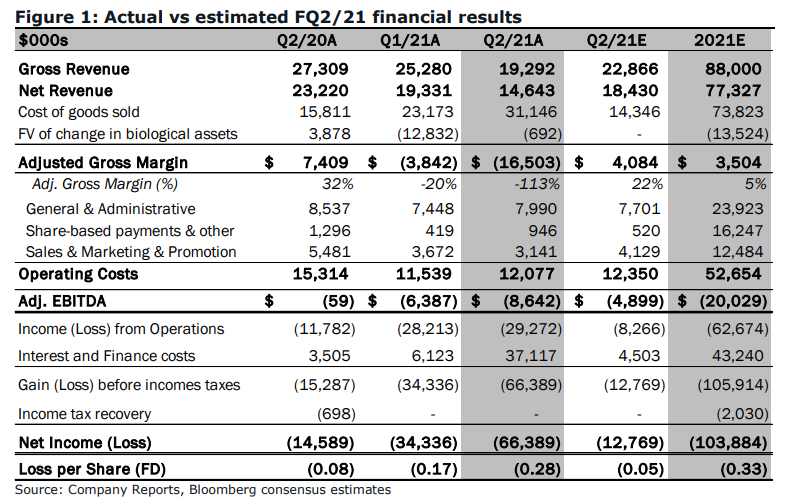

On April 13th, Organigram Holdings (TSX: OGI) (NASDAQ: OGI) reported their second fiscal quarter for 2021. Revenue for the quarter came in at $14.6 million, a roughly 25% decrease year over year. With gross margin being negative $17.2 million due to fair value adjustments and high cost of sales, adjusted EBITDA came in at negative $8.6 million for the quarter. These results came in quite a bit below the consensus estimates.

Organigram currently has 14 analysts covering the company with a weighted 12-month price target of C$3.75. This is down from the average before the results, which was C$4.14. Two analysts have strong buy ratings, two analysts have buy ratings, nine have hold ratings and one analyst has a sell rating. The street high comes from Cantor Fitzgerald with a C$6.15 price target, while Mackie Research has the lowest at C$2

Here are the most recent analyst changes:

- Canaccord Genuity raises price target to C$3.50 from C$2.00

- ATB Capital markets cuts price target to C$3.75 from C$4.20

- Alliance Global partners cuts price target to C$3.75 from C$4.00

- CIBC cuts to underperformer from neutral; cuts price target to C$3.25 from C$5.00

- Haywood Securities cuts target price to C$3.50 from C$4.75

In Canaccord’s note, Matt Bottomley, their cannabis analyst, actually raised their 12-month price target from C$2.00 to C$3.50 and reiterates their hold rating. Bottomley gives a few reasons as to why he increased the target, even after horrible earnings. The main reason for the increase can be attributed to the BAT investment. Bottomley says, “as one of only three LPs in Canada to secure a sizable equity investment from a global strategic partner, we have lowered our discount rate by ~200bp.”

The primary reason why Organigram missed estimates can be attributed to a COVID-19 outbreak at their Moncton facility which resulted in an estimated C$7 million in lost sales. Bottomley adds that the traditional “COVID-19 headwinds” also affected the company’s top-line growth as provinces right size their inventory levels.

Below you can see Canaccord’s second quarter estimates and how the company performed relative to these figures.

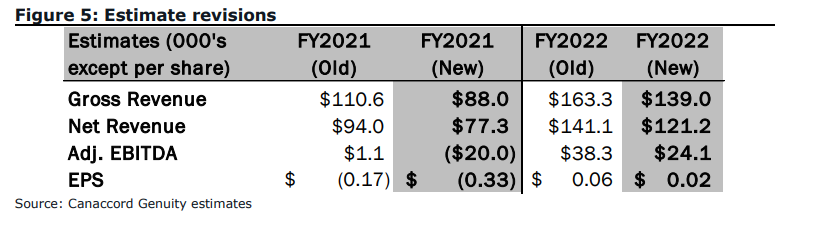

Below you can Canaccord’s revised estimates for 2021 and 2022

Onto Raymond James’ note, they reiterated their outperform rating and lowered their 12-month price target to C$5.00 from C$6.00. Although Rahul Sarugaser, their cannabis analyst, highlights the same details while providing a few key insights.

Sarugaser says that Organigram has not completed any additional shipments to their Isreal partner Canndoc since the fourth quarter. This follows the Ministry of Health upping their quality standards which now requires GAP certifications. Organigram’s grow houses are designed to this standard but have never received certifications, which will now need to be obtained in order to continue with this sales agreement.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.