Riverside Resources (TSXV: RRI) announced today an exploration earn-in option agreement with the Mexican subsidiary of Hochschild Mining for the company’s wholly-owned La Union gold-silver project in Sonora, Mexico. Total consideration for the agreement can reach up to US$31.0 million.

“The intention for the program is to initially conduct property wide sampling, improved mapping, and then geophysical work to rapidly refine drill targets,” the company said in its statement. “This would lead to expected drill testing in early 2023.”

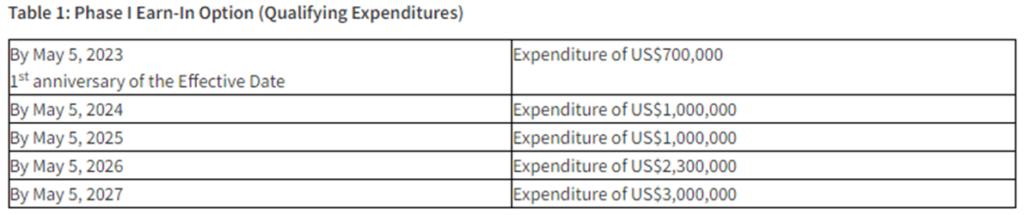

The agreement is drawn up in two earn-in optional phases. Phase 1 allows Hochschild to earn 51% of the project via incurring exploration expenses through reimbursements amounting to US$8.0 million within five years from signing. The two companies can then elect to form a 51%-49% joint venture.

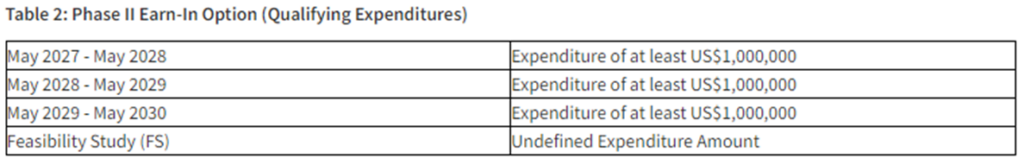

Hochschild can choose to expand to Phase 2 in order to earn an additional 24% in equity by further reimbursing expenditures amounting to $3.0 million and producing a feasibility study for the project within three years.

After which, Riverside has the option to sell its entire interest in the project for an additional US$20.0 million and 1% net smelter royalty.

We are delighted to partner again with Hochschild Mining as we have had a productive and positive relationship working together on several past projects. Riverside has invested in working up the project to an actionable stage and consolidated the tenures making this a highly prospective property that warrants the type of exploration spending that this agreement provides.

John-Mark Staude

President and CEO, Riverside Resources

The 26 km2 La Union project is located in the southern portion of the carbonate stratigraphic mountains of the Sierra El Viejo, in which the reactive limestone and dolomites formed a carbonate-hosted style of mineralization. The mining firm did a sampling in 2021, yielding significant mineralization with up to 59.8 g/t gold, 833 g/t silver, 5.8% lead, and 4.2% zinc.

Riverside Resources last traded at $0.15 on the TSX Venture.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.