All that glitters is not gold.

Newmont Corporation (TSX: NGT) on Wednesday reported its third quarter financial results after the close of the bell and well.. Lets just say that gold bugs had hoped for a more positive signal for the sector from the world’s largest gold producer.

Lets dive in.

The high level results

For the third quarter, analysts had predicted that Newmont would record revenue of $4.58 billion, alongside earnings per share, or EPS, of $0.83… or was it revenue of $4.71 billion and EPS of $0.86 a share ..or maybe revenue of $6.93 billion and EPS of $1.30 per share.

Newmont earnings out after the bell today. Consensus expectations for Q3 results have risen in recent weeks. Latest consensus for Q3 2024 revenue is $6.93 billion, and the earnings are expected to come in at $1.30 per share. $NEM has a US$66 billion market cap as of today's… pic.twitter.com/ViiWee9Ouf

— CEO Technician (@CEOTechnician) October 23, 2024

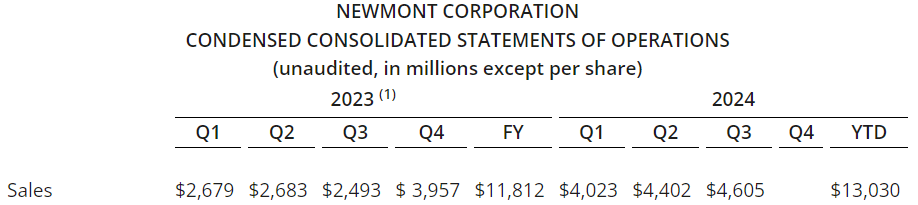

Whatever it was, the actual results that were put out by the company weren’t that great despite a rising gold price. Newmont in the third quarter reported earnings per share of $0.80, based on net income of $922 million from attributable production of 1.7 million gold ounces.

The revenue figure, bizarrely, was reported inconsistently between journo shops, with the figure reported being anywhere from $4.60 to $4.67 billion in topline revenue for the company. The actual figure, however, came in at $4.605 billion.

Net income grew on a quarter over quarter basis from $853 million, an 8% jump, which was largely the result of the average realized gold price jumping from $2,347 per ounce to $2,518, which represents an improvement of a little over 7%.

Free cash flow meanwhile improved nearly 28%, jumping from $594 million in the second quarter to $760 million in the third quarter.

Shareholders were rewarded with 9.4 million shares being repurchased since the last earnings release, of which $198 million was repurchased in Q3, while a further $2 billion in repurchases have been authorized to occur over the next 24 months.

Oh, and they declared a dividend of $0.25 per share for the third quarter, bringing total returns to shareholders during the quarter to $786 million – which trumped the aforementioned free cash flow of $760 million. I’ll leave you to decide how you feel about that.

The costing

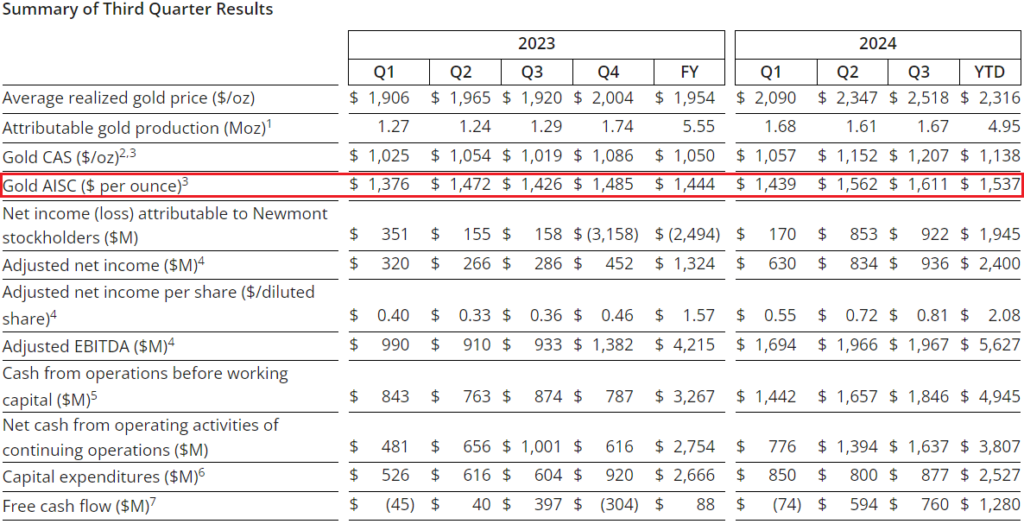

The gripe among investors, however, is the ballooning all in sustaining cost of gold production on a per ounce basis. Last quarter, Newmont’s AISC jumped by 9%, which the company partially blamed on higher third party royalties as a result of rising gold prices. The company at the time guided that for the remainder of 2024, its AISC would sit somewhere near $1,400 per ounce, based on $1,900 per ounce gold.

But gold has instead continued to climb. Dramatically. Instead of declining, all in sustaining costs jumped again in the quarter, climbing to $1,611 per ounce.

Newmont wasn’t taking a chance this time with its guidance, bumping its estimated all in sustaining costs through the remainder of the year to $1,475 per ounce, which is now based on $2,500 gold – a $600 per ounce bump in assumptions from the second quarter.

The company meanwhile expects to produce 1.8 million gold ounces during the final quarter of the year.

Shareholder response

Investors, however, did not take lightly to these costs. The reported AISC for gold was the talk of the town when it comes to the third quarter results, with Newmont’s stock also cratering over 12% as of mid-day Thursday.. And its still sliding as of the time of recording.

So yeah, investors. Not a big fan of the results. Checking in on social media, the stock’s performance certainly matches the mood.

Thomas wood referred to it as a bad start to big cap mining’s earning season.

$nem Bad start to big cap mining earnings season. Tomorrow is a BIG day to tell you how strong this mining bull market is/isn't imo. This dip should be bought and mostly recovered by end of day, as all news received bullishly in a true bull.

— Thomas wood (@WoodTwcapital01) October 23, 2024

Steve over here refers to the AISC as being “just nonsense” while questioning future guidance.

$NEM Trading down ~$3.50 in post market. Miss.

— Steve_Stonk🥇🥈 (@GotoKilroys9pm) October 23, 2024

CONs: $1,611 ASIC is just nonsense. What are these guys doing? Input costs should have fallen this quarter 🫤

PROs: 760M in FCF can't be ignored

4Q: Somehow 4Q ASIC will be $1,475. Not sure about that but mgmt is selling the story

And Hubrishunter views the costs as eye-popping.

$NEM AISC increase is eye popping . Mining inflation .. https://t.co/mZdfvqUL7B

— Hubrishunter (@hubrishunter) October 23, 2024

While IncomeDisparity seems quite level headed, stating that it takes more cash to squeeze ounces from the depleting mines.

It takes a lot more resources (cash) for $NEM to squeeze juice from their depleting mines.

— IncomeDisparity (@IncomeDisparity) October 23, 2024

And then, there was the less-than-kind approach some investors took..

81c/share in adjusted net earnings. What a 🤡🎪$NEM https://t.co/2kjTuC6Vmd

— Ben Kramer-Miller (@TheWealthMiner) October 23, 2024

$nem you f'n clowns : You couldn't find your way out of a wet paper bag. pic.twitter.com/tcHEck5ukx

— Carpathia Portfolio Consulting.AI enabled. (@RostronE) October 23, 2024

$nem is a crap ass management team they need replacement in the i d x with $aem.

— Carpathia Portfolio Consulting.AI enabled. (@RostronE) October 23, 2024

It's a tight race between $NEM and $GOLD to be the most mismanaged company in the world 🤣

— Alfons van Worden (@worden_van) October 23, 2024

And then there’s my personal favorite, from Eric Liquori, who had the most unhinged comment by saying that “owning NEM is like covering your ass with honey and sitting naked on a red ant hill.. Sure its stupid, but you’re connecting with your true feelings”

Whatever that means.

Yes, but you're forgetting to revel in the glory of the 1.9% dividend yield and the wave of (badly mistimed) stock buybacks. Owning NEM is like covering your ass with honey and sitting naked on a red ant hill…sure it's stupid, but you're connecting with your true feelings.

— Eric Liquori (@EricMLiquori) October 24, 2024

Right-sizing

Amid all this however, Newmont to their credit is working to right-size their operation following the acquisition of Newcrest late last year.

The company during the quarter announced the sale of its Akyem mine in Ghana for up to $1 billion in cash, while it also agreed to sell the Telfer mine and a 70% interest in the Havieron project for up to $475 million in gross proceeds.

Newmont continues to expect to receive at least $2 billion in gross proceeds from divesting high quality non-core assets, which is in addition to $527 million in proceeds from asset sales it conducted earlier this year.

The company has also reduced nominal debt by $233 million at a cash cost of $210 million since its second quarter earnings release, bringing total debt reduction year to date to $483 million.

In Closing

So what was my opinion on the quarter overall?

Well, I’m just a dude with a youtube channel. But to me, like everyone else has addressed, the costs were high this quarter and in my view they face some challenges in terms of hitting guidance for the fourth quarter, as far as all-in sustaining costs are concerned.

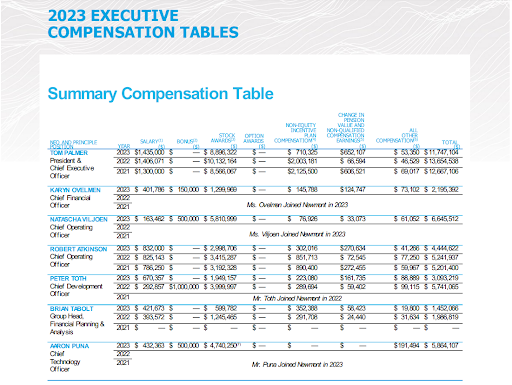

With that being said, Newmont is the aircraft carrier of gold producers. It takes a while to turn around, so its best to have some patience here. It won’t be fixed overnight, but if CEO Tom Palmer likes his annual compensation of about $12 million – and I suspect he does – then I imagine he’s going to do all that he can to turn it around.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.