Yesterday, on June 21st, Lundin Mining Corporation (TSX: LUN) cut their production guidance at Candelaria, causing the stock to drop 9.36% to $10.27. Lundin Mining said that they now expect 150,000 to 155,000 tons of copper and 85,000 to 90,000 ounces of gold for the full 2021 year.

This lead to 8 analysts lowering their price target on Lundin. Lundin’s 12-month consensus price target is now C$15.66, down from $16.16 before the announcement. The company has a total of 23 analysts, with four analysts having strong buy ratings, and nine having buy ratings. Nine have hold ratings and one single analyst has a sell rating. The street high sits at C$20 from IA Capital Markets, while the lowest comes in at C$10.

In Canaccord’s note, their analyst Dalton Baretto lowers their price target from C$15 to C$12 and reiterates their hold rating, headlining, “Candelaria shows its fault again.” He believes the main driver behind the production cut is due to a known fault zone, which caused the company problems back in 2017. He believes the markets are starting to see all these issues as a larger thing since there have been many operational issues at Lundin since September 2020.

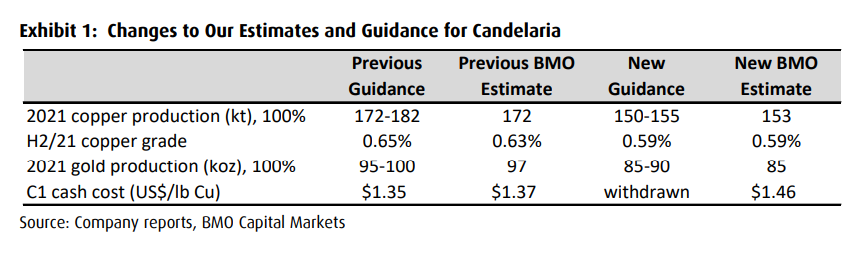

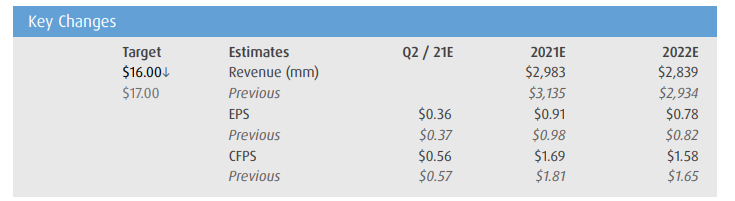

In BMO’s note, their analyst Jackie Przybylowsk lowers their 12-month price target to C$16 from $17 and reiterates their outperform rating. Przybylowsk asks the question, “Disappointing Guidance Cut at Candelaria; But Should We Be Surprised?” Below you can see BMO’s new estimates for Candelaria.

She believes that this revision in guidance is a result of management not planning properly. As said above, this is the same area that had a pit wall slide in 2017. She writes, “in our view it should reasonably have been expected that mitigation of risks here might be required and could have been incorporated into 2021 guidance when released in November 2020.”

Przybylowsk says that they should not be surprised because the changes came from a mine plan revision. Those plans “are seeing a wider step out, smaller benches, smaller blasts, and a shift to mining operations in the zone which hosts known fault zones.” Below you can see the updated 2021 and 2022 revenue estimates.

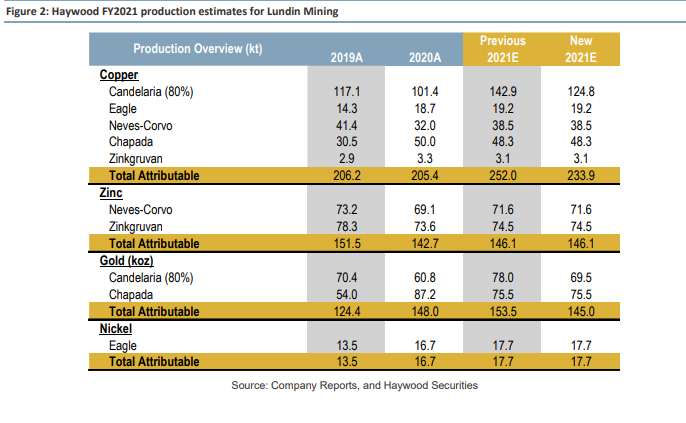

Haywood Capital Markets also came out with a note after the lowered guidance, their analyst Pierre Vaillancourt reiterated their buy rating but lowered their 12-month price target to C$16 from C$19. Off the back of this, they lowered their production estimates for Lundin Mining.

Haywood basically reiterates the same feelings that Canaccord and BMO had but still seems very favourable to the company, saying, “We believe LUN has made a prudent decision to manage risks in the Phase 10 area,” while saying that Lundin is one of the better ways to get exposure to a diverse amount of precious metals.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.