Other Asian countries, like Indonesia and the United Arab Emirates, are interested in utilizing the rupee as a trading unit, potentially lowering reliance on the world’s reserve currency for cross-border exchange of goods and services.

“The world can trade two ways – in one currency and the second option is to trade in other currencies. The second one is obviously less risky,” an Indian central bank executive stated on the sidelines of the G20 finance ministers and central bankers meeting.

HUGE – After Russia, now UAE, Malaysia & Nigeria to trade with India in Rupee instead of Dollar. Historic moment for India as 12 more countries are showing interest.

— Times Algebra (@TimesAlgebraIND) February 24, 2023

Indian Rupee Goes Global🔥🔥. Share the tweet & Follow our handle for more news.

BREAKING NEWS

— Gold Telegraph ⚡ (@GoldTelegraph_) February 23, 2023

INDONESIA AND THE UNITED ARAB EMIRATES ARE SHOWING INTEREST IN USING THE RUPEE AS A TRADING UNIT… POTENTIALLY REDUCING DEPENDENCE ON THE WORLD'S RESERVE CURRENCY FOR CROSS-BORDER EXCHANGE

More and more moves are taking place.

Last July, the Reserve Bank of India (RBI) enabled Rupee payments for worldwide trade, particularly with Russia, which had been thrown out of the global payments network following its invasion of Ukraine. It allowed Indian banks to open vostro accounts to ease Rupee transaction settlement.

The effort has had a cautious start, but many banks have launched such accounts, generating inquiries from other countries looking for a risk-reduction alternative. The government intends to capitalize on the existence of India’s regulator-backed National Payments Corp., which has established a powerful payments railroad.

India and Singapore established a cross-border link that relied on their respective payment systems, Unified Payments Interface (UPI) and PayNow, to settle transactions.

“The linkage of Unified Payments Interface (UPI) and PayNow is a new milestone in India-Singapore relations and its launch is a gift to the citizens of the two countries,” Prime Minister Narendra Modi said at the launch earlier this week.

Russia and India have also been in talks for an initiative that might see Russia’s Mir and India’s RuPay payment cards be mutually accepted in both countries. The two governments are also reportedly discussing the possibility to integrate UPI and Russia’s SPFS–the countries’ own versions of the SWIFT system for interbank transactions.

The threat of increasing rupee trade is yet another shot at de-dollarization. Since the beginning of the war in Ukraine, India has also strategically ramped up purchases of Russian oil and coal, ultimately lessening Moscow from the blow of sanctions while also securing important raw materials at copious discounts.

“Indian rupee to outperform Asian peers“

Improved macroeconomic fundamentals have strengthened the Indian rupee, but the central bank’s “hands-on” attitude during periods of volatility will help ensure the rupee outperforms its Asian peers in the future, strategists and experts said.

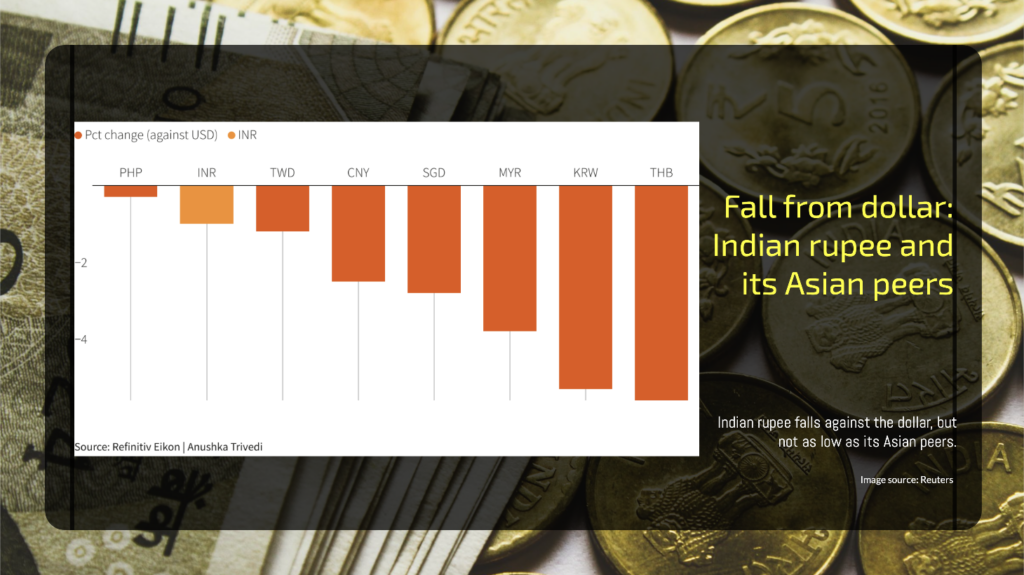

The rupee is down 1% against the US dollar so far in February, as uncertainty over the future path of the Federal Reserve’s rate hikes has shaken markets around the world, but its losses have been less severe than those of most other Asian currencies.

Prior to the previous rate hike in February, investors expected the US Fed to raise rates only once more, but a string of strong economic indicators since then has spurred investors to ask for two to three additional rate hikes.

Dollar strength is predicted to continue to weigh on other Asian emerging market currencies, but the rupee is likely to be better insulated due to improved macro fundamentals and the RBI’s active presence, according to strategists.

“The rupee’s carry is attractive and volatility is low, while equity inflows and lower oil prices are supportive,” Ashish Agrawal, head of Asia FX and EM macro strategy research at Barclays, told Reuters.

India’s merchandise trade deficit fell to a 12-month low in January, alleviating concerns about the country’s expanding current account deficit, a significant risk to the currency. The shrinking trade deficit is encouraging, but Agrawal believes the RBI’s presence is a driving reason behind the rupee’s stability.

“This is not the case in some of the other markets. RBI…is a little more hands-on, so that’s likely to contribute to rupee’s resilience, and while others are weakening, it will now outperform,” the analyst noted.

In 2022, when the rupee was one of the worst-performing regional currencies, the RBI sold nearly $46 billion in the spot market. Between November 2022 and January 2023, the currency lagged behind its peers.

India is also seen to become the world’s third-biggest economy by 2027, after the United States and China, a full two years ahead of its target. The South Asian economy is set to take the spot as Japan and Germany, currently third and fourth respectively, fall behind.

Data from the International Monetary Fund’s (IMF) October World Economic Outlook shows that India, currently sitting as the fifth largest economy after beating the UK just recently, is growing faster than other economies in the G20, save for Saudi Arabia.

Further giving a boost to the Indian economy is the global companies shifting parts of their offshore operations from China to India. Apple Inc (NASDAQ: AAPL), which has been producing a small portion of its iPhones in India since 2017, started to move major parts of its manufacturing operations to India along with Brazil earlier this year in an effort to navigate China’s stringent Covid restrictions.

This effort has since expanded. Earlier this month, it was reported that the tech giant is moving production out of China. A decision that was spurred by turmoil in its Zhengzhou facility, where the company’s manufacturing partner Foxconn Technology Group employs as many as 300,000 workers.

Information for this briefing was found via The Economic Times, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.