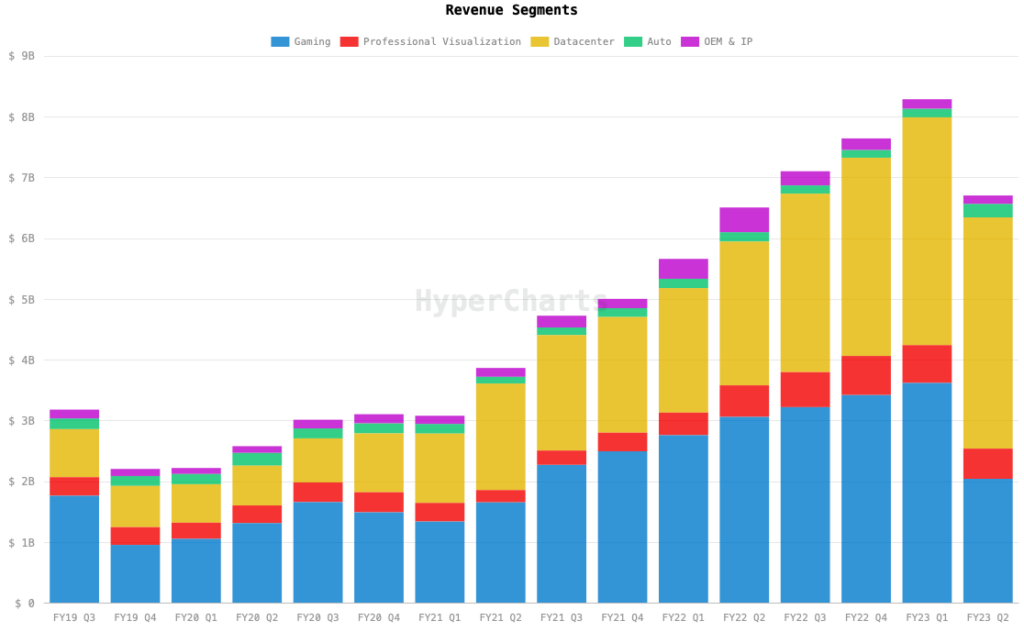

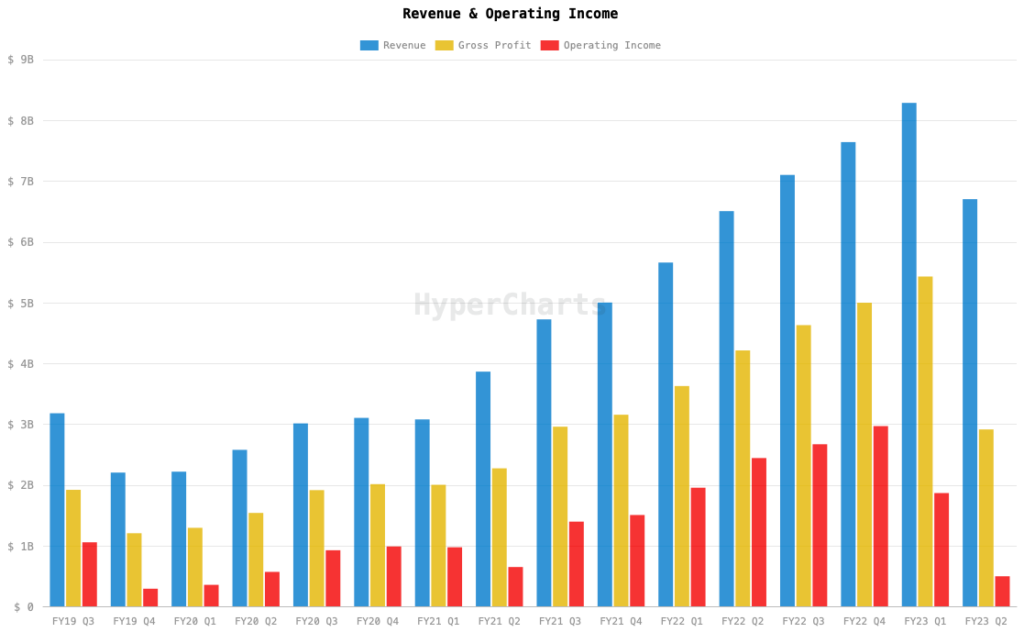

NVIDIA (Nasdaq: NVDA) announced Wednesday after the closing bell its financial results for the fiscal second quarter of 2023, ended July 31, 2022. The report highlights a topline revenue figure of US$6.70 billion, a decrease from Q1 2023’s revenue of US$8.29 billion but a marginal increase from Q2 2022’s revenue of US$6.51 billion.

“We are navigating our supply chain transitions in a challenging macro environment and we will get through this,” said CEO Jensen Huang.

Breaking down the topline figure, data center business contributed US$3.81 billion (up 1% quarterly, up 61% annually), gaming business contributed US$2.04 billion (down 44% quarterly, down 33% annually), visualization services contributed US$496 million (down 20% quarterly, down 4% annually) and automative business added US$220 million (up 59% quarterly, up 45% annually).

The gross margin also declined to 43.5% this quarter coming from 65.5% last quarter and 64.8% last year. The firm also recorded US$499 million in operating income, down from last quarter’s US$1.87 billion and last year’s US$2.44 billion.

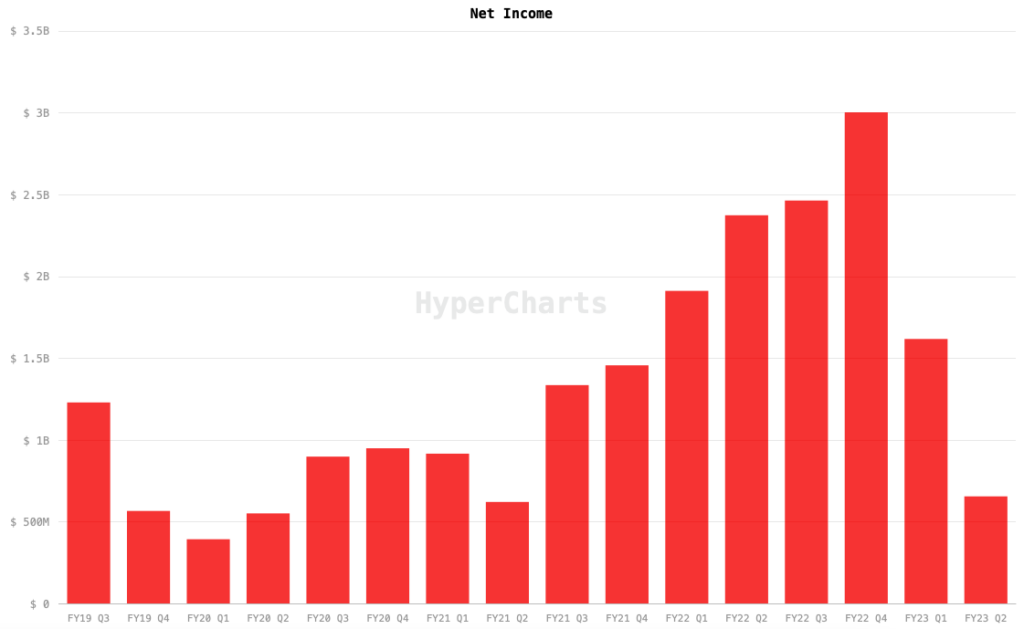

Further down the financials, net income also dwindled during the quarter to US$656 million compared to US$1.62 billion last quarter and US$2.37 billion last year. The quarterly income translates to US$0.26 earnings per diluted share.

Adjusted for financial calibrations, non-GAAP net income came in at US$1.29 billion, but still down from last quarter’s US$3.44 billion and last year’s US$2.62 billion. Non-GAAP earnings also translated to US$0.51 per diluted share.

Continuing the decline, the tech firm anticipates the revenue for the next quarter would land at US$5.90 billion (+/- 2%), a huge drop from Q3 2022’s revenue of US$7.10 billion. The company expects revenue contribution from gaming and visualization divisions to drop sequentially “as OEMs and channel partners reduce inventory levels to align with current levels of demand.”

Gross margin is also expected to come back up to 61.9% – 62.9% in Q3 2023. Operating expenses, which came in at US$2.42 billion this quarter, is expected to increase to US$2.59 billion next quarter.

Following the company’s earning release, the firm’s share price fell as much as 5% in pre-market trading, before rebounding after the bell.

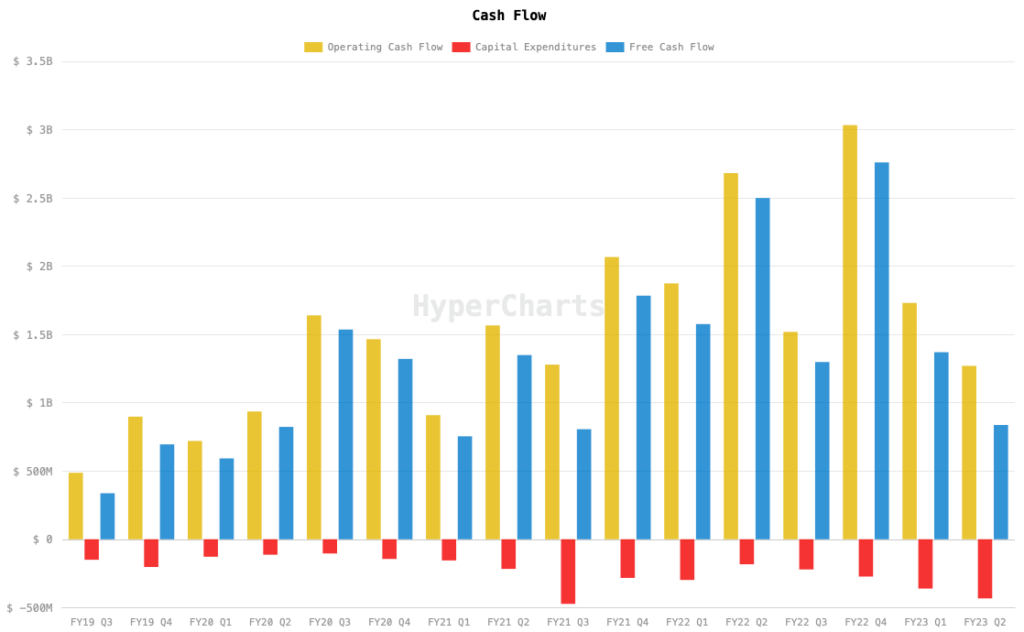

Operating cash flow generated during the quarter came in at US$1.27 billion while free cash flow ended at US$837 million. These compare to last quarter’s US$1.73 billion operating cash flow and US$1.37 billion free cash flow, and last year’s US$2.68 billion OCF and US$2.50 FCF.

The firm ended the quarter with a US$3.01 billion cash and cash equivalents balance from a starting balance of US$3.89 billion. The cash burn is heavily driven by the share repurchase program that amounted to US$3.35 billion, with US$11.93 billion still remaining under the program through December 2023. The company’s current assets balance ended at US$27.42 billion while current liabilities came in at US7.57 billion.

The tech company has recently made the headlines after Paul Pelosi, husband of US House Speaker Nancy Pelosi, reportedly made bank after buying US$1 million worth of additional NVIDIA stock a day before the Senate was scheduled to vote on the landmark CHIPS Act that aims to provide support to the semiconductor industry. Rep. Pelosi has since denied the insider trading allegation.

NVIDIA last traded at US$176.06 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.