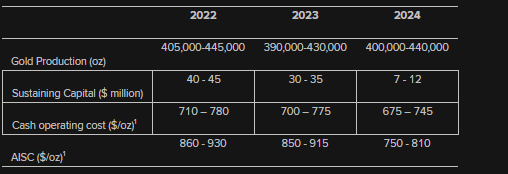

On December 14th, Lundin Gold Inc. (TSX: LUG) announced its three year outlook. The company is estimating that gold production for the full year 2022 to be between 405,000 and 445,000 ounces with an all-in sustaining cost between $860 to $930 per ounce.

Cash operating costs are expected to be between $710 and $780 per ounce, while the total sustaining capital in 2022 is estimated to be between $40 and $45 million. Below you can see the companies three-year production outlook.

A number of analysts slashed their 12-month price targets on Lundin Mining after the news, bringing the average 12-month price target to C$13.97 from C$15.00 last month. Out of the 9 analysts covering the stock, 8 have buy ratings and 1 analyst has a hold rating. The street high sits at C$15.50 from Stifel-GMP while the lowest 12-month price target of C$11.75.

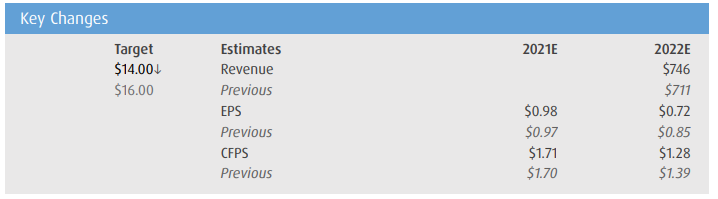

In BMO Capital Markets’ note, they reiterate their outperform rating but lower their 12-month price target from C$16 to C$14, saying that management’s commentary on inflation has cautioned them. With that, they have raised their opex assumptions higher.

For the 2022 guidance, BMO says the production guidance represents a 6.3% increase in production and an 11.9% increase in the all-in sustaining cost from 2021. The guidance is in-line with their own estimates, mainly hitting the midpoint for their estimates.

Onto the 3-year production outlook, BMO says that the company keeping production at >400,000 ounces per year is strong and is pleased with seeing the flattened production profile. While the production guidance for 2023 and 2024 are both above the street and their estimates, the all-in sustaining costs are “materially above expectations.”

Below you can see BMO’s updated changes for 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.