On February 19th, Magna International (TSX: MG) announced its fourth quarter and full year financials alongside providing 2021 and 2022 guidance. The company announced quarterly sales of $10.56 billion, up 12% year over year. Earnings per share came in at $2.83, just a little more than double last year. The company is guiding for $40-$41.6 billion in sales for 2021 along with $43-$45.5 billion in 2022.

Magna International currently has ten analysts covering the company with a weighted 12-month price target of $100.34. This is up from the average before the results, which was $80.34. One analyst has a strong buy rating, while eight analysts have buy ratings. Only one analyst has a hold rating on the name.

Below you can see the latest analyst changes:

- Credit Suisse raises target price to $91 from $74

- JP Morgan raises target price to $100 from $90

- Scotiabank raises price target to $105 from $100

- Benchmark raises target price to $99 from $67

- BMO raises price target to $96 from $70

- TD Securities raises price target to $100 from $85

- Morgan Stanley raises target price to $61 from $45

In BMO’s note to investors, they call the results very strong and note that the guidance is above consensus estimates. Peter Sklar, BMO’s analyst, writes, “Magna’s strong Q4/20 earnings was a culmination of robust platform mix and cost reductions. Magna’s recent e-mobility agreement highlights its ability to provide BEV engineering and vehicle assembly capabilities.”

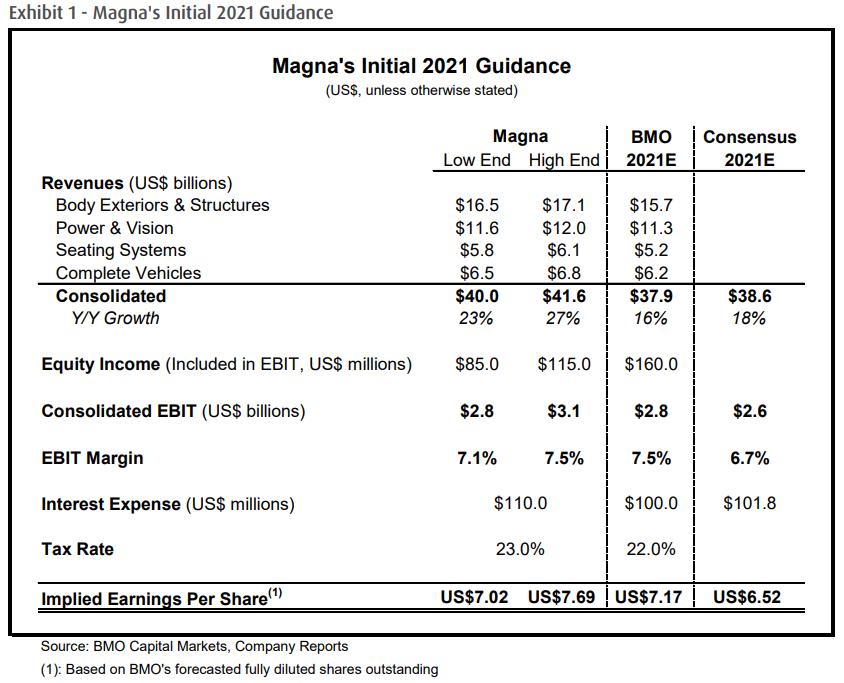

Magna’s $2.83 earnings per share were above their $2.14 estimate, while the guidance implies an earning per share between $7.02 to $7.69, which is above their $7.17 estimate. Below you can see how guidance stacks up against BMO’s 2021 estimates.

Sklar writes, “We continue to believe Magna will enter into more agreements and/or JVs with BEV OEMs, which should help further re-rate the stock.” Currently, Magna has a lot of exposure to the BEV space. They have production for hybrid dual-clutch transmissions for BMO, another batch of production for another unnamed client, and a joint venture with Huayu Automotive to produce e-drive powertrain systems.

They also have two JVs with Beijing Electric Vehicle for the engineering of electric vehicles, the production of the Jaguar I-PACE, engineering and manufacturing of the Fisker Ocean, and a joint venture with LG Electronics to manufacture e-motors, inverters, onboard chargers, and e-drive systems

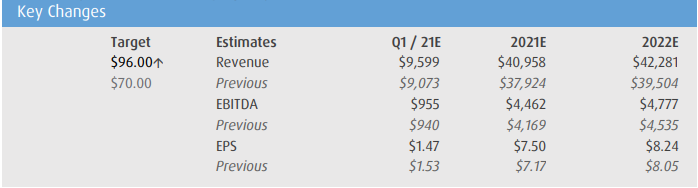

Below you can see the fundamental changes made by Sklar on his 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.