Earlier this week, Medipharm Labs (TSX: LABS) reported their fourth quarter and 2020 year-end financial results. The company announced revenue grew 22% on a quarterly basis to $6.1 million and had a surprising gross profit margin of NEGATIVE 408%. Meanwhile full-year revenues came in at $36 million, and gross profit margin for the year was -122%

MediPharm Labs currently has five analysts covering the company with a weighted 12-month price target of C$0.99. This is down from the average before the results, which was C$1.29. One analyst has a strong buy rating. Two analysts have buy ratings and another two have hold ratings. The street high comes from Alliance Global with a C$1.25 price target, while Mackie Research has the lowest at C$0.60.

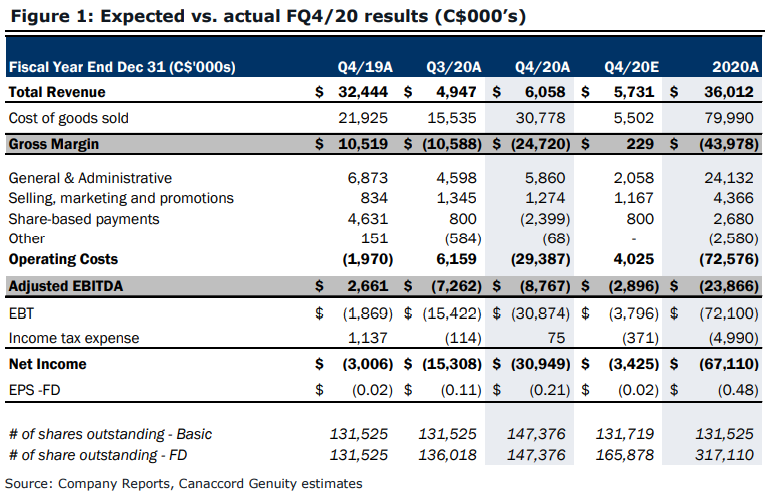

Canaccord subsequently lowered their 12-month price target on MediPharm from C$1.75 to C$1.00 and reiterated their speculative buy following the earnings report. Shaan Mir, Canaccord’s analyst, headlines, “FQ4/20 review: Setting the stage for international medical markets.”

Mir says the reason for the price target decrease is due to them revisiting their margin assumption, “as the company continues to work through higher cost inventory balances in FY/21,” while slowing down the ramp of their European sales and cutting their Canadian market share by 1%.

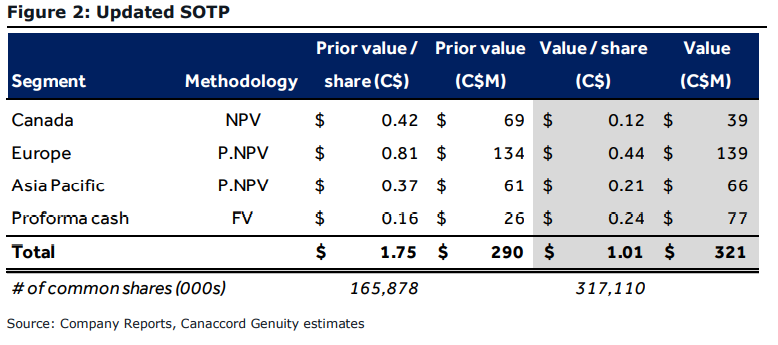

Surprisingly, MediPharm Labs’ quarterly revenue came in higher than Canaccord estimates. Canaccord estimated fourth-quarter revenue to come in at $5.7 million, while they did not forecast for a large cost of goods sold impairment. For the quarter, Mir says that the beat mainly came from improvements in their Canadian finished product segment, formulated products, and new SKU’s. Meanwhile the bulk of new future revenue will come from international markets, Mir believes. Below you can see how MediPharm did versus Canaccord’s estimates.

Mir believes that the Stada partnership helps de-risk MediPharm’s international operations as Stada is a reputable partner, which will also allow them to sell cannabis outside just Germany. Mir writes, “in our view, could become a cornerstone arrangement for the company within its international customer base,” and he also believes that MediPharm is positioned perfectly to “secure an outsized proportion of contracts as more international markets come online.”

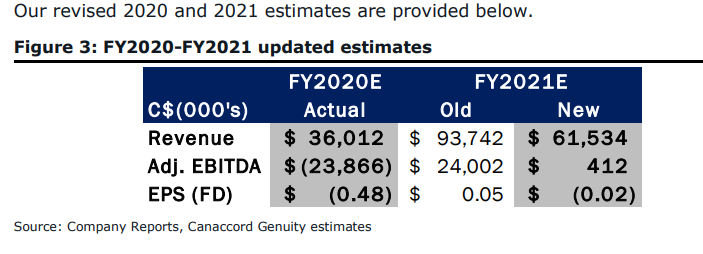

Below you can see Canaccord’s updated fiscal 2021 numbers.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.