The Canadian rental market has hit yet another record high in July, with the average asking price for a rental unit reaching an unprecedented $2,078, according to the latest rental report jointly published by Rentals.ca and Urbanation.

This surge in rental prices follows closely on the heels of a new high set in June. The month of July witnessed a notable 1.8% increase in average asking rents over June, marking the most rapid month-over-month growth in the past eight months. The report, released last week, reveals that July registered the swiftest pace of growth in the past three months, reflecting a staggering 8.9% annual increase in rents.

Comparing rental prices to the same period in 2021, the report discloses an astonishing 21% surge in average asking rents in Canada, translating to an additional monthly expenditure of $354 on average for renters. Douglas Kwan, the director of advocacy and legal services at the Advocacy Centre for Tenants Ontario, has expressed concerns about the trajectory of these prices, predicting that average asking rents in Ontario might soar to $3,500 next year.

The impact of these skyrocketing rents is evident in the experiences of individuals and families across Canada. Stories abound of tenants being taken aback by exorbitant rent increases from their landlords. One family of Syrian refugees, for instance, initially secured a rental home in Waterloo, Ont., for $2,000 per month, only to face a staggering demand of nearly $4,000 a month a year later.

Contributing factors to this escalating trend in rental prices include a scarcity of affordable housing, amplified by a surge in post-secondary students signing leases ahead of the fall semester, an unparalleled population growth rate, and potential homebuyers deferring purchases in response to rising interest rates.

Shaun Hildebrand, president of Urbanation, identified a “perfect storm” of driving factors behind the surge in rents, including peak lease activity, an influx of new residents due to open border policies, rising incomes, and the exacerbating issue of declining home ownership affordability conditions.

The real estate landscape further shapes these trends, as spooked prospective buyers, concerned about the impact of interest rate hikes on their purchasing power, opt to remain in the rental market. The Canadian Real Estate Association reported that the average home price reached $709,218 in June, indicating a 6.7% increase from the previous year.

Significantly, July marked a watershed moment in the rental market, with average asking rents for purpose-built condominiums and apartments surpassing the $2,000 mark for the first time, settling at an average of $2,008.

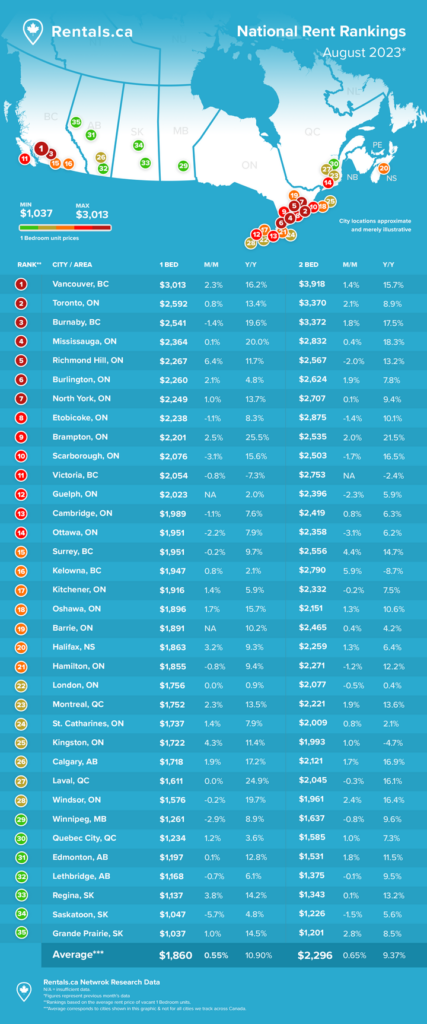

Distinct trends emerged within specific apartment types. One-bedroom apartments experienced a 13% annual rise and a 2.5% monthly increase, resulting in an average rent of $1,850. Two-bedroom units commanded an average rent of $2,191, and three-bedroom units registered a slightly higher average of $2,413. At the more affordable end of the spectrum, studios recorded an average rent of $1,445.

While Toronto and Vancouver reported a slower annual rent growth rate in July at 11.5% and 12.2%, respectively, Vancouver retained the highest average rent among major markets at $3,340, indicating a 2.9% monthly increase.

Is the surge in immigration to blame?

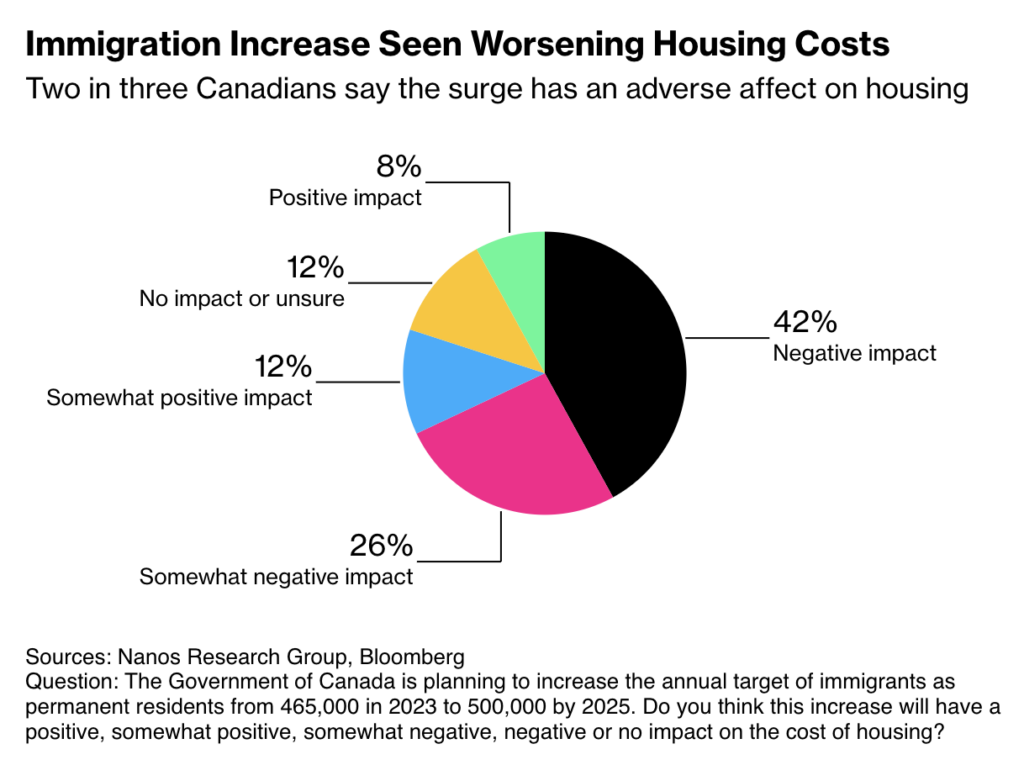

According to a recent Nanos Research Group poll for Bloomberg News, two in three Canadians believe that the surge in immigration pushed by Prime Minister Justin Trudeau’s government is negatively impacting housing.

“Although Canadians traditionally support immigration, increasing the number of new Canadians while there is stress on the housing market has dampened enthusiasm,” Nik Nanos, chief data scientist and founder of Nanos Research Group, said.

This is a stark difference from just five months ago, the Nanos poll from that period showed that 52% of the respondents supported the government’s immigration push saying it’s likely to have a positive impact on the economy.

The annual target for permanent residents has been increased to 465,000 in 2023, up from a record 431,000 last year. It will go up to half a million by 2025.

“The research puts a spotlight on the housing pain point and the collision of increasing the number of new Canadians when housing is seen as being increasingly unaffordable.”

Rising interest rates

Increasingly anxious and desperate amid inflation and rising interest rates, Canadians are also putting the blame on rising interest rates. A single mother recently started a petition calling on the prime minister to prevent further rate hikes and reduce mortgage interest rates.

When interest rates increase, one of the desired results is a slowdown in the housing market. When interest rates are up, the cost of housing also goes up, and thus the demand goes down. When demand is down, home prices also go down.

But it has been an especially long and difficult hike cycle while more Canadians are failing to see the light at the end of the tunnel.

There is almost nothing that can stop this, at this point.

— Kendal Harazny (@khzny) August 12, 2023

CMHC MLI SELECT is a great program, but they are completely backlogged, so can’t approve projects fast enough.

Rents in Canada will continue to rise. The crisis will continue to worsen.

We desperately need new… https://t.co/o17HsSdIyE

As of this writing, her petition has received close to 18,000 signatures.

Information for this story was found via Bloomberg, Rentals.ca, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

“As drought ruins more crops, more Canadians are concerned about the water fountains in the park…”

Adjusting imigration to make up for a lack of housing is beyond stupid, and so is anyone who floats it. It’s accomodating the problem, instead of fixing it.