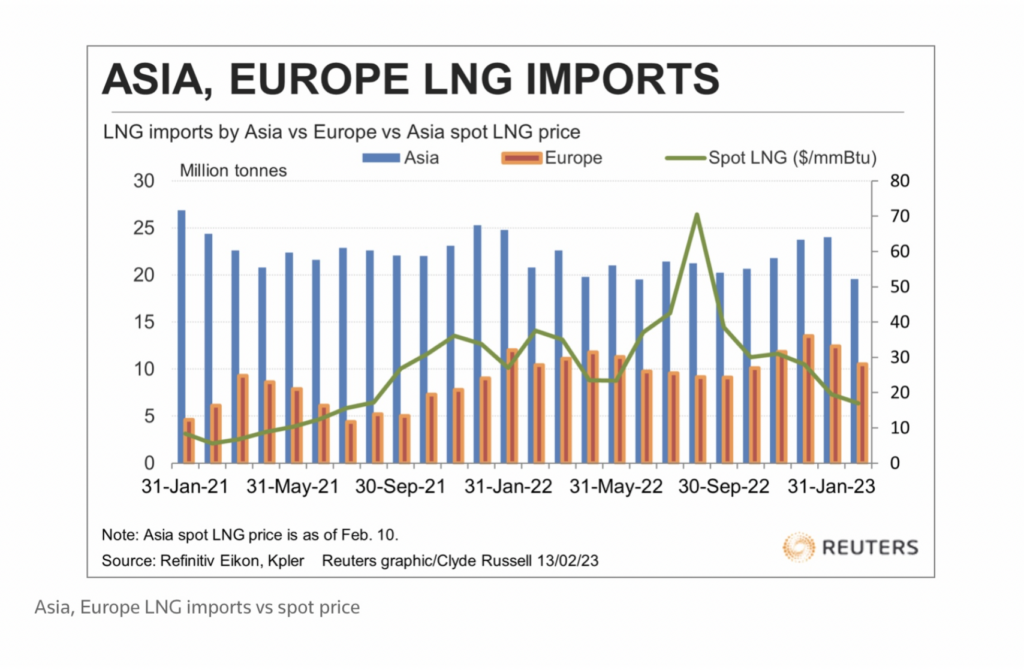

The price of natural gas, in any form, continues to fall across the globe. In particular, spot liquefied natural gas (LNG) prices for delivery to northern Asia have declined about 75% since late summer to US$17 per million BTU (MMBTU). This is even despite Europe turning toward the commodity to replace the natural gas Russia decided to withdraw from the markets, and as China’s economy moves closer to reopening.

After this dramatic drop, LNG prices could be close to stabilizing as significant incremental LNG supply is not expected to come on until 2025 (aside from the Freeport facility restart).

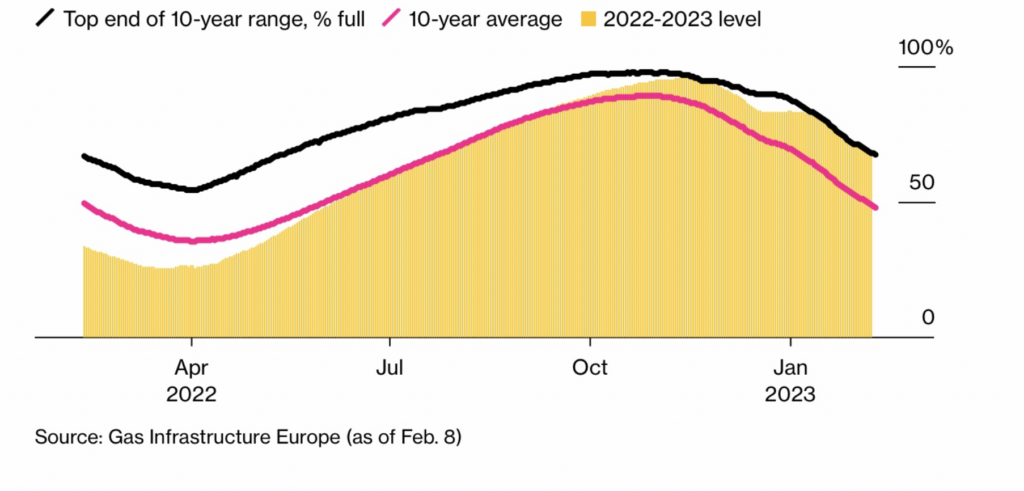

An extremely mild winter in Europe, coupled with increased usage of alternative energy sources like nuclear and wind power and remarkable energy conservation efforts, has pressured both European gas and LNG prices. The European Union consumed about 20% less natural gas over the four-month period August 2022 through November 2022 than the 2017-2021 historical average, according to Eurostat. As a result, the benchmark Dutch TTF gas futures price is about US$16 per MMBTU, down 80% in around six months.

European natural gas storage levels are well above average, a condition which could keep a ceiling on prices. Currently storage tanks are about 65% full. Storage was about 74% full at the end of January 2023 versus a five-year average of 54%. Some analysts project a storage figure of 50% or more at the end of winter, about double last year’s end-of-season percentage.

LNG prices have fallen even though LNG imports to Europe are much higher than they were prior to the start of the Russia-Ukraine war. Europe imported a record high 13.44 million tonnes of LNG in December. Imports fell slightly to 12.49 million tonnes in January 2023 and are expected to total only 10.5 million tonnes in February, per Kpler, an energy data and analytics firm.

READ: Natural Gas Prices Continue To Plummet With No Turning Point In Sight

Interestingly, China’s projected 4.47 million tonnes of LNG imports in February 2023 will be below the 4.95 million tonnes imported in February 2022. In the peak of winter, China imported 7.28 million tonnes and 6.12 million tonnes in December 2022 and January 2023, respectively.

Meanwhile, U.S. natural gas prices continue to trade like a falling knife, dropping to US$2.43 per MMBTU from nearly US$10 last autumn. As is the case in Europe, mild weather has been a key reason for the fall, which in turn has caused U.S. storage volumes to be much fuller than historic norms.

One factor which may be keeping gas prices higher than they might otherwise be is the potential restart of the Freeport LNG export plant facility along the Texas Gulf Coast, the second biggest such plant in the U.S. Freeport’s re-start would create significant incremental natural gas demand. It has been down since a massive fire shuttered operations in June 2022. On February 13, Freeport filed a restart permission request with the FERC.

Information for this story was found via Energy News, Trading Economics, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

thanks for info