The Office of the Superintendent of Financial Institutions (OSFI) launched a public consultation of Guideline B-20 on Residential Mortgage Underwriting Practices and Procedures on Thursday. The consultative document outlines addendum proposals to the current guidelines to mitigate mortgage lending risks.

“Mortgage lending risks, particularly related to debt serviceability, have increased considerably since the onset of the pandemic. These heightened near-term risks underscore the need to consider complementary measures to mitigate them,” the agency said in a statement.

Rising household debt is a significant vulnerability to #mortgage lenders.

— Superintendent of Financial Institutions (@OSFICanada) January 12, 2023

Share your views on our proposed measures to better control risks to lenders from high consumer indebtedness. https://t.co/TXJ60gczJL#osfiB20 pic.twitter.com/CvyxF5PUPP

Earlier in September 2022, OSFI already announced that it will not ease the underwriting standards in Guideline B-20 after many Canadians called for loosening the procedures in response to the ballooning mortgage prices caused by the recent hikes in interest rates. The latter contributed to a drop in home sales, with Mattamy Homes–one of Canada’s biggest builders–reportedly closing down some of its sales centers.

READ: OSFI On Easing Mortgage Underwriting Standards: “We Will Not Do That”

Among the proposed changes in the guidelines is recalibrating the debt serviceability measures, ensuring moving forward that borrowers would be able to pay their mortgages amid the turbulent macroeconomic environment.

The current prevailing minimum qualifying rate (MQR), designed to test a borrower’s ability to service debt, helped “mitigate the risks that borrowers may face from future increases in mortgage rates, decreases in income, or unexpected increases in other expenses.” This proved to be useful since early 2021 after mortgage rates have risen materially from the historic low levels experienced at the onset of the COVID-19 pandemic.

But the agency argued that additional measures may be needed to mitigate mortgage lending risks.

“However, FRFI [federally regulated financial institution] lenders still face increased risks,” the office said. “Mortgage interest rates are at their highest in over a decade. Borrowers are facing record levels of indebtedness.”

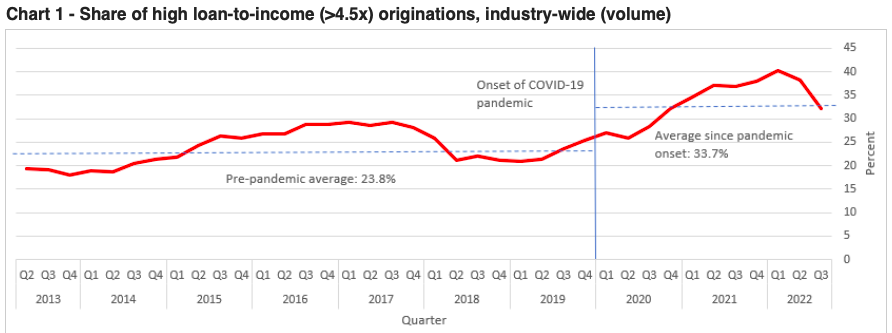

OSFI wants to look into debt serviceability measures like loan-to-income (LTI) and debt-to-income (DTI), particularly in having a “clear and consistent definition of ‘income’, and a set LTI high threshold and volume limit for the industry.” The office proposes a high LTI threshold of 4.5, with a 25% quarterly volume limit on originations that exceed this threshold.

Although particular LTI or DTI limitations for FRFIs have not been legislated, an LTI of 4.5 or greater is typically regarded as “high,” and in the past, OSFI has utilized a 3.5 LTI threshold in its industry monitoring activities.

The office added that high LTI lending is not distributed evenly among FRFI lenders, and smaller and medium-sized lenders have a higher proportion of high LTI loans in their portfolios.

While debt service coverage ratios such as gross debt service (GDS) and total debt service (TDS) are already commonly used, the office believes this could be strengthened “by introducing a lender-level volume restriction on loans.”

OSFI is considering the current definition for these ratios, including adopting the measures currently used for insured mortgages. It is also scrutinizing capping appropriate GDS and TDS thresholds for uninsured mortgages, as well as setting an explicit amortization limit.

Further, the current minimum affordability test is being argued to be not risk-sensitive enough. Some loan options, such as variable rate mortgages or shorter-term mortgages, can pose a higher payment and renewal risk. As a result, a greater affordability test on such mortgages may better respond to underlying risk. Loans with fixed rates and longer terms, on the other hand, may pose less risk.

Therefore, OSFI is exploring options to have more risk-sensitive tests of affordability, which includes “creating an explicit principles-based expectation” to encourage FRFIs to different MQRs, in addition to the current MQR set in regulation. The office is also looking into applying MQR to a borrower’s total debt service.

Some users on twitter are thinking the OSFI’s move is reactionary and too little too late.

What the Hell prevents all Government agencies from seeing the coming crisis while it is CLEARLY developing

— Ron Butler (@ronmortgageguy) January 10, 2023

Why always commence the Study on closing the barn door a year or 2 after the horse has got all the way across town

In short:

— Gord McCallum 🔥🧱 (@gordmccallum) January 12, 2023

"The market is already correcting in response to higher rates, so we're going to jump in here and make sure it over corrects." –OSFI https://t.co/74loWt9EfT

Stakeholders that intend to submit comments should do so via email before the consultation closes on April 14, 2023, the agency noted.

Information for this briefing was found via OSFI and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.