Magna Mining has seen a flury of activity as of late.

Most recently, they released an updated preliminary economic assessment for their past producing nickel-copper Crean Hill Project, which is located in the Sudbury mining district.

The assessment, which was released weeks ahead of schedule, follows the company being the talk of the Precious Metals Summit in Beaver Creek for a day after acquiring a producing mine in the same region.

Lets dive in.

High Level Overview

Lets start from the top.

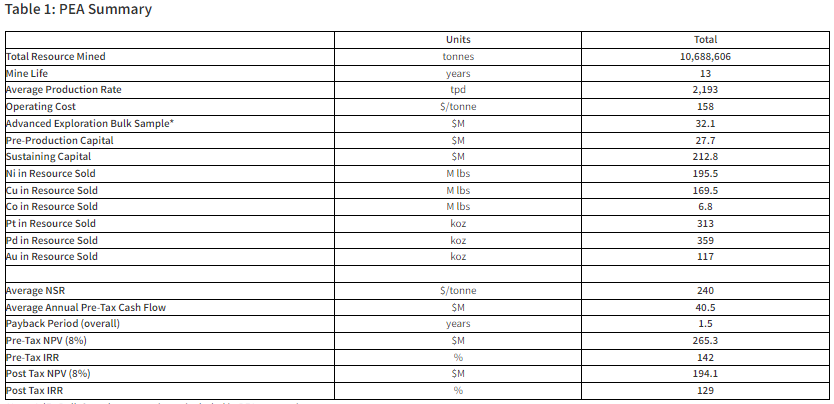

Magna Mining recently released an updated PEA with positive project economics for the Crean Hill project. The PEA outlined an after-tax net present value (8% discount) of $194.1 million, using a mine life of 13 years, based on $8.50 per pound nickel, and $4.00 per pound copper.

We’ll get into the specifics of the envisioned mine in a second here, but one thing that should be highlighted is the internal rate of return, or IRR. On an after-tax basis, the IRR is estimated at 129% – a simply unheard of figure in the world of mining.

This IRR is based on pre-production capital costs of just $27.7 million – meaning the company doesn’t expect to spend much to get this asset into production – especially when you consider that advanced exploration names such as Dolly Varden Silver just raised $30 million via the markets.

There is a catch however, in that the company also expects to spend $32.1 million on an advanced exploration bulk sample. Even on a combined basis however, at under $60 million, the expected CapEx spend here is miniscule. Sustaining capital meanwhile is estimated at $212.8 million.

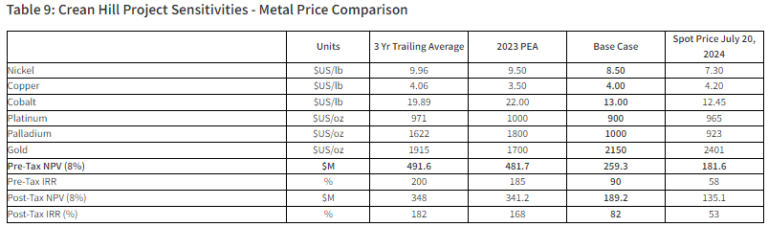

It should be noted that the PEA used metal prices that are somewhat.. all over the map. Nickel pricing came in pretty high compared to current levels, while copper was low, and the pricing of other metals has since changed a bit as well.

In this regard, the company was nice enough to provide a simple breakdown of the net present value based on July 20, 2024 metal prices, which reduced the after-tax NPV to $135.1 and the IRR to 53%. But the price of gold has since skyrocketed, copper has gone up a bit.. Unfortunately for juniors, prices don’t exist in a vacuum. And by the time this thing is built, the current numbers will have changed again, so it kind of “is what it is”

Proposed Mine Details

Okay, so the details of the mine.

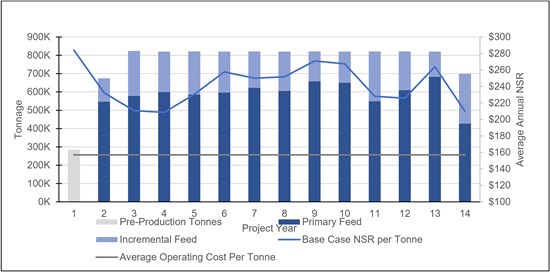

In short, the company expects to have an average production rate of 2,200 tonnes per day, which is further broken down into 1,650 tonnes per day of high margin primary feed, and 550 tonnes per day of lower grade incremental feed.

All mining is to occur underground, with rehabilitation of existing facilities and infrastructure on site to occur as the mine gets developed. Ore pulled from the ground is expected to be crushed on site, before being shipped to a local third-party processing facility.

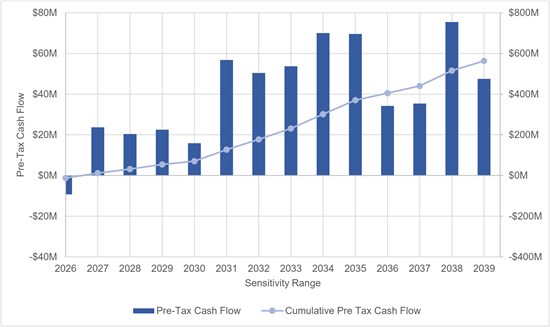

In terms of a development timeline, Magna expects the advanced exploration program to take roughly 15 months, to be followed by a 12 month pre-production ramp up prior to commercial production beginning, which is expected to again last for 13 years or so.

Magna doesn’t say specifically how much nickel or copper it expects to pull out of the ground on an annual basis, but in total it expects to sell 195.5 million pounds of nickel and 169.5 million pounds of copper over the life of the mine.

Doing the math, that works out to a very rough 15 million pounds of nickel and 13 million pounds of copper sold on an annual basis, based on the (poor) assumption that production is fairly equal throughout the life of mine.

There’s also some cobalt, platinum, palladium and gold credits involved here which we won’t get into, but materially add to the annual expected income of the proposed mine. All told, the mine is expected to generate average annual pre-tax cash flows of about $40.5 million, with the mine expected to have a payback period of about 1.5 years.

The Big Transaction

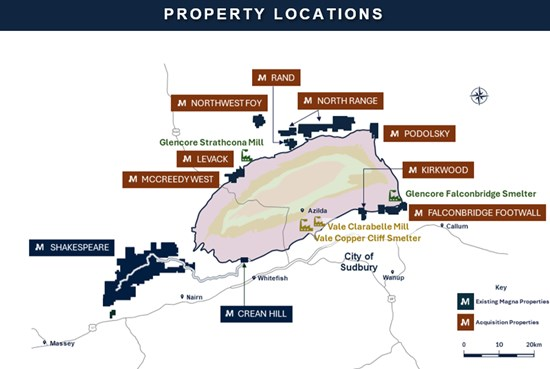

While the PEA is a big deal for the company, it takes a bit of a back seat to the news announced the week prior, which is that the company is set to acquire a portfolio of base metals assets within the Sudbury Basin, through the acquisition of a subsidiary of KGHM International.

Included in the purchase is the currently producing McCreedy west copper mine, as well as three past-producers, two of which produced copper and nickel in the last decade, and four related assets. Key here, is the fact that the closing of the transaction will propel Magna from the position of a project developer to that of a producer.

The McCreedy West mine in 2023 pulled 317,660 tonnes of copper out of the ground in 2023, consisting of 1.59% copper, 0.23% nickel, 1.34 g/t palladium, with further credits in cobalt, platinum, gold and silver.

Financial details of the mine’s operations however were not provided.

In terms of the transaction as a whole, the assets are to be acquired for $5.3 million in cash on closing, as well as $2.0 million in Magna common shares. A $2.0 million deferred cash payment is due by the end of 2026, while contingent payments of up to $24 million exist, dependent upon certain milestones being hit. A 4.0% NSR is also in play on new discoveries on certain properties included within the transaction.

Funding for the purchase is planned to come from a credit facility worth $20 million that is currently being negotiated with FCDQ, a subsidiary of the Desjardins Group. The significant purchase is expected to close by the first quarter of 2025.

In Closing

The developments over recent weeks have materially changed the game for Magna – as demonstrated by its stock price, which is up 48% since the start of September. Not bad for a junior. But that being said, it’s a bit early to get excited.

In fairness to the bears, on the PEA, the technical report has yet to be filed – the company has 45 days to do so as per exchange requirements. And on the asset acquisition, financial details of the operating mine weren’t released. There’s likely a reason they were able to grab the assets for the price they did.

But that being said, it appears that there’s a real asset here, and a real operation. And that’s more than many of Magna’s peers in the mining space can say.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.