This morning Raymond James initiated coverage on The Valens Company (TSX: VLNS) with a C$4 price target and Outperform rating. They believe that Valens’ strategy of developing IP and offering more comprehensive services and products as a way of building a moat or barrier is the best thing they could have done.

Further, Raymond believes that the extraction business will become commoditized as licensed producers to start building their own in house extraction systems. They are overall cautious and placed a conservative price target for that reason.

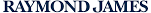

Raymond James breaks down the investment thesis base case alongside some upside and downside notes and potential catalysts they are watching for. The firm believes Valens has a differentiated and robust position with multiple multi-year agreements with licensed producers (as seen below) in cannabis 2.0, making it very important to the 2.0 value chain.

As of today, Valens currently hold the title for the largest capacity outsourced extractor in Canada. They mention that the way Valens bundles its white-labeling and manufacturing contracts together makes it a “deft move designed to deepen its partner relationships, and to augment and protect the company’s long-term growth.” Although not everything is rosy, Raymond reminds investors that Valen’s is a second-mover in the Cannabis 2.0 space and will need highly unique products and IP to claim a material share of the 2.0 cannabis market.

Below is Raymond James’ three base case scenarios with their notes on upside, downside and some potential catalysts:

Base Case

- Reliable short term revenues from the extraction

- Short-term margin compression which will lead to declining toll revenues

- Expanding white-label and proprietary product revenues

- Slow growing cannabis markets in Canada, Hindered by the slow roll-out of retail stores and undersupply of 2.0 products

Upside

- Displacement of Canadian market participants which will allow Valens to capture larger market share

- Larger gross margins from white-labels and proprietary products

- Expansion into international medical cannabis or CPG markets

- Cannabis 3.0 which allows specific cannabis containing products for minor ailments to be consumed without physician approval.

Downside

- Weak Canadian market penetration

- Faster margin compression due to the commoditization of Valens services

- Issues among the large licensed producers that Valens has tolling agreements with

- Slow or no growth in international markets in the next couple of years

- Negative FDA/WHO comments/opinions on Cannabis’ Safety

Catalysts

- New white-label or tolling agreements

- New proprietary product launches

Information for this briefing was found via Sedar and The Valens Company. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

How do one download and go through the full report? Help me out.

They are busy now in the future, and in high demand. I, personally, know of two companies not 5vmonths zgo who were looking for a reputable extraction company and struck out. Long wait list…would be at least a year wait to get their product extracted….Valens is one of the first and has steadily grown their reputation, and brand. I loaded up on the Covid 19 drop and 0ick up more as I can. I’m a believer…I’m in!

Hey, I would like to help them extract. Would you help?

Conservative? How about bordering on ridiculous. Valens was at $4 cdn on February 25 BEFORE they announced 3 new customers; 3 world class new BOD members; and an extremely favorable LOC type funding with no dilution. Today they announced the roll out of a $50 million minimum deal that is extremely profitable for them.

I think $4 is in the bag by the 4th of July. This estimate is app. 50% below all other estimates.

RJ must be trying to improve their track record. Hitting a $4 target they were at pre Covid and pre all those recent announcements shouldn’t be too hard.