Peloton Interactive (NASDAQ: PTON) investors had a very rough week last week after falling almost 16% after the company recalled 125,000 Tread+ products, then on Thursday, it reported its fiscal third-quarter results. Its third-quarter results came in above analysts’ expectations. The company announced third-quarter revenue of $1.262 billion, and a gross margin of 35.2%. Net income for the quarter was $(9) million, or a (0.7)% net margin, and earnings per share of $(0.03).

A number of analysts lowered their price targets off the back of Peloton earnings, bringing their average 12-month price target lower from $158.67 to $141.79 from a total of 28 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- CFRA cuts target price by $20 to $150

- UBS cuts target price to $74 from $124

- Oppenheimer cuts target price to $150 from $185

- Stifel cuts target price to $140 from $170

- MKM Partners cuts target price to $110 from $130

- Truist Securities cuts target price to $125 from $160

- Wedbush cuts target price to $114 from $120

- JP Morgan cuts target price to $140 from $200

- Credit Suisse cuts target price to $152 from $164

- Evercore ISI cuts target price to $105 from $125

- Cowen and Company cuts price target to $135 from $177

- Oppenheimer cuts target price to $150 from $185

In BMO’s note to investors, their analyst, Simeon Siegel, reiterated his underperform rating and $45 price target on the company, writing, “Through the pandemic, numbers took a backseat to theses; ironically or not, now, these are potentially scarier than the numbers. PTON had a nice quarter, beating guidance, impressively topping 2mn C.F subscribers.”

However, Siegel then goes on to remind investors that the 2 million subscribers is far below any sort of valuation based level and now recalls are triggering more concerns for the company. Meanwhile the company is pushing harder on marketing, which to Siegel shows that the company is having a hard time selling units and fears, “numbers will again replace hope (equipment drives >80% of sales), & see further downside.”

Although it does seem like Siegel is a bear on the company he tips his hat to their earnings beating his estimates with the most looked at number being CF subs, which came in at 2 million, 5% above the highest analyst estimate. He adds, “PTON also Added ~266K sequential net digital adds (strongest in years), impressively arriving as PTON begins to lap tougher compares.”

He notes that equipment continues to be the driver of revenues with equipment sales equating to roughly 80% of revenues which, “are impressive, but not recurring and will likely begin to prove difficult to lap and should command a much lower sales multiple,” while he believes that Peloton’s gross margin pressures will continue to persist as logistic headwinds trouble the company while they figure out how to pick up returned Tread/Tread+ units.

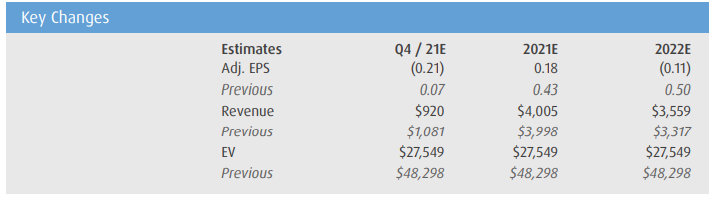

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.