Colonial Coal International (TSXV: CAD) took a nose dive yesterday, falling 23.9% to $1.05, on 1.72 million shares. The fall from grace, which added to a continued decline in share price from highs of $3.08 earlier this year, is believed to be in relation to the nearby Sukunka Mine, a proposed project by Glencore Canada, failing to receive permits.

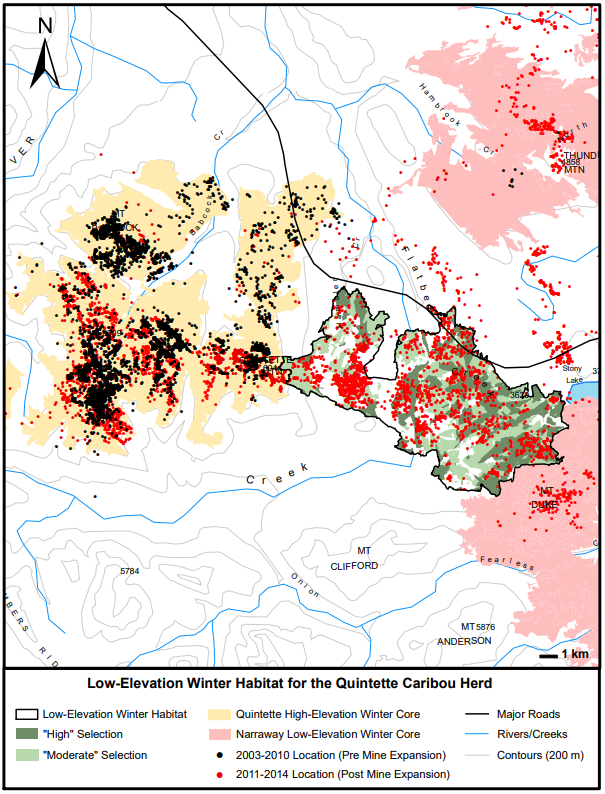

The Sukunka Coal Mine, located near Tumbler Ridge, BC, failed to receive permitting from Ottawa after consultations with indigenous groups, scientific experts, and the public, on the grounds that the development of the project would negatively impact caribou and grizzly bears in the region, as well as result in the discharge of selenium and mercury into local waterbodies. The proposed project area reportedly consisted of a critical habitat for the Quintette herd of South Mountain caribou.

READ: Liberals Scrap Proposed BC Mining Project Due To Caribou, Grizzly Populations

“The scientific evidence gathered in assessing this project showed that its negative impacts were significant and could not be mitigated. While encouraging sustainable resource development, Canadians expect the Government of Canada to take concrete actions to protect our country’s natural landscapes, its people and wildlife today and for the generations that follow,” commented Steven Guilbeault, Minister of Environment and Climate Change under Trudeau’s Liberal minority government.

The proposed project was an open-pit metallurgical coal mine that was expected to produce three million tonnes of coking coal per year for export. It was estimated that the project would provide a $450 million boost to the British Columbian economy, with construction of the mine expected to result in the creation of 700 jobs, and the operation of the mine consisting of 250 permanent jobs once operational.

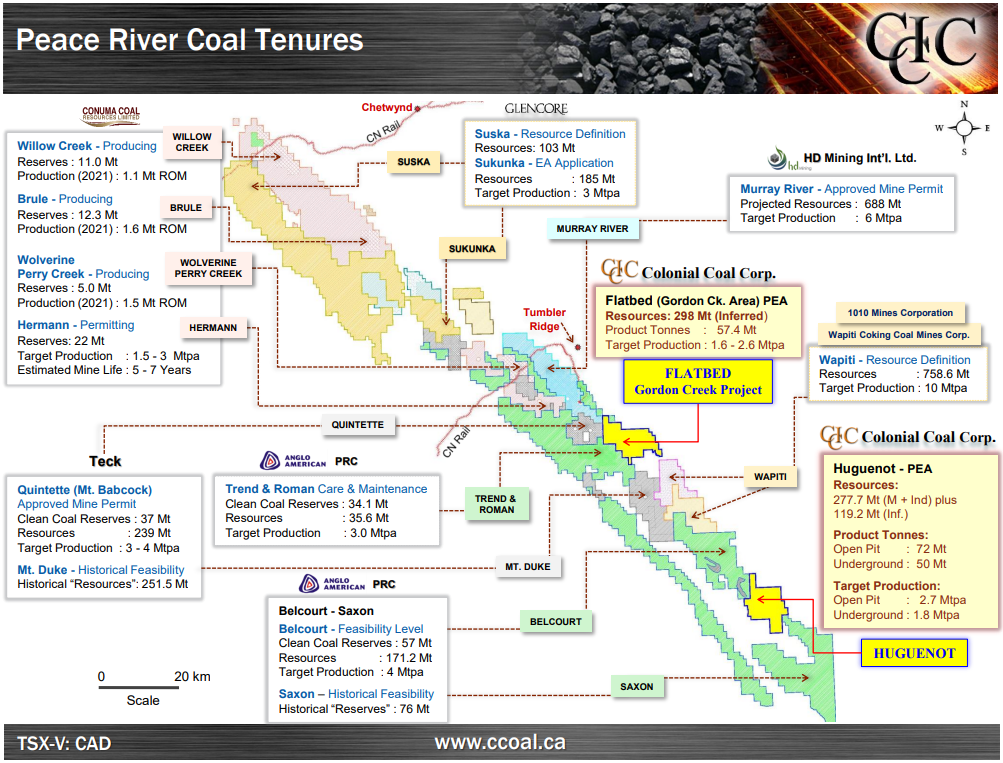

The announcement that a coal project was halted by the Government of Canada did not fare well for Colonial Coal, who’s Flatbed project is located near-to the Sukunka Coal Mine. In fact, the property is close enough to the same caribou herd that in 2014 the firm withdrew applications for 1,130 hectares of mineral claims for the Flatbed property, so as to protect the Quintette caribou’s identified winter habitat. Those claims were located on the southernmost end of Colonial’s flatbed property.

To be fair to Colonial however, there are differences in the Sukunka and Flatbed properties. For starters, outside of the stage of development and resource sizes, the Sukunka project was designed as an open-pit mine, which inherently would have significant surface impacts. The Flatbed project comparatively has been designed as an underground mine, with 298 million tonnes of inferred resources. The project currently has a target production of 1.6 to 2.6 million tonnes per annum, and is at the PEA stage of development.

Further down the Peace River, Colonial Coal also has its Huguenot project, which is not believed to be impacted by the caribou herd that has held off Glencore’s development in the region. The Huguenot project is also believed to be the firms flagship project, which currently has a resource estimate consisting of 277 million tonnes of measured and indicated resources, and 119 million tonnes of inferred resources. The project has the option of being developed as either an open-pit only mine, or a mix of open-pit and underground mining.

The decision by the Government of Canada arguably resulted in the fall experienced yesterday by Colonial, resulting in Shane Austin, whom serves in corporate development for the firm, putting out a brief news release last night.

“Colonial Coal International Corp. has confirmed that, on the facts as presently known to the company and the market, the recent decision of the B.C. Environmental Assessment Office respecting an environmental assessment certificate for Glencore Canada’s Sukunka mine has no bearing whatsoever on Colonial Coal’s current coal projects and their further development.”

While on the surface such a statement might be true, as Colonial can certainly work to further its projects at the current juncture, whether they are ultimately approved as mines by the Government, should they get to that stage of development, remains to be seen.

Colonial Coal last traded at $1.05 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Did CAD return grounds that might be carbon related a few years ago? The management at CAD isn’t new to the operating game in their area where Glencore , well they just think they can bend steel