BMO Capital Markets this week initiated coverage on New Found Gold (TSXV: NFG) with an outperform rating and a C$10 12-month price target, which is an upside of 40%. In announcing the initiation they comment that the rating is based “on the high-profile Queensway discovery in Newfoundland, Canada.” They add that the company has found “a large system of high-grade gold mineralization,” for which they will go ahead and leverage its $76 million exploration program to explore the area, which BMO believes holds potential for high-margin extraction.

BMO Capital Markets is the second firm to cover the stock, with Paradigm Capital being the other, whom has a C$12.30 12-month price target on the name. This puts the average between the two firms at C$11.15, or a 55% upside to the current stock price. Both analysts have buy ratings on the stock.

BMO calls New Found Gold’s Queensway project one of the highest-profile gold discoveries in recent years, with such discoveries that “have both high grades and apparent scale are scare.” They add that the company is backed by a number of strategic investors and an experienced management team.

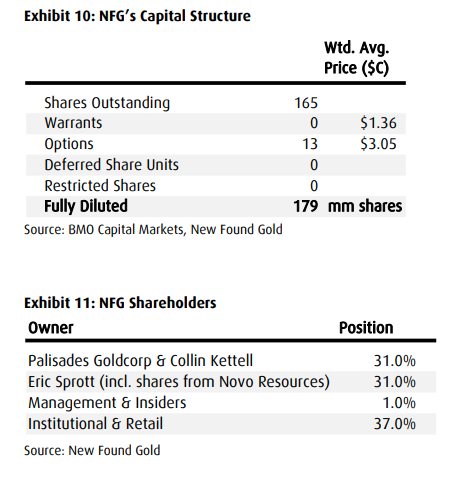

The company is backed by two large investors, Palisades Goldcorp and Eric Sprott, who both hold a roughly 31% ownership stake in the stock. While the management has a number of capital markets and mining exploration backgrounds, with founder Denis Laviolette working in capital markets and Collin Kettell having “an extensive entrepreneurial background in mineral exploration companies.”

With the exploration already ongoing, BMO explains a few things that investors should expect from the company. The first is that progress will happen slowly and “patience will be required” as even with the company moving from 12 drill rigs to 14, the exploration will happen on an incremental basis due to “the extent of drilling required to quantify the extensions of Keats.”

They also anticipate that the Appleton fault will get defined with multiple zones of mineralization that are potentially overlapping or intersecting and that a future mining operation fed by multiple underground mines is quite possible for this location.

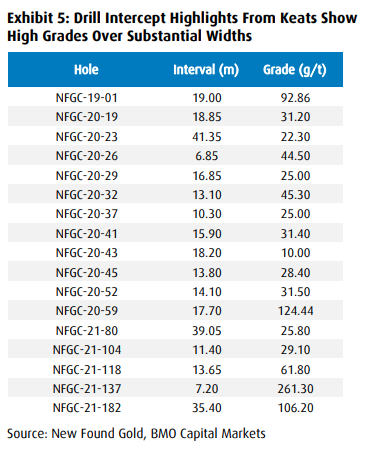

Lastly, BMO believes there will be relatively low dilution at Keats, which would allow for the deposits to be mined at a very high grade, and that an eventual underground mining scenario at Keats will unfold. If this were to occur they expect the grades to range from 15 g/t to over 30 g/t.

They say that the ability of Keats to generate high grades across widths ranging from 10m to 20m is what sets the zone apart from other high-grade discoveries, and one of the main risks to this location is the lower-grade halo of mineralization that surrounds the high-grade zone. They believe that this could dilute the overall grade and could potentially change the economics of the mine.

BMO provides their main risk to the company’s share price, which is, “delivering on market expectations for a continuation of strong drill results and additional discoveries at Queensway.” BMO believes that investors would rather see more thick intercepts drill results. As there is no NI 43-101 resource estimate, BMO finds it hard to quantify the potential gold endowment, meaning that the project/stock has a higher risk profile compared to many other advanced gold projects.

They also believe another risk to the stock could be the market losing interest in the stock due to “the reality of the pace of drilling and exploration,” as New Found Gold has a large drill program, which will make exploration lengthy.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.