California Governor Gavin Newsom on Thursday released a new video on his campaign to put a penalty on gas price gouging to “force oil companies to lower the cost of gas.” But, as the second-term governor continues to blame Big Oil for California’s high gas prices, people are calling him out and bringing attention to the state’s high gas taxes.

Big oil is ripping you off AND lying to you!

— Office of the Governor of California (@CAgovernor) January 26, 2023

We’re working with the Legislature on a price gouging penalty to keep oil company profits in check.pic.twitter.com/qTWoGSbrK2

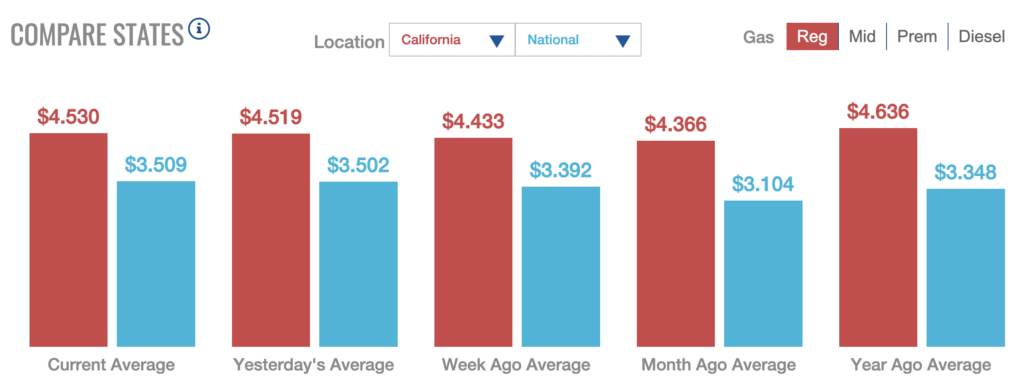

California’s gas prices continue to be among the highest in the United States, second only to Hawaii. The average price per gallon in California is currently $4.53, while the national average is $3.51, according to data from AAA.

Patrick De Haan of Gasbuddy.com criticized the governor for blaming oil companies when the state “taxes fuel at the highest rate in the country,” also pointing out that California does not contribute to gasoline production, which would help lower gas prices at the pump, but instead “hinders it.”

it's weird that a state that taxes fuel at the highest rate in the country, has the highest living cost of anywhere in the country, suddenly says "oh its oil companies". the state does nothing to produce gasoline, in fact hinders it, but then taxes it like no other, & blames oil. https://t.co/7nbFZKxI8A

— Patrick De Haan ⛽️📊 (@GasBuddyGuy) January 27, 2023

Twitter user Mike Umbro replied to the governor with a table of California’s gas taxes that shows that as of October 24, when the average gas price was at $5.50 per gallon, taxes and fees made up $1.17, or 21.27% of the cost at the pump.

We do have some high gas taxes… pic.twitter.com/cVwsWzv9UF

— Mike Umbro 🪃 (@mike_umbro) January 27, 2023

Tracy Shuchart, the CEO and Chief Energy and Materials Strategist at Hightower Resource Advisors, LLC, challenged Newsom to repeal the state excise tax, which is currently $0.54, if he is “serious about bringing down prices at the pump in your state.”

You have the highest state oil taxes in the nation. Repeal state excise taxes if you are serious about bringing down prices at the pump in your state. Many states have done so…CA residents are waiting https://t.co/Mj23TmUWjZ

— Tracy (𝒞𝒽𝒾 ) (@chigrl) January 27, 2023

In the video, Newsom says the high gas taxes as the cause of California’s high gas prices is a myth, arguing that California’s gas taxes have not changed throughout the price increases.

“Big Oil didn’t say why they suddenly started charging Californians a record $2.61 more per gallon than people in other states,” he says. “But we know it resulted in record profits.”

As we’ve written back in October, Newsom has yet to show proof of price gouging. And many agree that gasoline prices are higher in California because of a combination of factors that are unique to the state with its green energy transition goals: the refining recipe of seasonal blends meant to minimize emissions, and more recently, a reduced capacity in its oil refineries as part of the legislation that pushes to phase out internal combustion engines, and then there’s the high gas tax rate and the overall higher cost of doing business in California.

In the video, Newsom calls this reasoning “nonsense,” but stops short of saying why.

The governor unveiled the measure at a special session at the state Capitol in December. The proposal does not yet include key details including how much profit oil refiners would be allowed, as well as the proposed amount of the penalties for those who exceed the cap.

Information for this story was found via Twitter, Cal Matters, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The taxes are not responsible for the oil companies excessive profits.