FULL DISCLOSURE: This is sponsored content for Lithium Chile.

Lithium Chile (TSXV: LITH) has seen its resource estimate at its flagship Salar de Arizaro project increase dramatically following drilling that was recently conducted at the property.

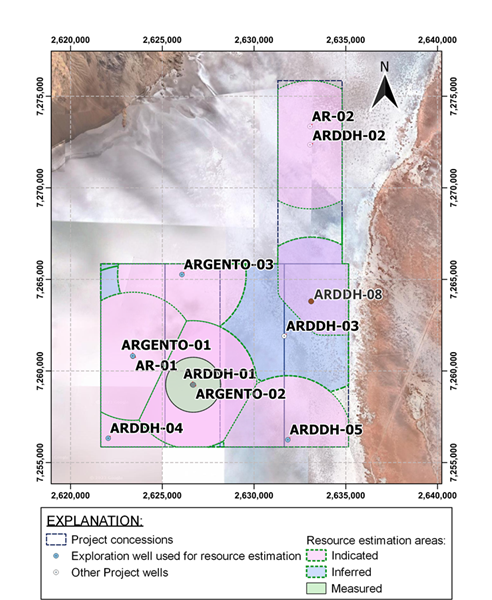

Total lithium carbonate equivalent resources increased by 24% to that of 4.12 million tonnes LCE. The increase follows the incorporation of hole ARDDH-08, as well as the ARGENTO-02 well into the estimate.

“Increasing our lithium resource by 24% marks substantial progress for our Arizaro project from just 2 additional wells. This yet again reinforces our belief that the Arizaro property is a world class lithium project,” commented Steve Cochrane, CEO and President of Lithium Chile.

Hole ARDDH-08 is attributed to substantial tonnes being added as a result of higher grade brine being intersected, with the hole hitting an average grade of 538 mg/L from 200 to 300 metres depth, and an average grade of 343 mg/L from 300 to 570 metres depth.

READ: Lithium Chile Farms Out Four Chile Properties, Exploration Spend Projected To Hit US$20 Million

The resource estimate now contains 261,000 tonnes of LCE in the measured category at an average grade of 261 mg/L, 2.2 million tonnes LCE at 302 mg/L in the indicated category, and 1.6 million tonnes LCE in the inferred category at 362 mg/L.

Moving forward, Lithium Chile is expected to release an updated prefeasibility study for the Salar de Arizaro by the end of the current quarter. Growth to the current resource estimate is also anticipated, with further analysis of ARDDH-08 ongoing, while hole ARDDH-09 is nearing completion.

Lithium Chile last traded at $0.80 on the TSX Venture.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.