McEwen Mining (TSX: MUX) last night announced its official guidance for calendar 2022. Guidance provided includes both production and cost guidance across the firms global operations.

For the full year, the company currently expects to produce between 153,000 and 172,000 gold equivalent ounces. Broken down, it translates to 118,000 to 133,000 ounces of gold, and 2.52 million to 2.80 million ounces of silver.

Gold production is expected to be rather evening split amongst the firms San Jose, Gold Bar, and Black Fox mines, with San Jose expected to produce between 34,500 and 38,500 ounces, while Black Fox is expected to produce between 44,000 and 49,000 ounces. Silver production meanwhile will solely come from the San Jose Mine in Argentina.

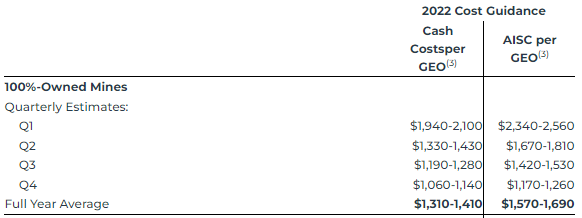

In terms of cash costs, the cash cost per gold equivalent ounce are expected to amount to between $1,310 and $1,410. All in sustaining costs per gold equivalent ounce are meanwhile anticipated to be between $1,570 and $1,690 for the year.

The first quarter is expected to be the highest cost quarter, with all in sustaining costs per gold ounce estimated to be between $2,340 and $2,560 per ounce – a loss at current commodity prices. Costs are expected to fall dramatically throughout the year, to $1,170 to $1,260 per ounce by the fourth quarter.

The figures overall compare to 2021’s production of 154,410 gold equivalent ounces, which were produced at a cash cost of $1,453 per ounce. All in sustaining costs meanwhile were $1,635 per ounce for the full year.

McEwen Mining last traded at $1.15 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.