The coronavirus pandemic has demolished economies worldwide, causing countries to impose mandatory lockdowns and safety measures as a way of mitigating the spread of the deadly virus. One of the industries impacted by the pandemic has been mining operations, which were either forced to completely shut down or partially shut down their operations.

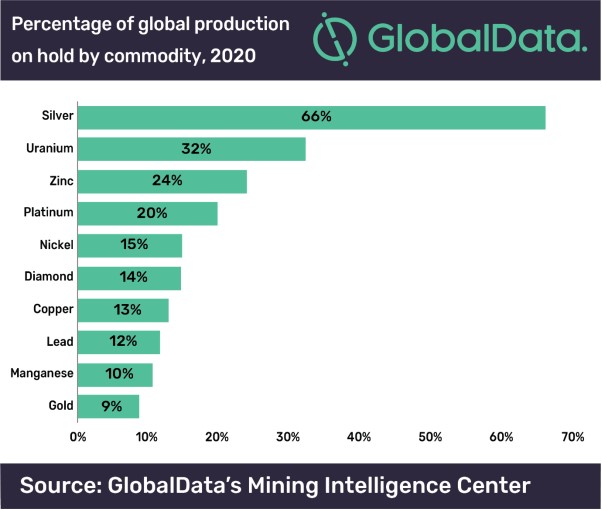

Many countries around the world have imposed some sort of lockdown orders which in turn have shut down various non-essential business and industries. Since mining is not considered an essential operation in many jurisdictions during a global pandemic, over 1,600 mines had to suspend their activities for the time being. This has significantly affected global output of precious metals, with silver experiencing a production drop of 66%, uranium production decreased by 32%, and zinc decreased by 24% since the onset of economic lockdowns.

Although many mines had closed temporarily, there are still some operating, albeit at reduced levels. Some mines, including Hochschild, First Majestic, Endeavour Silver, and Hecla Mining had put their 2020 guidance reports on hold for the time being, meanwhile mines in the construction stage had also halted activities. Peru’s Quellaveco mine, which is set to be one of the largest mines in the world once construction is concluded, had decided to pull the plug and halt further development.

Several mining jurisdictions around the world have currently put a hold on extraction operations, including Mexico, Bolivia, Peru, and Namibia. Meanwhile, mining operations in Quebec have resumed as of April 15, but only under the condition that all safety measures are followed adequately. Some jurisdictions however, deem mining as an essential service, given that it supplies a significant portion of the country’s revenue. The jurisdictions which have lifted lockdown measures for mining include Zimbabwe, India, South Africa, and Argentina.

Information for this briefing was found via Mining.com. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.