An axiom in the investment world is that when a stock is priced for perfection, the underlying company had better execute its business strategy flawlessly. Rivian Automotive, Inc. (NASDAQ: RIVN) may have violated that rule.

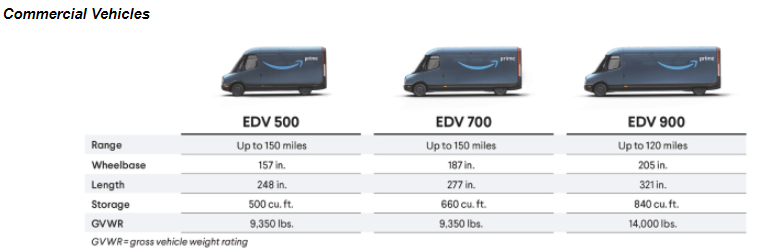

On November 19, The Information, an online publisher of business articles, reported that Rivian’s commercial electric vans may have a far more limited battery range than what the company disclosed in its S-1 Registration Statement that was filed with the SEC. A driver testing the vans said that the battery drained 40% faster than advertised if the vehicle’s heating or cooling system was on. In its S-1, the company disclosed its vans had estimated ranges of 120 to 150 miles depending on the size of the van (e.g., an EDV 700 depicted below has 700 cubic feet of storage).

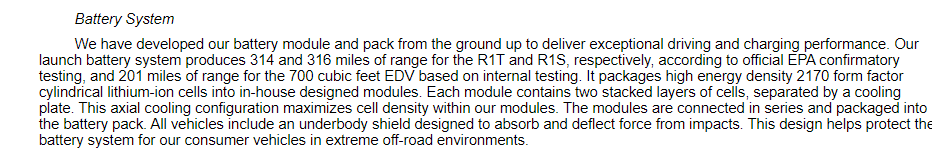

In another section of its S-1, Rivian discusses a 201-mile range for the EDV 700 (see below), but the driver in The Information’s report discusses a 40% battery drain compared with 120-to-150 mile ranges.

In 2019, Amazon, which owns an approximate 20% stake in Rivian, ordered an initial volume of 100,000 EDVs, at the time the largest order of electric vehicles (EVs) ever placed. According to The Information, an Amazon executive said the company plans to deploy 10,000 of the vans in 2022.

As an aside, a 120-to-150 mile range for an EV van is not an especially unusual figure. For example, start-up EV maker Arrival SA (NASDAQ: ARVL) announced in May 2021 that its Van model has a range of 112 to 211 miles. In early 2020, UPS placed an order for 10,000 Vans.

Rivian has the capacity to produce 150,000 electric vehicles per year at its manufacturing plant in Normal, Illinois. More specifically, the company could potentially produce 65,000 R1T pickup trucks and R1S SUVs per year (about 1,310 per week assuming 49.6 working weeks per year), and 85,000 electric delivery vans, or EDVs, annually, principally for Amazon (1,710 per week).

Rivian is not currently producing anywhere near these levels. It expects to produce and deliver ten EDVs to Amazon by year-end 2021. The company manufactured 168 R1Ts in the month of October and delivered 145 of them. R1S production is supposed to begin in December. Rivian expects to produce 25 and deliver 15 SUVs by the end of 2021.

If, as the company projects, Rivian can reach weekly production levels of 1,310 R1T/R1S vehicles and 1,710 EDVs in approximately two years — which would be no small feat given the current modest manufacturing levels — the company’s annualized revenue at that time would be around US$10.5 billion. This rough sales estimate assumes about US$70,000 in revenue per vehicle.

Even if we fully assume this scenario, Rivian trades at an enterprise value-to-late 2023 annualized revenue run rate of more than 8x, a high figure for any growth company. Moreover, this valuation does not reflect any potential erosion of investor confidence from perhaps a lower-than-promised range of its electric commercial vehicles.

Rivian Automotive, Inc. last traded at US$112.13 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.