The stock market is facing two main obstacles: 1) the global economic impact of the potential Russia-Ukraine conflict, particularly regarding the availability and pricing of energy supplies; and 2) the implications of the U.S. Federal Reserve’s beginning to withdraw its extraordinarily accommodative monetary policies.

Specifically, the Fed is expected to raise short-term rates from nearly zero in March 2022 and follow that with a series of incremental hikes throughout 2022, bringing the year-end federal funds rate to perhaps 1.5%-2.0%.

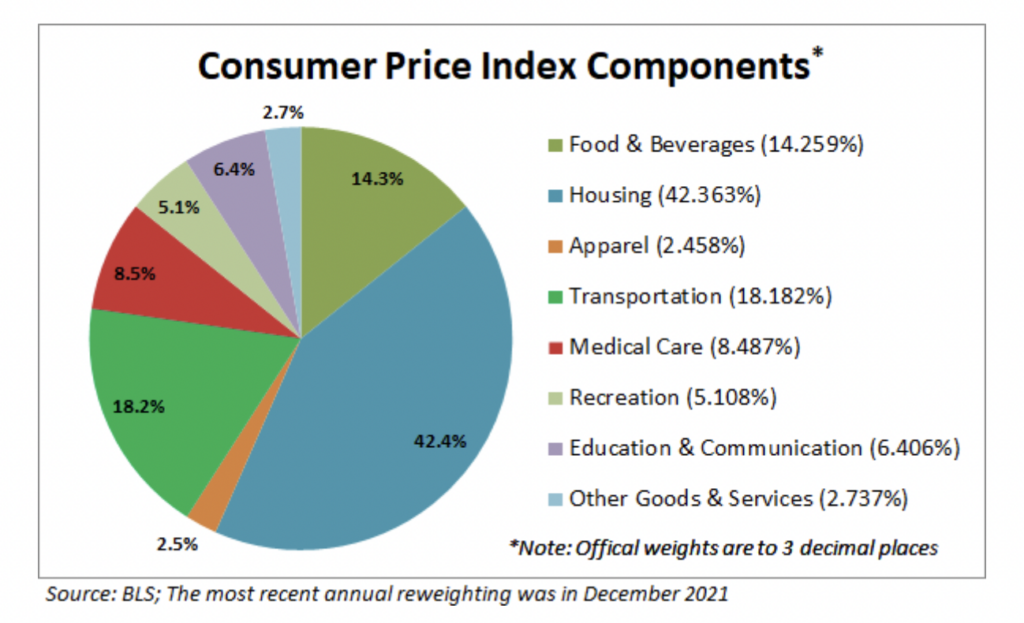

An optimistic view on this scenario, at least for market participants, is that the commencement of hostilities in Eastern Europe could mark some sort of market bottom (“Buy when there is blood in the streets ….”), and that the Fed’s actions will bring inflation down markedly from current levels. U.S. inflation, as measured by the Consumer Price Index (CPI), is currently running at a 7.5% annual rate (6.0% excluding food and energy).

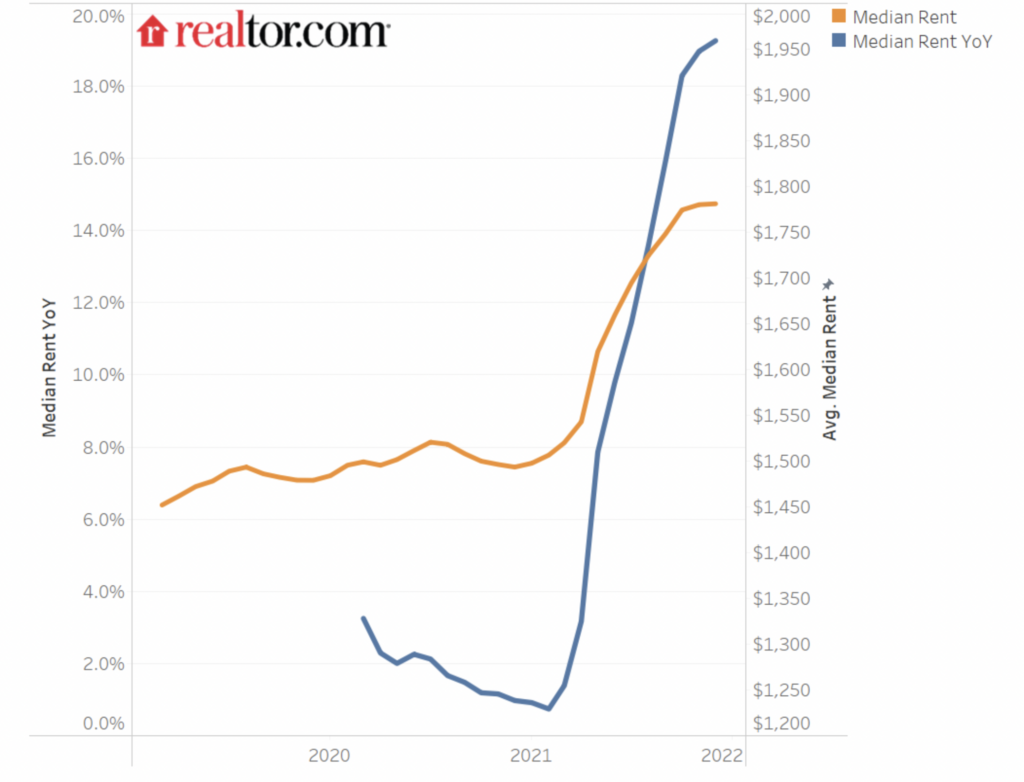

However, given the rapid, unrelenting pace of rent increases across the U.S. and housing costs’ outsized weighting in the CPI, the Fed may be forced to be far more aggressive in raising short-term interest rates than most investors seem to expect.

Consider the following five data and economic trends:

First, in December 2021 average monthly rents increased 19.3% on a year-over-basis in the 50 largest metropolitan areas in the U.S., according to data from realtor.com (the blue line in the graph below). Furthermore, year-over-year percentage increases rose steadily throughout 2021, and December 2021 data marked the highest percentage increase of the year. There appears to be little cause to believe this trend will change for some time.

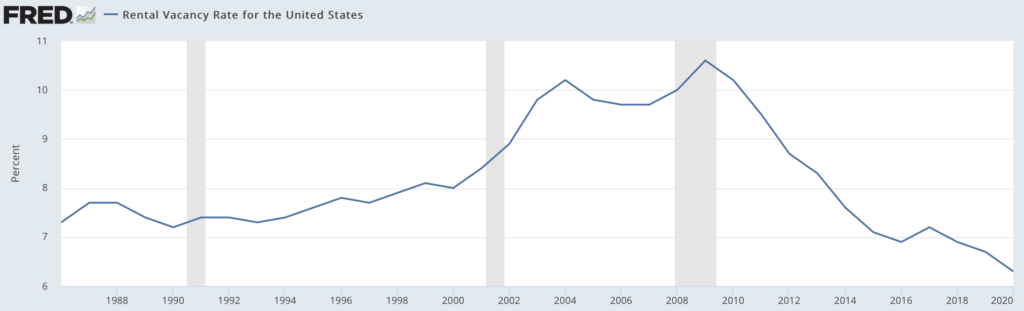

Second, rental vacancy rates in the U.S. are at their lowest point in at least the last 36 years. The 5.6% current reading suggests there is little supply of rental units in the country, allowing landlords to continue to raise monthly rent asking prices.

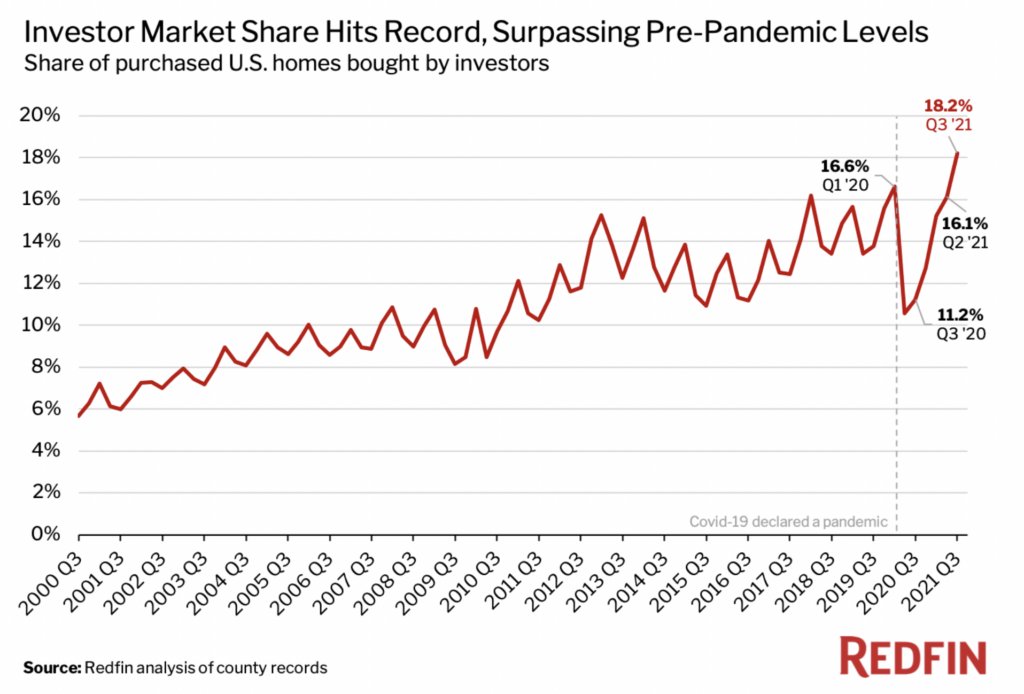

Third, Redfin data shows that the percentage of homes purchased by an institution or company that purchases real estate, as opposed to individual purchasers, reached an all-time high of 18.2% in 3Q 2021 (the most recent data available). Investor home purchases had dipped during the early stages of the pandemic. Presumably, investors are interested primarily in return on investment and want to increase rents to as high a level as possible while maintaining near or full occupancy.

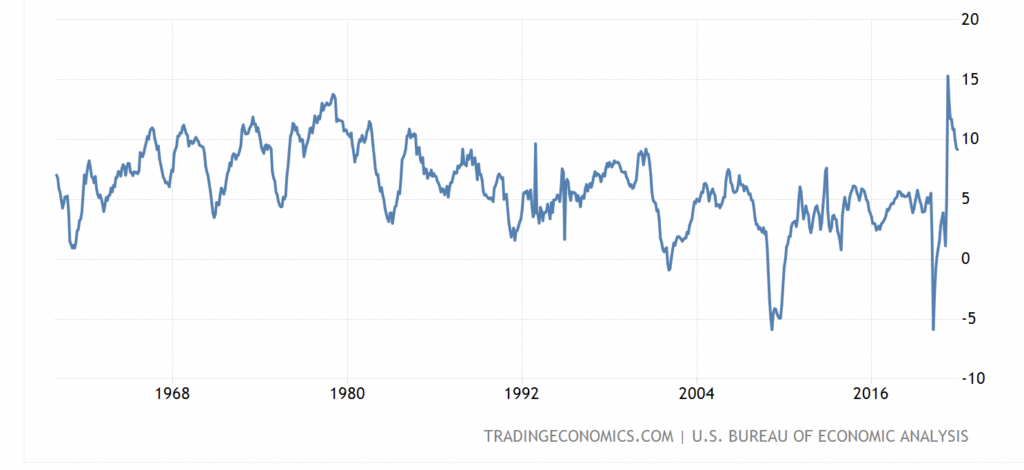

Fourth, rent increases will ultimately be constrained by wage growth, but average wage and salaries grew by more than 9% in December. This represents the fastest rate of increase — excluding the pandemic recovery months of April 2021 through October 2021 — since the early 1980s.

Finally — and what makes all this so troubling for the prospect of reducing CPI growth — housing represents by far the largest single component of the CPI index, at 42.4%. Mathematically, bringing down CPI growth would require a substantial cut in a super-charged pattern of rent increases in the U.S. Doing so may very well require more than just a few hundred basis points of short-term rate increases in 2022.

Information for this briefing was found via the St Louis Fed, Redfin, Realtor.com, the BLS and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.