Max Resource Corp (TSXV: MAX) has successfully attracted a mining major to its project in northwestern Colombia. The company this morning revealed that it has entered into an earn-in arrangement with that of Freeport-McMoRan Exploration for its flagship Cesar Copper-Silver project.

The arrangement will see Freeport acquire up to an 80% interest in the project under a two-stage program that will see cumulative funding of $50 million in the form of project expenditures, as well as $1.55 million in the form of cash payments to Max.

The first stage of the program will see Freeport earn a 51% stake in the project by funding $20 million in exploration over five years at Cesar, along with staged payments of $0.8 million. Max will remain the operator of the project during this stage of the earn-in agreement.

The second stage will see Freeport expand its ownership in Cesar to 80% by funding a further $30 million in exploration at the property over a second five year term, with staged payments here to amount to $0.75 million.

“Freeport has a track record of global copper discoveries that have proceeded to mine development and production. Max looks forward to advancing our Cesar Project with Freeport, one of the world’s largest copper producers,” commented Max Resource CEO Brett Matich.

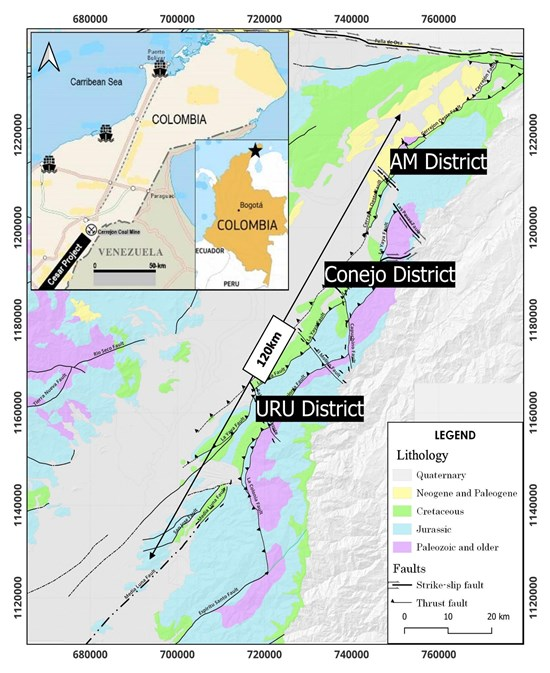

The Cesar Project currently spans a collective 188 square kilometres in Northern Colombia, with the massive project comprising of three separate districts that spans 120 kilometres in length. The project is viewed as one of the world’s largest underexplored sedimentary copper-silver systems, with samples collected including highlight values of 34.4% copper and 305 g/t silver, which come from the AM District. Drilling within the URU district meanwhile has seen highlight values of 10.6 metres of 3.4% copper and 48 g/t silver.

Max Resource last traded at $0.21 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.