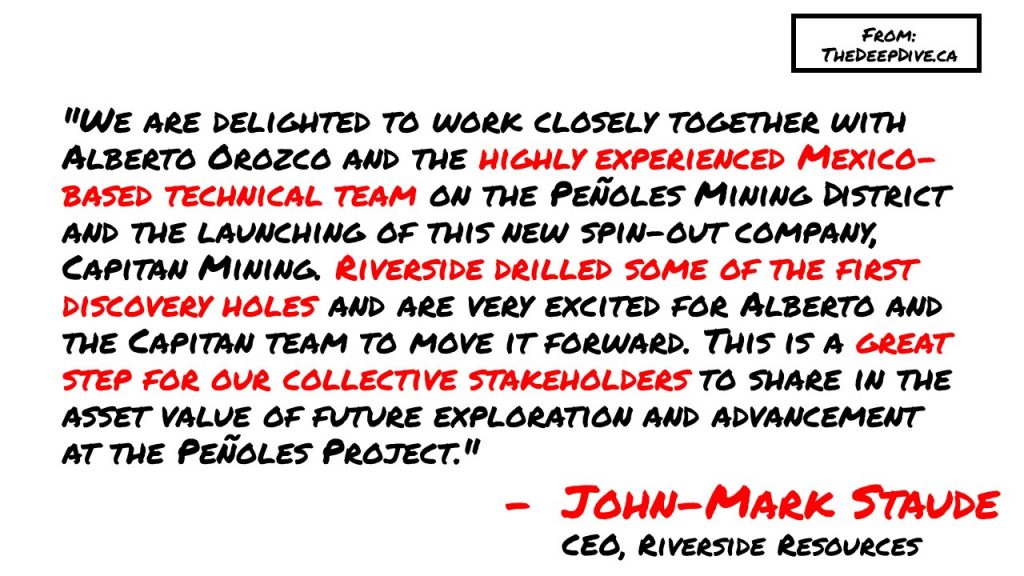

Riverside Resources (TSXV: RRI) has completed the spin out of shares of Capitan Mining (TSXV: CAPT) as of this morning. The spin out saw 100% of the interest in the Peñoles gold-silver project placed into a new public vehicle, which expects to list on the TSX Venture by the end of the month.

Under the terms of the plan of arrangement, Riverside Resources saw its common shares delisted from the TSX Venture, with each shareholder receiving one new common share of Riverside and 0.2594 of a Capitan share for each old share held of Riverside. The new Riverside shares are listed on the TSX Venture under the same symbol, and commence trading this morning.

Capitan has received conditional approval to list its shares on the TSX Venture under the symbol “CAPT”. The firm is currently undergoing a financing at a price of $0.20 per share, for which it has raised $3.5 million currently. The financing is expected to close by August 21, with the company expected to commence trading shortly thereafter.

Riverside Resources last traded at $0.39 on the TSX Venture.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.