Despite the launch of a boycott movement aimed at hitting Loblaw Companies (TSX: L) in the pocketbook, the grocery giant this morning announced that it will be again hiking its dividend to shareholders following a strong financial performance in the first quarter of 2024.

Loblaw this morning declared it would be hiking its quarterly dividend payment by 15%, resulting in the payment jumping from $0.446 per share held to that of $0.513 per share held. The increase amounts to an annualized $0.268 increase for shareholders in dividend payments, with the first quarterly dividend at the new rate being payable on July 1. The increase marks the thirteenth consecutive annual increase in dividend payments by the grocer.

The increase is sure to enrage several Canadians, especially considering the hike comes on the first day of a month-long boycott that has been arranged by a group of Reddit posters known as r/LoblawsIsOutOfControl. The community, now number 63,000 in size, says that the boycott should not be viewed as middle vs. low class or left vs. right, but rather as “Canadians from coast to cost vs corporate greed,” via a post made within the community entitled “on the eve of our boycott.“

“Through this boycott, please remember whose side we are on, and why we are doing this. This is not left vs. right, middle vs. low class, boycotters vs. those not able to, and so on. This is Canadians from coast to coast vs corporate greed, oligarchs and monopolies running our country into the ground. If you eat, you are welcome in this movement, full stop.

To the oligarchs reading this: Canadians will no longer stay complacent. We want better for ourselves, and those who come after us. We deserve better, too.

Please continue to help us keep our boycott list updated. Share your memes, grocery bills, thoughts, and more throughout this next month.“

The post follows a list of demands made less than a week ago by the group in advance of the boycott, which included items such as Loblaw signing onto the grocer code of conduct, no further retailer-led price increases for 2024, a commitment to affordable pricing, a commitment to ending price gouging.. and no further increases to dividends.

Impact of dividends

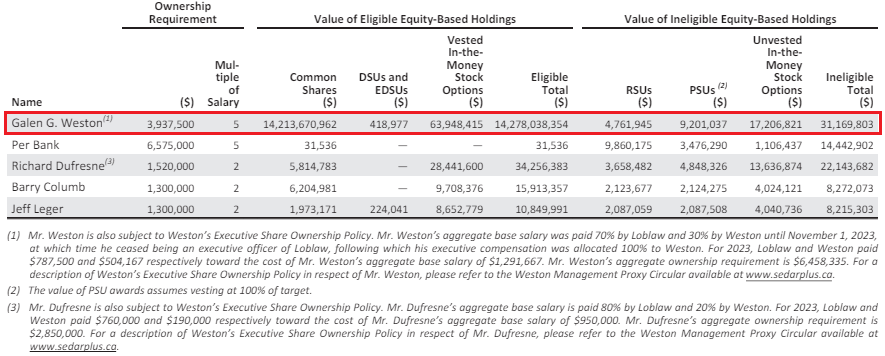

Of course, it stands to reason that the largest benefactor of the dividend increase, is that of Galen G. Weston, Chairman of Loblaw. Weston, through his direct ownership in Loblaw equity, as well as the indirect ownership through George Weston Ltd, of which he is a majority owner, had an ownership stake in Loblaw worth approximately $14.2 billion as of March 11, 2024, the record date for the most recently filed Management Information Circular filed by the company.

Galen Weston directly holds 473,636 common shares of Loblaw, while George Weston, the corporation, owns 162,825,925 shares in Loblaw. Given the dividend hike, this will result in Galen receiving an additional $126,934.45 in dividends annually – bringing his total dividend check in 2024 to an estimated $971,901.07, assuming he doesn’t exercise any stock options or other compensation units.

George Weston meanwhile is set to receive an additional $43,637,347.90 just from the dividend increase. On a combined basis, George Weston is expected to collect an eye-popping $334,118,798.10 in dividends in 2024 from Loblaw.

As for his cut from George Weston, Galen currently holds a 58.0% stake in the company. Investors get to find out next week, on May 7, if Weston is also hiking its quarterly dividend check, and if so, by how much.

For reference sake, Galen’s 77,840,725 common shares held in George Weston earned him an estimated $55,500,436.92 every quarter last year. Total dividends paid to Galen by George Weston is estimated at $222,001,747.70 for 2024.

It should also be noted that Loblaw during the first quarter spent $470 million to repurchase 3.2 million common shares of the company via stock buybacks – putting more money in shareholder pockets.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Any one with any common sense would go and invest in Loblaws and profit from their time and money instead of complaining all the time.