As the equity markets have staged one of the sharpest, and perhaps most surprising, start-of-the-year rallies in some time, investors are debating whether the markets can build on or at least hold those gains. Some sell-side analysts at large brokerage firms who have access to broad customer trading data seem to suggest the “easy” gains have been achieved and that further appreciation, at least in the short run, could be more difficult.

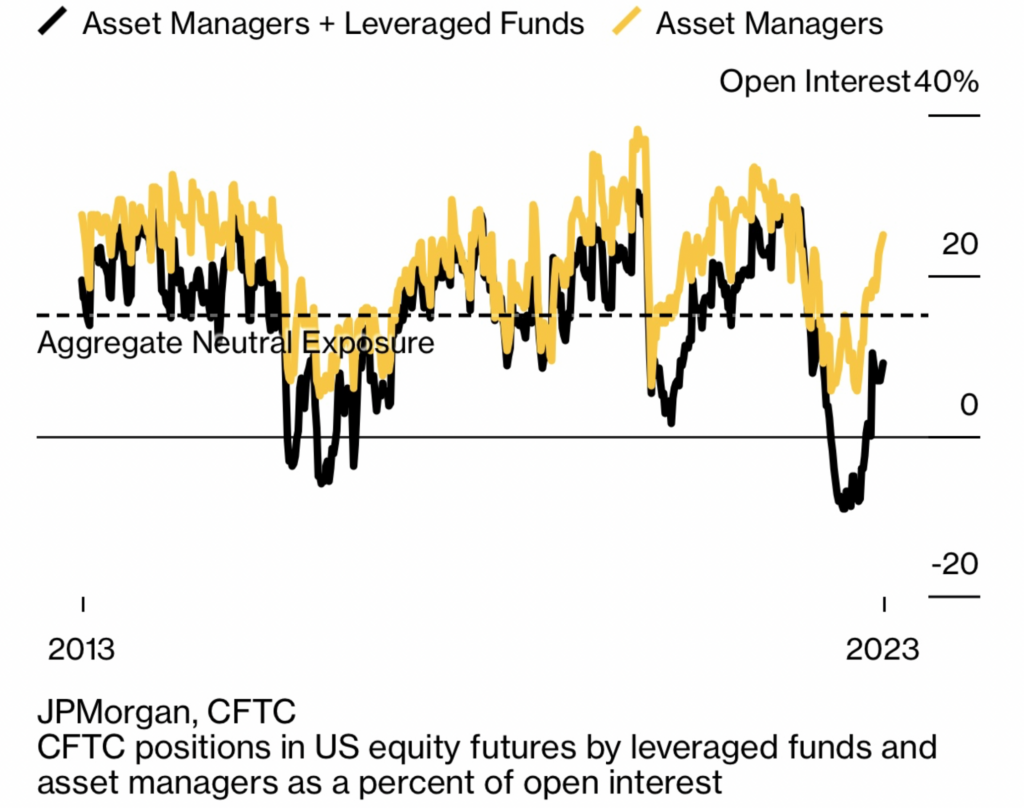

According to analysts at JPMorgan, investors have closed out US$120 billion of bearish U.S. equity futures positions since the fall of 2022. Asset managers had cut their futures positions to a 10+ year low of minus 9% of open interest in October 2022 (dark line in below graph). The explosive equity rally since January 1, 2023 has pushed this figure to positive 9% as of February 7, 2023.

Since an aggregate neutral position is considered to be around positive 15%, there is still scope to rally further before hitting or exceeding that level. However, such a move would have to come off a much higher base.

More broadly, JPMorgan believes that US$300 billion of aggregate bearish equity-linked positions have been unwound in the market’s sharp upward move. Again, a substantial amount of dry powder has been used in this buying program.

READ: What Are Current Bond Spreads Telling Us About The Economy?

Similar thoughts were expressed by Goldman Sachs. Analysts there contend that hedge funds covered short positions in the week ended February 3 at the fastest pace of any week since 2015. Notably, the rate at which institutional short sellers abandoned short bets was faster than during the stretch in January 2021 when soaring meme stocks like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings, Inc. (NYSE: AMC) forced several hedge funds to close.

Tellingly, even after many risky stocks have gained 30% or more over the first six weeks of 2023, hedge fund managers remain neutral to bearish on the market. A JPMorgan Positioning Intelligence report says, “Positioning isn’t ‘high’ and it doesn’t seem like many investors are bullish, per se.”

We've just experienced some of the most significant short covering by hedge funds in 6 years. pic.twitter.com/YuYhUiRAs6

— Markets & Mayhem (@Mayhem4Markets) February 5, 2023

Equity hedge funds had a positive January; the group on average was up 4.24% according to the data provider HFT. However, this performance still noticeably trailed the 11% and 6% moves in the NASDAQ Composite and the S&P 500 Index, respectively, during the month.

Clearly, almost all bull markets start as short covering rallies, but the JPMorgan and Goldman data seems to imply this market move might only be a short-term, short covering recovery.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.