Planet 13 Holdings (CSE: PLTH) yesterday saw a number of insiders file sales transactions with the regulator in relation to sales conducted on January 8, 2021. Notably, those transactions occurred just four days before the company announced that it would be conducting a $50.1 million private placement at a price of $7.00 per unit, which was subsequently upsized to $60.0 million.

The filings indicate that a number of senior officers of the company sold shares, with the first filing being made by Stephen Markle, whom is reportedly the VP of Production at the company. Following two transactions where he exercised share rights, he subsequently sold 27,608 common shares of the issuer at $7.69 per share for gross proceeds of $212,305.52.

Next to file was William Vargas, whom after exercising a number of rights, disposed of 45,746 common shares of the issuer, also at $7.69, for gross proceeds of $351,786.74.

This was followed by a number of similar transactions by management, which breaks down as follows:

- Dennis Logan, CFO, sold 35,430 common shares for proceeds of $272,456.70

- Larry Scheffler, Co-CEO, sold 113,748 shares for proceeds of $874,722.12

- Christopher Wren, VP of Operations, sold 72,049 shares for proceeds of $554,056.81

- Leighton Koehler, General Counsel, sold 24,804 shares for proceeds of $190,742.76

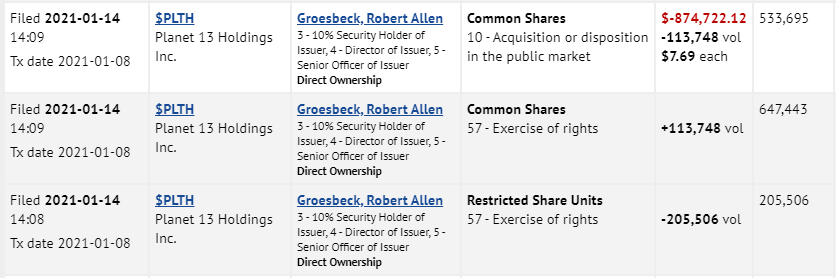

- Robert Groesbeck, Co-CEO, sold 113,748 common shares for proceeds of $874,722.12

Notably, all share sales reported were at a price of $7.69, and occurred on January 8, 2021 as per filings. This suggests that it may have been a pre-planned sale, although no such filing indicating this has been filed on either Sedi or Sedar.

—

UPDATE: It appears remarks were made in connection with certain sales made by members of management. However, the filings do not match to the commentary provided with the changes in equity, as seen below, and appear to still show additional sales of the equity.

—

Planet 13 Holdings last traded at $7.41 on the CSE.

Information for this briefing was found via Sedar and Planet 13 Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.