Issues with energy providers appears to be a prevelent issue within the public crypto mining space. Following two straight months of fluctuating power costs impacting Hut 8 Mining’s (TSX: HUT) operations in Alberta, industry peer Marathon Digital (NASDAQ: MARA) is now on month two of issues with one of its power providers.

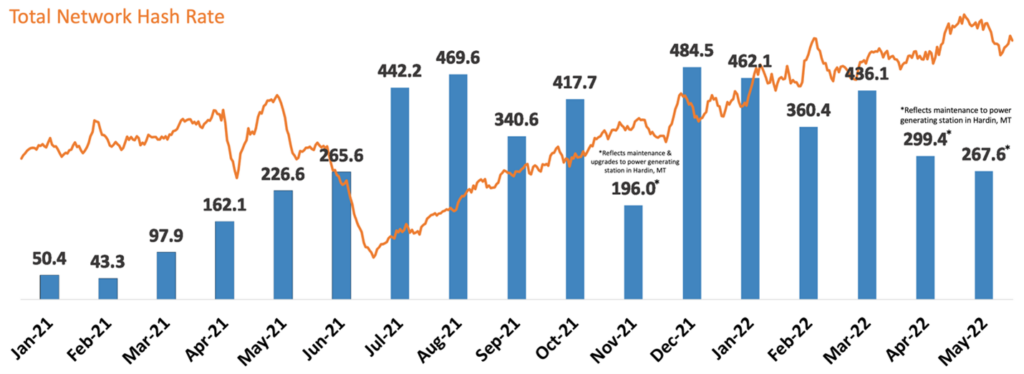

Marathon last night issued its production results for the month of May, demonstrating the second straight month of declines, amid a downward trend that it has experienced since December in terms of overall bitcoin mining production. The company produced just 267.6 bitcoin during the month of May, down from 299.4 in the month of April, and well shy of the record 484.5 produced in December.

Total bitcoin holdings meanwhile are said to current sit at 9,941.

The company continues to see delays in the launch of its new facilities in Texas, for which it places blame on the energy provider for the facility. Originally expected to be launched on April 17, the facilities remain offline as a result of the energy provider waiting on a federal agency for confirmation of its tax exempt status.

A total of 19,000 miners are installed at these facilities waiting for energization to occur, representing total capacity of 1.9 EH/s. The entire fleet in operation comparatively represents 3.9 EH/s of capacity, with a target of reaching 23.3 EH/s by early 2023. A further 10,000 miners are expected to be installed this month, along with 21,000 and 28,000 miners in July and August, respectively.

In terms of its current production, the company is reportedly undergoing issues with its energy provider in Hardin, Montana. The power station there reportedly has seen ongoing maintenance issues for the second straight month. Bitcoin production at the facility was reportedly down 47% as a result for the month of May, versus expected levels of production.

The company is currently looking to transition its operations away from the Hardin facility.

Marathon Digital last traded at $7.66 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.