Lyft, Inc. (Nasdaq: LYFT) released on Tuesday its Q1 2022 financials while Uber Technologies, Inc. (NYSE: UBER) published its financials this morning. Despite reporting year-on-year increases in topline revenue, both ride-hailing platforms still recorded net losses.

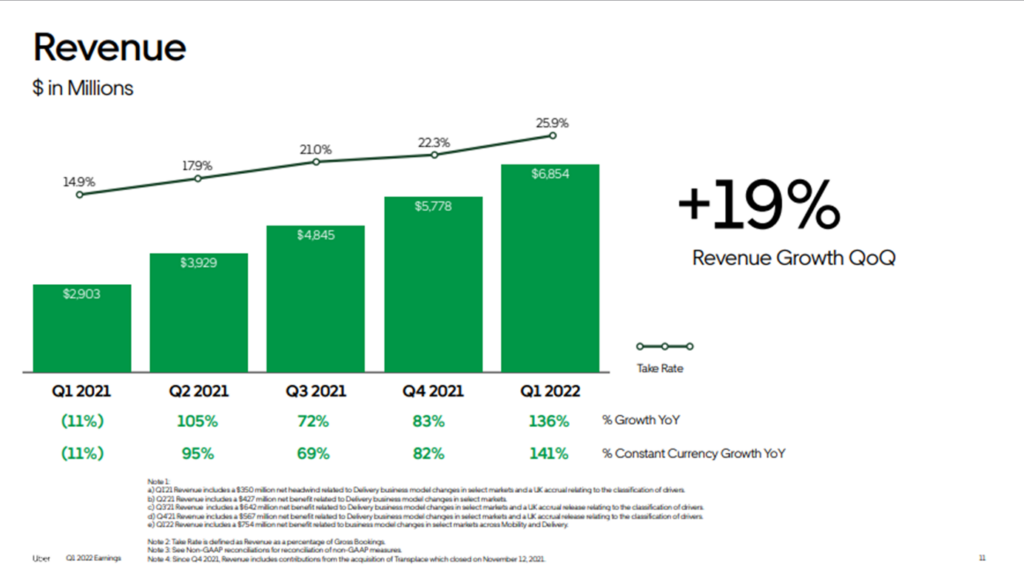

Uber notched US$6.85 billion in revenue for the quarter compared to Q1 2021’s US$2.90 billion. Lyft posted US$875.6 million in revenue vis-a-vis its last year’s counterpart at US$609.0 million.

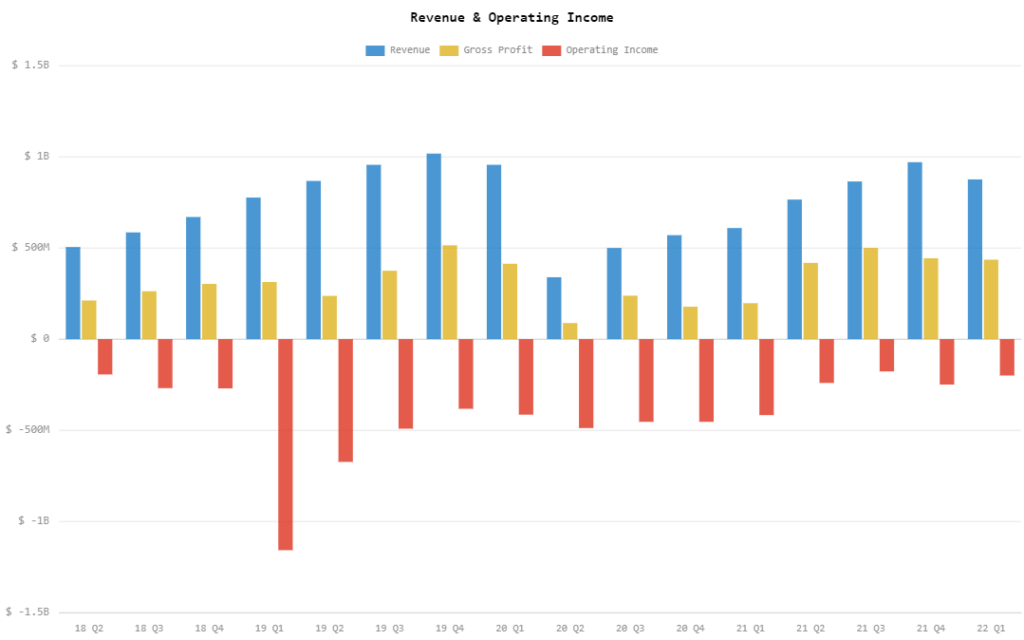

However, with both firms recording costs and expenses higher than their revenues, both also recorded net losses for the quarter–Uber at US$5.93 billion and Lyft at US$196.9 million.

Source: Hypercharts

$LYFT now trading at 2x trailing revenues on disappointing guidance. $DASH still at 5x.

— Diogenes (@WallStCynic) May 3, 2022

How does a company lose money by leasing out their gps to people to drive their own cars as taxis? $UBER $LYFT

— FedProm 💃🏻 (@FedProm) May 4, 2022

Following the releases, Lyft’s shares sank 34% while Uber sank 11% as the market opened today.

$LYFT down 27% after-hours, $UBER down 14%. How's that $TSLA ridesharing model looking now, Cathie?$TSLAQ $ARKK @ARKInvest @CathieDWood pic.twitter.com/cTr2HC3zuT

— passthebeano (@passthebeano) May 3, 2022

Nevertheless, Lyft’s topline revenue figure beat its outlook of US$800 – US$850 million. The firm also beat its adjusted EBITDA outlook of US$5 – US$15 million with US$55 million for the quarter, coming from a loss of US$73 million in the year-ago period.

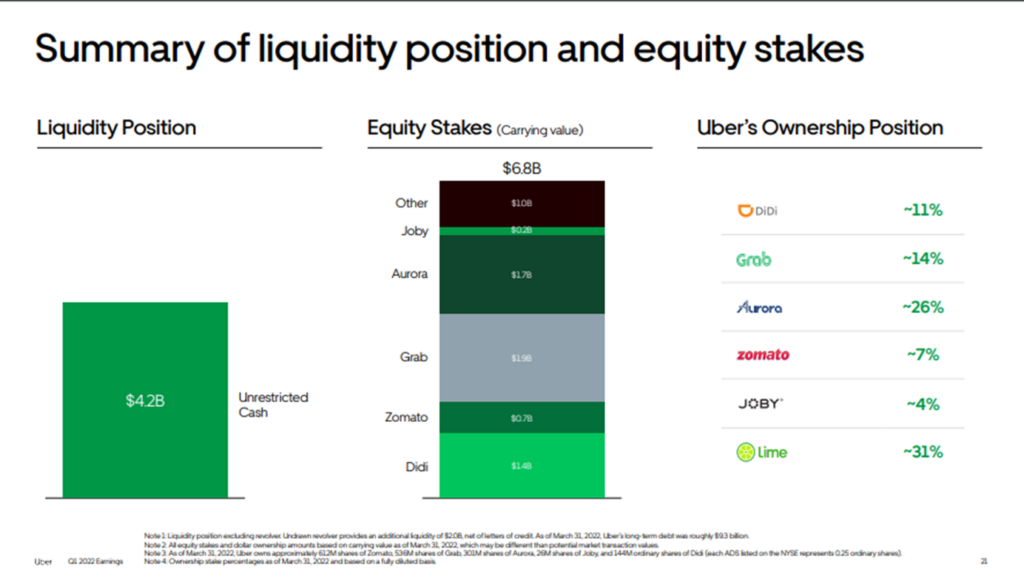

On the other hand, Uber’s significant widened net loss for the quarter includes US$5.6 billion recorded losses relating to Uber’s equity investments. The company’s losses also included US$359 million in stock-based compensation expenses.

Lyft’s net loss also included a US$163.2 million stock-based compensation and related payroll tax expenses.

For the quarter, Uber’s adjusted EBITDA came in at US$168 million compared to a loss of US$359 million last year.

$UBER: Uber Technologies 1Q'22 Earnings Results vs. Consensus

— Consensus Gurus (@ConsensusGurus) May 4, 2022

Importantly, $UBER guides 2Q'22 Adj. EBITDA $240-270M vs. Consensus of $248M, a contrast to $LYFT who are paying up in incentives for drivers and taking a write-down to 2Q Adj. EBITDA expectations. pic.twitter.com/A70yMW2Fgw

In Q2 2022, Uber guides the quarter’s adjusted EBITDA between US$240 and US$270 million, meeting the consensus at US$248 million. In sharp contrast, Lyft guides the next quarter with figures lower than that of the consensus.

$LYFT 2Q'22 Guidance from the earnings call (at mid-point) vs. Consensus:

— Consensus Gurus (@ConsensusGurus) May 3, 2022

CFO calls out need to invest in more driver supply as driver of weak guide $UBER pic.twitter.com/vb1YHgRBER

*quality* of profit matters more than ever$lyft (and $uber) still talking about adjusted EBITDA $abnb expected to notch *net income* this year pic.twitter.com/b9QwOmIov8

— Deirdre Bosa (@dee_bosa) May 3, 2022

Due to the quarterly losses, Lyft still generated an operating cash burn at US$152.3 million while Uber recorded an operating cash burn of US$611 million.

Lyft still ended the quarter with US$214.9 million in cash and cash equivalents, putting the balance of the current assets at US$2.94 billion. Uber ended the quarter with US$4.30 billion in cash and cash equivalents, putting the balance of the current assets at US$8.82 billion.

Uber’s current liabilities for the quarter ended at US$9.02 billion while Lyft’s came in at US$2.58 billion.

Uber last traded at US$29.47 on the NYSE while Lyft last traded at US$30.76 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.