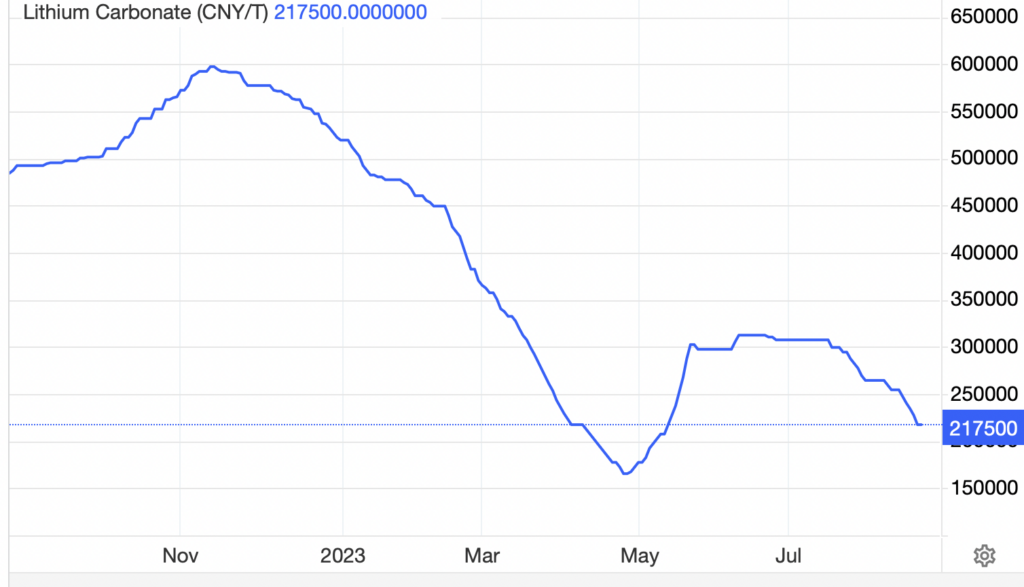

Lithium carbonate prices have plummeted over the last several weeks. After stabilizing at around US$42,000 per tonne from the end of May through mid-July, spot prices have retreated to US$30,000 per tonne.

Lithium prices bounced off the US$22,750/tonne level in late April 2023 after a whopping 75% fall over the previous six months. It appears that battery manufacturers have pulled back their buying of the key battery metal since the start of the third quarter as inventories have piled up.

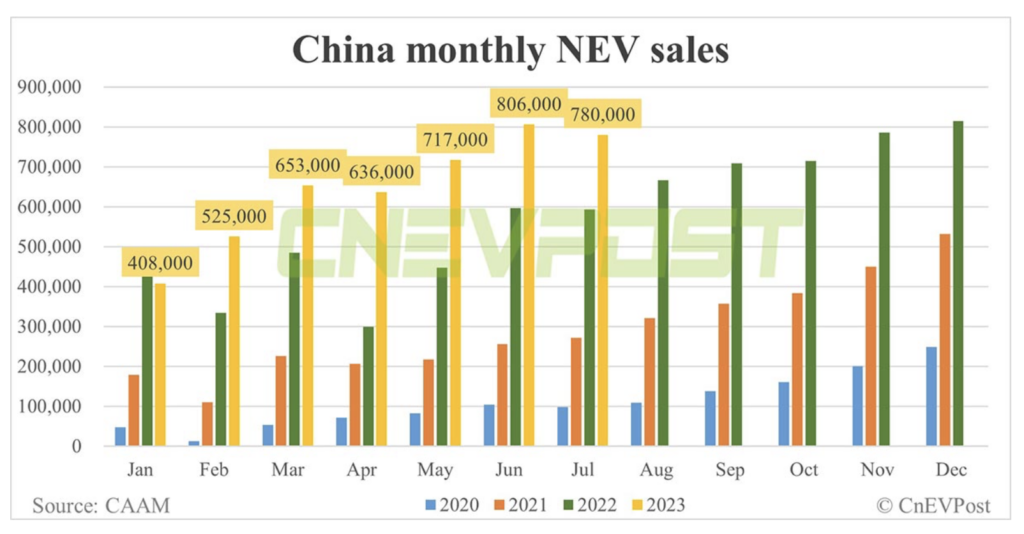

The lackluster (stagnating?) Chinese macroeconomic backdrop seems to have translated into a slowing of consumer demand for electric vehicles. EV sales in China declined 3.2% in July to 780,000 units from 806,000 vehicles in June, according to the China Association of Automobile Manufacturers (CAAM). Admittedly, July unit sales were up nearly 32% versus year-ago levels, but investors appear to be more focused on sequential growth trends.

Even the darling of the EV industry is struggling in China. The China Passenger Car Association reported that Tesla, Inc. (NASDAQ: TSLA) sold just over 64,000 China-made EVs in July 2023, down 31% from the previous month.

A somewhat more constructive recent datapoint: the CAAM reported that EV sales increased 1% over the period August 1 through August 13 versus the first thirteen days of July 2023 to about 208,000 vehicles.

Interestingly, China leader Xi Jinping has shown little interest in stimulating the country’s economy; instead, his government seems much more focused on strengthening national security. In turn, this stance has prompted investors to limit the cash they put to work in the world’s second largest economy. In addition, the Chinese yuan has weakened to about 7.29 yuan = US$1.00. In mid-January, the exchange rate was about 6.7 yuan = US$1.00.

To attempt to meet second half 2023 sales targets, about a dozen Chinese EV manufacturers began another round of price cuts in August, only months after the previous series of reductions. This action apparently forced Tesla to slash the prices of its Model S and Model X cars in China by about 7% each just a few days ago.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.