MicroStrategy’s (Nasdaq: MSTR) bitcoin strategy is being threatened by the latest price crash, ushering in talks of a possible margin call. But CEO Michael Saylor is shrugging these off, even if the benchmark price came from the firm’s own CFO.

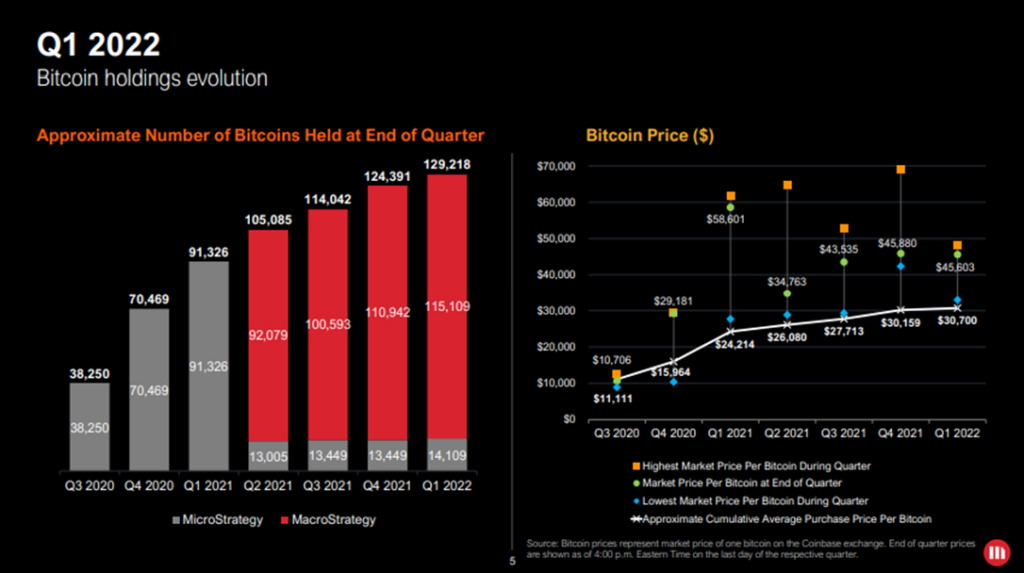

In its latest financials for Q1 2022, the business intelligence firm held 129,218 bitcoin at the end of the quarter–solidifying its lead as the largest bitcoin holder public company. Total purchase price for the holdings stands at around US$4.0 billion, but bitcoin’s falling price led to a series of impairment charges totalling US$1.1 billion, leading to a book value of approximately US$2.9 billion.

The market value is estimated at US$5.9 billion.

That was when bitcoin averaged US$45,000. Now, the price has breached the infamous US$21,000-mark.

The (dropped) margin call

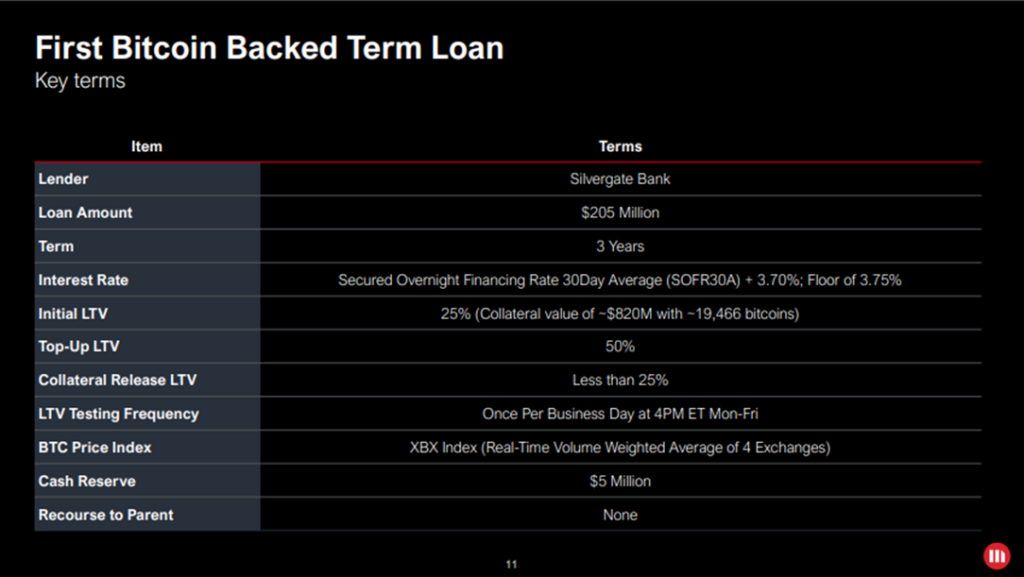

It should’ve been an impairment-loss-on-digital-asset-as-usual story for Microstrategy, but things got dicey when the firm took out a loan with its bitcoin holdings as collateral.

The US$205-million loan is tied to bitcoin valued at around US$820.0 million–approximately 19,466 bitcoin at the time–and with a 50% loan-to-value requirement. This means if the bitcoin price would fall such that the collateral tied to the loan would end with a value below US$410.0 million, the company would have to add more bitcoin to the collateral based on a 25% loan-to-value ratio.

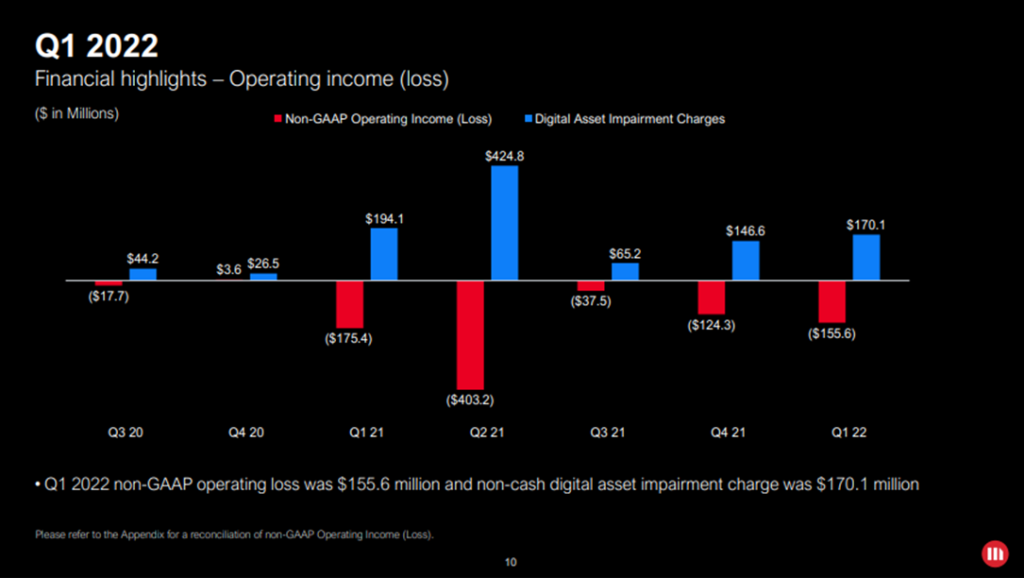

Based on applicable accounting principles, when the value of the digital asset increases, the gains are not reflected in the firm’s financials as these are considered “indefinite-lived intangible assets.” But the decline in value from the asset’s book value should be reported as an impairment charge.

This is the same conundrum Tesla (Nasdaq: TSLA) is facing, which is now looking at recording an impairment loss of around US$500 million.

The US$21,000 bitcoin price stipulation for the company to do a margin call was actually verbalized by the firm’s own President and CFO Phong Le in the Q1 2022 earnings call.

“As far as where Bitcoin needs to fall, we took out the loan at a 25% LTV, the margin call occurs 50% LTV. So essentially, Bitcoin needs to cut in half or around $21,000 before we’d have a margin call,” said Le.

“Before it gets to 50%, we could contribute more Bitcoin to the collateral package, so it never gets there, so we don’t ever get into a situation of March call also,” get added.

Now that the bitcoin has breached that price point, investors are wary about a possible margin call. The sentiment is very well reflected when the firm plummeted 27% when markets opened on Monday.

MicroStrategy’s share price is back at the level before owning any #Bitcoin, except that now the company has $2.5bn of debt against $100m EBITDA 23 estimates from its core software business which will be needed to pay interest. Not sure how those bonds get paid back.$MSTR pic.twitter.com/262fQDlmnb

— Alexander Stahel 🇺🇦 (@BurggrabenH) June 14, 2022

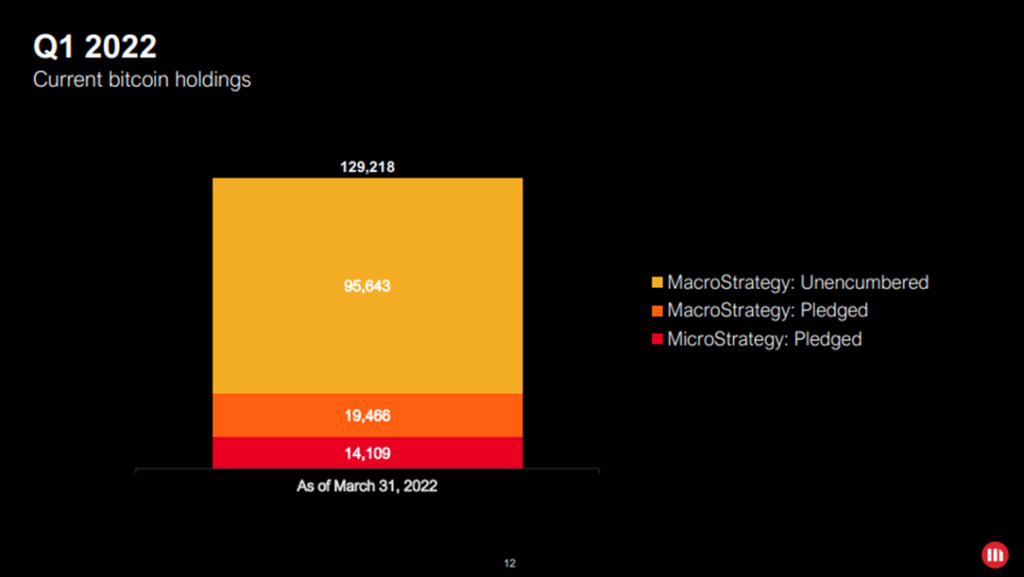

But Saylor dismissed the uproar as “all FUD”. When asked in a Yahoo Finance interview about the potential margin call, the MicroStrategy chief explained that considering the amount of bitcoin tied to the loan vis-a-vis the total crypto holdings, it is really a “non-issue.”

“We started with US$5 billion of unpledged collateral, we borrowed US$200 million against it. So that’s a loan-to-value of 4%… You know, people got their hands around the fact that we would adjust some collateral of bitcoin if ever it’d got to US$21,000 but it’s really a non-issue.”

“Michael, if #Bitcoin falls below 21,000$ , there might be some form of Margin Call….”@YahooFinance

— ∞ ฿ł₮₵Øł₦ 𝒫𝑜𝒹𝒸𝒶𝓈𝓉𝑒𝓇 ©️ (@bitcoinpods) May 16, 2022

“That’s all FUD” @saylor on #Bitcoin #BTC pic.twitter.com/xhwZxvL4kp

Saylor further tweeted that the firm “anticipated volatility” when it started investing in bitcoin.

When @MicroStrategy adopted a #Bitcoin Strategy, it anticipated volatility and structured its balance sheet so that it could continue to #HODL through adversity. https://t.co/rPSUVPHUVw

— Michael Saylor⚡️ (@saylor) June 14, 2022

According to the firm’s chief executive, a known bitcoin bull, the price would have to fall down to US$3,562 to run out of bitcoin collateral for the loan. Saylor is confident if that were to happen, “MicroStrategy could post some other collateral.”

MICROSTRATEGY SAYS IT HAS MORE THAN SUFFICIENT BITCOIN TO MEET LOAN REQUIREMENTS

— FXHedge (@Fxhedgers) June 15, 2022

Looking at the composition of the company’s bitcoin holdings, around 74% of the asset is unencumbered–the potential pool for adding collateral to the term loan should it need it.

All things considered, the said term loan is set to mature in March 2025.

At the current bitcoin prices, the firm’s 129,218-bitcoin asset has a market value of approximately US$2.7 billion. This could mean that the firm is looking to add another US$200 million in impairment loss for the next quarter.

So it seems things are still on the fence for Saylor’s faith in the crypto asset.

In #Bitcoin We Trust.

— Michael Saylor⚡️ (@saylor) June 13, 2022

MicroStrategy last traded at $156.87 on the Nasdaq, then fell 7.89% after-hours.

Information for this briefing was found via Yahoo, Seeking Alpha, Coin Desk, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Great writeup, ER!

Everything we need and nothing we don’t. Keep up the great work.