FULL DISCLOSURE: This is sponsored content for Lithium Chile.

Lithium Chile (TSXV: LITH) halted trading this morning to reveal a preliminary economic assessment for its Arizaro Project in the Salta Province of Argentina. The project is said to contain a pre-tax net present value (8% discount) of US$1.8 billion.

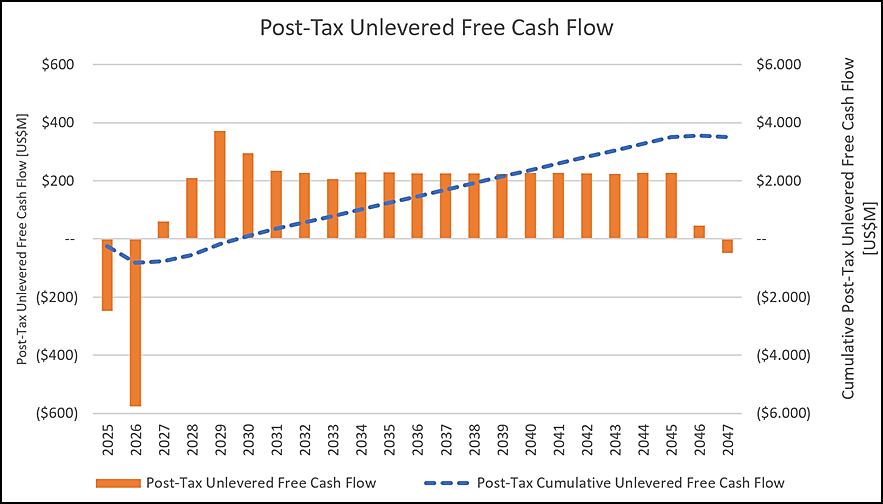

The assessment outlines an after tax internal rate of return of 24.1%, based on a life of mine average lithium carbonate price of $21,396 per tonne, and an operating life of 19.1 years.

The PEA suggests annual production of 25,000 tonnes LCE per year from its mine and processing facility.

“These results support our view that the Arizaro Project has the potential to be a world class producer of Lithium Carbonate. We are excited about continued advancement of this project – a continuing journey of near-term enhancement opportunities that have already been identified,” commented Lithium Chile president and CEO Steve Cochrane.

After-tax, the net present value of the Arizaro Project is pegged at $1.1 billion based on an 8% discount, with a payback period of 3.6 years. The figure is based on annual cash flow of $229 million on an after-tax basis.

The assessment expects direct costs of construction of $452 million, which when combined with contingencies and indirect costs, estimates total initial capital costs for development of $823 million. Operating costs meanwhile are estimated at $5,197 per tonne of LCE, or $129.94 million per year.

The PEA is also said to consider the use of direct lithium extraction, which has a shorter start-up and ramp-up time frame, due to smaller infrastructure requirements. Several opportunities for enhanced economics have also been identified via further optimization and engineering.

An initial production water aquifer is said to have been identified with permitting currently underway.

“We are very proud of our entire Argentinian team, whose previous unique experience in starting up other Lithium projects has worked in creating real value for all stakeholders in the Arizaro project, including communities in which we work, as well as all shareholders of Lithium Chile. We have achieved in less than 2 years this important step and we are confident in advancing quickly to eventual production,” commented Jose de Castro, president of South America for Lithium Chile.

Lithium Chile last traded at $0.74 on the TSX Venture.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.