FULL DISCLOSURE: This is sponsored content for LNG Energy Group.

LNG Energy Group (TSXV: LNGE) this morning provided an update on its sales for the month of August, as well as year to date production data for its operations in Colombia.

During the month of August, the company reported 19.2 million cubic feet equivalent per day (MMcfe/d) in natural gas sales. Year to date, that figure sits at 18.6 MMcfe/d, representing 15% growth relative to 2022. In terms of sales, year to date 93% has been derived from natural gas production.

As a further positive, LNG has identified that it will begin realizing natural gas sales prices at a range of US$8.30 to US$8.50 per Mcf in December under new take or pay natural gas contracts, which have durations of up to five years. The new contracts as a result will push the average weighted price of total contracted volumes for 2024 to US$7.52 per Mcf. Total contracted volumes meanwhile are said to be 18 MMcf/d.

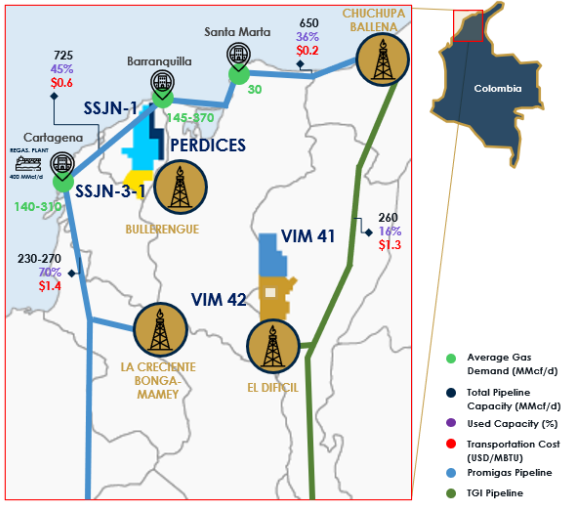

At the same time, the company has growth on its mind, with drilling set to begin in October. The company intends to drill a minimum of three wells under a drilling and workover campaign that will take place on the SSJN-1 and Perdices blocks, beginning with the Bullerengue Oeste 5 well.

“Colombia is seeing very strong fundamentals in the natural gas sector due to current supply – demand dynamics in the country. We look forward to growing our Colombian natural gas production base and working with our local stakeholders to continue to provide consistent production to our customers,” commented CEO Pablo Navarro.

LNG Energy last traded at $0.39 on the TSX Venture.

FULL DISCLOSURE: LNG Energy Group is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of LNG Energy Group. The author has been compensated to cover LNG Energy Group on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.