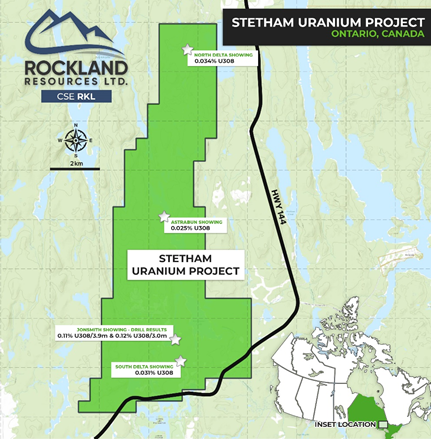

Rockland Resources (CSE: RKL) has entered the uranium space. The company this morning announced that it entered into an option agreement to acquire the Stetham uranium project in Ontario.

The project itself is located just 30 kilometres to the northeast from the Cote Lake Gold project, one of the largest resource projects in the province, while being 110 kilometres southwest of Timmins, Ontario. The property covers a total of 5,360 hectares via a total of 268 claims, with nearby power, rail and road access.

The property is believed to have a low grade, high tonnage deposit, as identified in 2008 by Delta Uranium. Four known prospects are located on site, with historical drilling in the late 1960’s reporting U3O8 concentrations of up to 0.11% over 3.9 metres. Follow up drilling conducted a decade later meanwhile reported 0.12% U3O8 over 3.0 metres.

More recently, Delta Uranium conducted exploration on site in the mid 2000’s. Exploration included airborne magnetics, prospecting and rock sampling. A strike length of 15 kilometres was identified at the time, with further data collected by the firm still being compiled and examined.

“With the uranium market heating up so much we felt it a prudent move to make this acquisition for our shareholders. Historic drilling, while limited, shows widespread uranium and we look forward to getting on the property in the coming weeks to get a lay of the land,” commented Mike England, CEO of the company.

Under the option arrangement, Rockland can earn a 100% stake in the property via the issuance of 1.2 million shares of company. A 2% NSR exists on the claims as well, half of which can be repurchased for a payment of $1.0 million.

Rockland Resources last traded at $0.17 on the CSE.

FULL DISCLOSURE: Rockland Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rockland Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.