FULL DISCLOSURE: This is sponsored content for Lithium Chile.

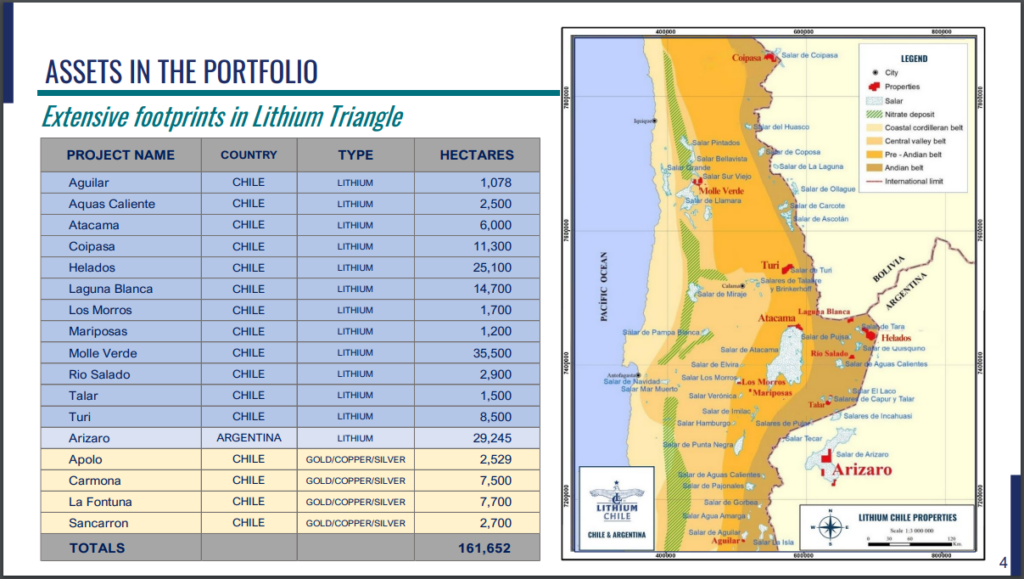

Lithium Chile (TSXV: LITH) is set to maximize shareholder value through the spin out of its Chilean assets into two separate entities. The spinout, as per the company, has been designed to allow for a transaction to be pursued that relates to its assets in Argentina.

The proposed spinout will begin with the company’s gold and lithium assets being moved into new subsidiaries of Lithium Chile, in anticipation of a potential future spin out. The firms Chilean gold assets will be transferred to a subsidiary referred to as Karios Gold Inc, while the Chilean lithium assets will be moved to Lithium Chile 2.0 Inc.

Karios Gold will contain a total of five projects covering 22,629 hectares of prospective land claims, with the flagship asset to be Las Garillas. The project, located in the Central Porphyry Copper-Gold Belt, has seen assays sample as high as 61 g/t gold and 329 g/t silver within veins measuring between 0.3 metres and 1 metre in length. Further exploration of the project is slated to get underway later this month.

Lithium Chile 2.0 meanwhile is to hold 12 separate projects, which cover a total of 111,978 hectares of land claims. Two of these projects have already been placed into strategic partnerships, including the Turi project which is under a joint venture with Summit Nanotech, a firm focused on directly lithium extraction. Summit has an option to acquire 50.01% of the project after meeting several exploration requirements.

READ: Lithium Chile Farms Out Four Chile Properties, Exploration Spend Projected To Hit US$20 Million

The other partnership for Lithium Chile 2.0 will see Eramet, the renowned European mining company, undertake a three phase exploration project at Llamara, Aguilar, Rio Salado and Aquas Caliente. The program is expected to see US$20 million spent in exploration, enabling Eramet to obtain up to 70% interests in the projects.

“We believe this is the best course of action to pursue the development of our Chilean projects while creating a restriction-free path to enhance value for shareholders via our Argentina assets,” commented Lithium Chile CEO Steve Cochrane.

READ: Lithium Chile Grows Resource Estimate By 24% At Salar de Arizaro

Once all rights have been transferred to the appropriate subsidiary, Lithium Chile will then consider distributing shares of the subsidiaries to shareholders on a pro-rata basis. Shareholders are expected to receive 1 share of Kairos Gold for every 10 shares of Lithium Chile held, and 1 share of Lithium Chile 2.0 for every 4 shares of Lithium Chile held, as of the record date. Both new companies are expected to become reporting issuers should the spinout proceed.

A record date has yet to be established, and is expected to be provided at a later date.

Lithium Chile last traded at $0.85 on the TSX Venture.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.