Despite the number of new coronavirus cases in the US continuing to climb, and the unemployment rate being astronomically far from reaching pre-COVID levels, it appears that certain sectors of the US economy are showing an above average rebound.

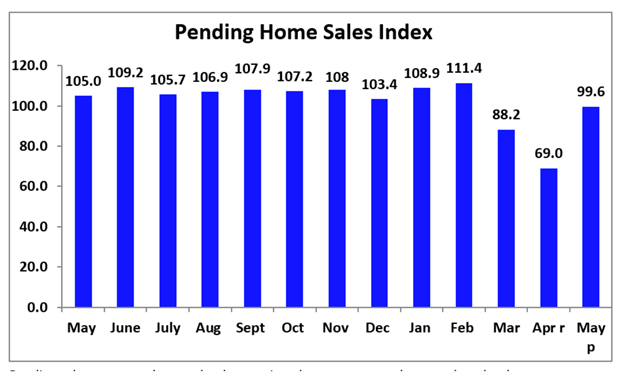

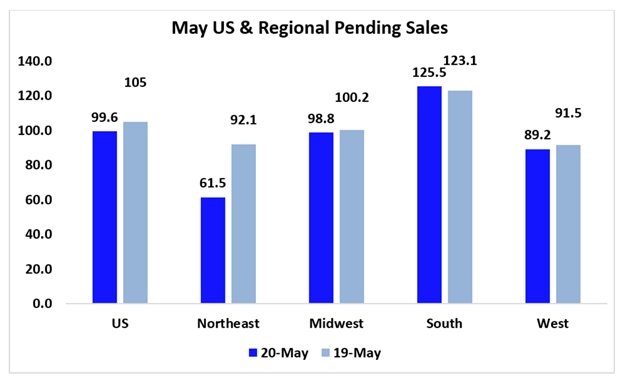

According to the National Association of Realtors (NAR) index, contract signings on previously owned homes have surprisingly increased by 44.3% in the month of May, to an index of 99.6. This comes after April’s index was the lowest on records that date back to 2001, and Bloomberg economists had predicted only a 19.3% increase since. However, the index is still below pre-COVID levels of 111.4, which was recorded for the month of February.

Although home-buying season is usually amplified during the springtime, the coronavirus pandemic has put an unprecedented hamper on the market. However, with mortgage rates falling to record-low levels, the demand for residential property has rebounded sooner than many other markets in the US economy. NAR has increased its previous forecast of total units sold for the year from 4.77 million to 4.93 million. However, 2019 saw over 5.3 million existing homes sold, so the real estate market is not out of the rough waters just yet.

Back in May, some states began to hastily lift coronavirus-mitigating restrictions, but as infected cases exponentially skyrocketed soon after, states such as Texas, Florida, and California had no choice but to pause restriction-lifting. Nonetheless, home-purchase loan applications are still set to reach an 11-year high.

Information for this briefing was found via Bloomberg, CNBC, and the National Association of Realtors. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.