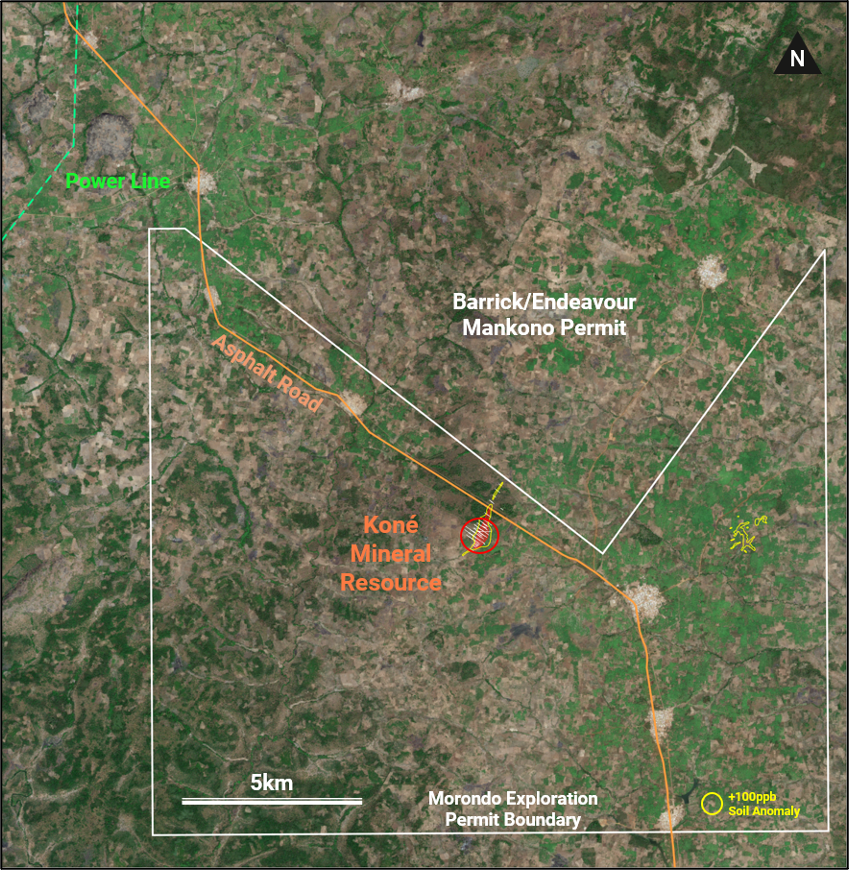

Montage Gold (TSXV: MAU) has begun a 50,000 metre drill program at its flagship Morondo Gold project, located in Cote d’ Ivoire. The announcement of the program follows the completion of Montage’s $30.0 million IPO last Friday.

The drill program being launch of the Morondo Gold project is focused on expanding and upgrading the current resource estimate. Five drill rigs in total will be conducting work on the project, with 20,000 metres of drilling focused on updating the inferred resources in the first quarter of 2021, while 30,000 metres will be dedicated to upgrading the indicated mineral resource estimate in the second quarter of 2021.

Montage’s flagship property, which measures approximately 1,143 square kilometres, currently has an inferred mineral resource estimate of 1,536,000 ounces of gold at an average grade of 0.91 g/t gold, based on a cut-off grade of 0.5 g/t gold at the Kone deposit. The resource estimate was established in 2018 through 18,172 metres of drilling. Further drilling has since been conducted on site, with recent deep drilling intersecting 191.2 metres of 1.19 g/t gold, 106.15 metres of 1.12 g/t gold and 91.32 metres of 1.22 g/t gold, with mineralization being extended 250 metres below the current resource.

Currently exploration work is expected to form the basis of a preliminary economic assessment, which Montage intends to announce by the end of the first quarter of 2021. This assessment is currently said to be focused on an upgraded inferred mineral resource.

Montage Gold last traded at $1.14 on the TSX Venture, with a market capitalization of $114.9 million.

Information for this briefing was found via Sedar and the companies mentioned above. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.