FULL DISCLOSURE: This is sponsored content for Plurilock.

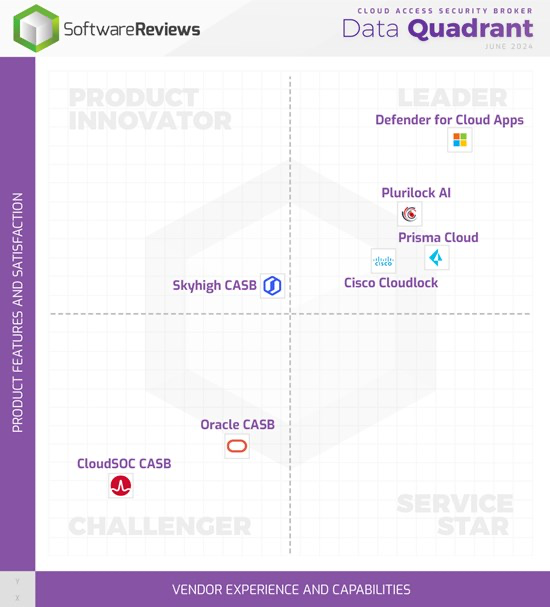

Plurilock Security Inc. (TSXV: PLUR) has once again proven its mettle by securing a gold medal in Info-Tech’s 2024 Data Quadrant for Cloud Access Security Broker (CASB) solutions. This marks the fifth consecutive year that Plurilock AI has been recognized as a top performer in the highly competitive cybersecurity market.

Plurilock AI, the company’s flagship product, offers advanced cybersecurity capabilities, including single sign-on (SSO), data loss prevention (DLP), and CASB protections, making it a preferred choice for organizations of all sizes. The platform’s ease of use, cost-effectiveness, and comprehensive features have garnered significant appreciation from its user base, particularly among small to mid-sized businesses.

Info-Tech’s rankings, derived from both analyst evaluations and customer feedback, highlight the exceptional satisfaction levels among Plurilock AI users. Over 90% of customers indicated they would recommend Plurilock AI to others, a figure that surpasses those of leading brands such as Microsoft, Palo Alto, Cisco, Oracle, and Broadcom. This high “would-recommend” percentage underscores the platform’s reliability and effectiveness in meeting the diverse cybersecurity needs of its clients.

“We’re thrilled that Plurilock AI is a data quadrant gold medalist for the fifth year running. Our customers love Plurilock AI. It’s a modern, cloud-centric platform that offers the cybersecurity essentials that today’s organizations need—without the legacy complexity and expenses that haunt competing platforms. We’d particularly like to thank our customers for making us Data Quadrant gold medalists once again.”

Ian L. Paterson, CEO of Plurilock

Strategic developments and growth

This win comes on the heels of Plurilock’s recent developments that reflect its strategic initiatives and growth trajectory. The company reported over $20 million in new orders since the beginning of the year, demonstrating robust demand from both government and commercial clients. Notable contracts include a $4.7 million order from a U.S. public library and a $6.16 million order from the U.S. Treasury.

Moreover, Plurilock’s Critical Services division, launched in February 2024, aims to address the increasing demand for specialized cybersecurity solutions. This division focuses on providing immediate and effective responses to cybersecurity challenges, leveraging Plurilock’s expertise in government, security, and technology. The division has already seen substantial growth, evidenced by recent expansion contracts and the addition of key advisory board members, including Bryan Cunningham and Joe Sexton.

READ: Joe Sexton: Enhancing Plurilock’s Vision with Decades of Experience

Plurilock’s financial performance in 2023, with revenues exceeding $70 million, highlights its stability and growth potential. The company has also undertaken significant financial restructuring to optimize its capital structure, including a $5.5 million capital infusion and a 10:1 share consolidation. These measures are designed to enhance long-term financial stability and shareholder value.

Ali Hakimzadeh, Executive Chairman of Plurilock, emphasized the company’s strong financial fundamentals and strategic direction, stating, “The financial fundamentals are strong and going in the right direction. Continued growth in our margin profile, continued trending towards positive earnings, potential acquisitions that will be accretive for us, and potential uplistings to more senior exchanges potentially down south are key areas for investors to watch.”

With its robust financial performance, strategic initiatives, and high customer satisfaction, Plurilock is well-positioned to capitalize on the growing demand for cybersecurity solutions. The company’s focus on expanding its high-margin services and SaaS offerings, along with its ability to attract top talent, positions it for continued success in the cybersecurity industry.

FULL DISCLOSURE: Plurilock Security is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Plurilock Security. The author has been compensated to cover Plurilock Security on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.