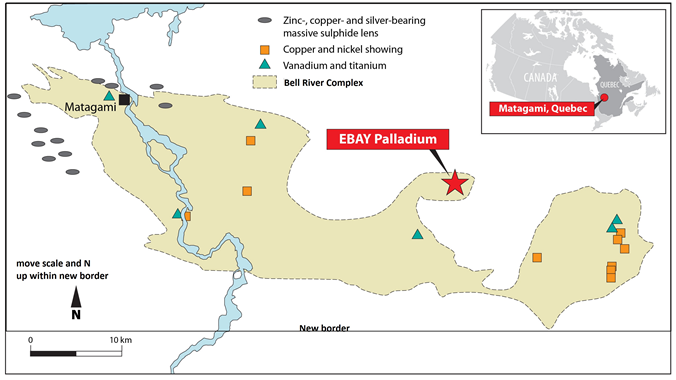

Max Resource Corp (TSXV: MXR) has entered into a letter of intent through its PGE Americas Metals Corp subsidiary for the purchase of a palladium project in Quebec, Canada. The project, referred to as the EBAY Palladium Project, is located 30 km southeast of Matagami, Quebec, and is accessible by logging roads and trails.

The project, located in the Abitibi Region of Quebec, is underlaid by the Archean Bell River complex, a mafic region measuring 65 km by 15 km, while being 5 km thick. The property has had a number of programs conducted on it since 2000, consisting of both grab sampling and drill programs, which have revealed potential reserves of palladium-platinum, as well as traces of rhodium.

Past programs include:

- 2000: Blast pit program conducted, with grab sample revealing highlight values of 4.87 g/t of palladium-platinum from a 4 to 5 metre wide north trending zone.

- 2006: Follow up trench of program revealed highlight grab sample values of 3.04 g/t palladium, 1.39 g/t platinum (4.43 g/t palladium-platinum), 0.12 g/t rhodium with highlight values of 0.18 g/t.

- 2006: New trenching program exposed a new zone where grab samples revealed 2.46 g/t palladium/platinum, with no rhodium. Zone was traced for 500 metres.

- 2006: Drilling resulted in the EBAY Palladium Discovery. Hole EB06-05 revealed 1.90 g/t of palladium-platinum over 3.0 metres from 80.0 to 83.5 metre.

- 2006: Further drilling intersected a zone of mineralization ranging 6.7 to 31.1 metres wide over a horizontal distance of 600 metres, at a maximum depth of 120 metres. Mineralization in this zone showed highlight values of 2.52 g/t palladium-platinum, with the zone remaining open in all directions. Aero-magnetic surveys have extended the target zone to 4.8 km of strike, with highlight values of 1.12% copper and 0.36% nickel over 1.8 metre also being intersected.

The discovery at EBAY was the first reported drill interval of palladium-platinum mineralization being found within the Bell River complex. Max Resource as a result has engaged the EBAY head geologist to conduct reinterpretation of existing data. The company has also commenced re-analysis of core samples taken from the property, and intends to look for rhodium, iridium, osmium and ruthenium values within the samples. Historical exploration data has not yet been verified by the company.

Under the letter of intent, Max Resource has paid $25,000 as a deposit for the exclusive right for a 60 day window to acquire 100% of the EBAY Palladium Project. Under the terms of the letter of intent, to acquire the property in full, Max will have to execute the definitive agreement on or before expiry of the option period.

Following the execution of the definitive agreement, several payments are required to be made to acquire the property in full. As follows:

- The issuance of 2,950,000 common shares to the vendor, as well as $250,000 in expenditures before the first anniversary of executing the definitive agreement.

- Payment of $25,000 in cash, plus the issuance of $75,000 in common shares and $600,000 in expenditures by the second anniversary.

- Payment of $75,000 in cash ($150,000 in aggregate), $225,000 in common shares issued to the vendor, and $900,000 in expenditures ($1.5 million in aggregate) by the third anniversary.

Max Resource Corp will also be required to issue a 2% net smelter royalty to the vendor upon final completion of the expenditure commitments. One half of that royalty can be purchased for $1.0 million by Max Resource.

Max Resource Corp last traded at $0.07 on the TSX Venture.

FULL DISCLOSURE: Max Resource Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Max Resource Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.