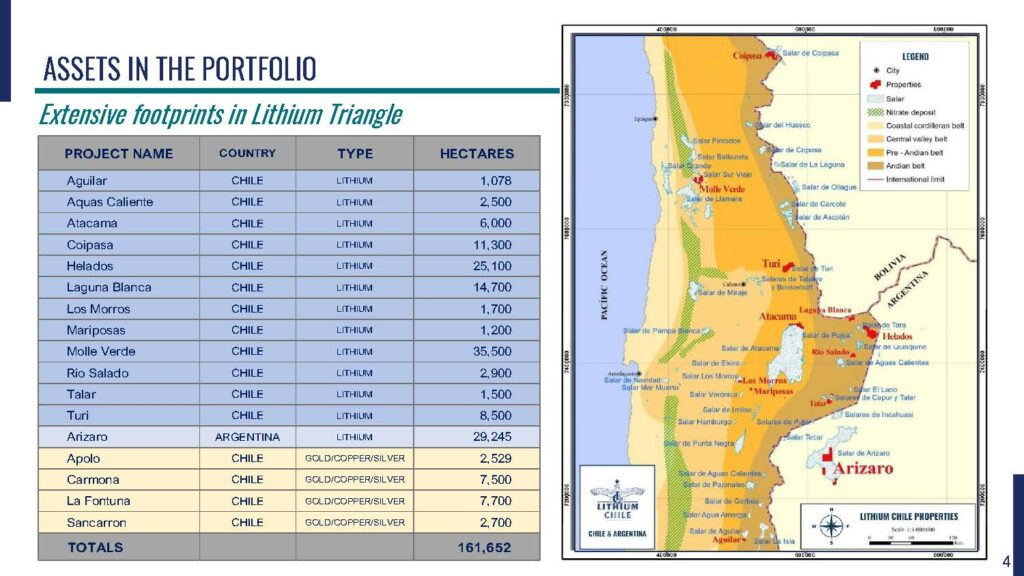

The four properties included under the farm-in agreement include Llamara, Rio Salado, Aguilar, and Aquas Caliente, which collectively amount to over 40,000 hectares of land claims. The agreement will see three separate phases of exploration carried out on the four properties over the next three to four years, with total spend projected to be in the area of US$20 million.

Each stage will enable Eramet to increase its ownership stake in the properties, with the completion of the third stage resulting in a 70% ownership interest in the properties. A further option is said to exist for the mining giant to wholly own the asset at its discretion.

“Eramet’s unparalleled expertise and credibility further enhances our position in the mineral industry. This partnership underscores our shared commitment to advancing sustainable mineral projects in Chile. We look forward to leveraging their capabilities to maximize the potential of our Chilean properties,” commented Steve Cochrane, CEO of Lithium Chile.

READ: Lithium Chile Hits 690 mg/l Lithium At Arizaro

The farm-in agreement has been entered into in parallel with the strategic process currently being conducted by PI Financial.

Lithium Chile last traded at $0.70 on the TSX Venture.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.