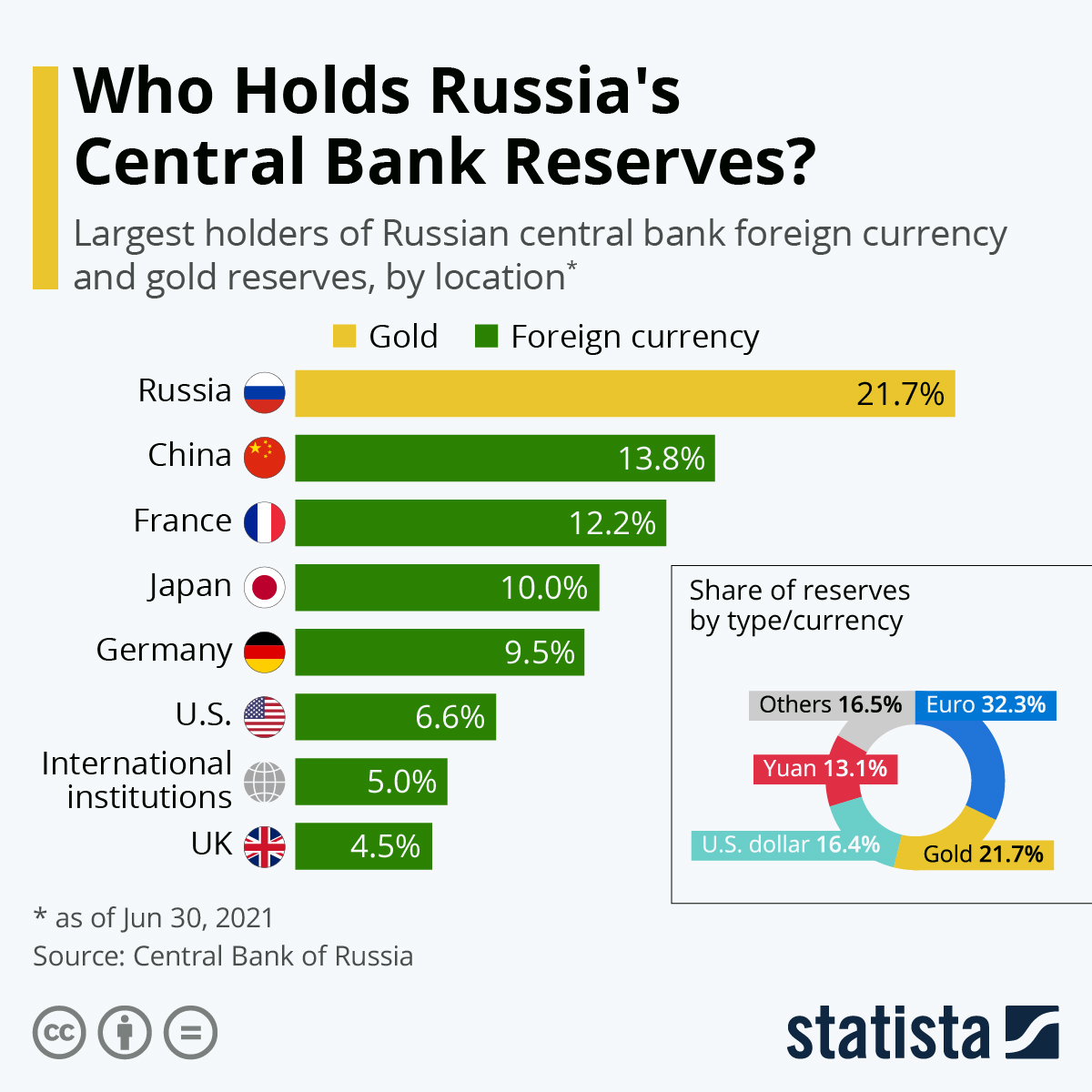

After the Group of 7 nations announced a ban on Russia’s gold imports, Moscow appears to have responded by passing a bill that would make details about the country’s gold and foreign exchange reserves classified.

BREAKING: RUSSIA IS GOING DARK FROM THE INTERNATIONAL MONETARY SYSTEM.

— Save Invest Repeat 📈 (@InvestRepeat) July 7, 2022

As per Chinese State Media, #Russia will not publish its #gold or foreign exchange reserve holdings i.e. how much & which fiat currency they have in their reserves.#Putin has now made those "State Secret". pic.twitter.com/kZm6Nh0HGy

The Russian Duma–the country’s lower house–has put forth a bill that would reclassify information on its reserves as “state secrets,” as reported by Chinese state media Guangming Daily.

The move is said to be a recourse due to the “unfriendly behavior of some countries and international organizations,” prompting a need that “reserves should be protected from being obtained.”

US President Joe Biden disclosed the agreement among G7 leaders to ban the importation of Russia’s gold, which he regarded as “a major export that rakes in tens of billions of dollars for Russia.”

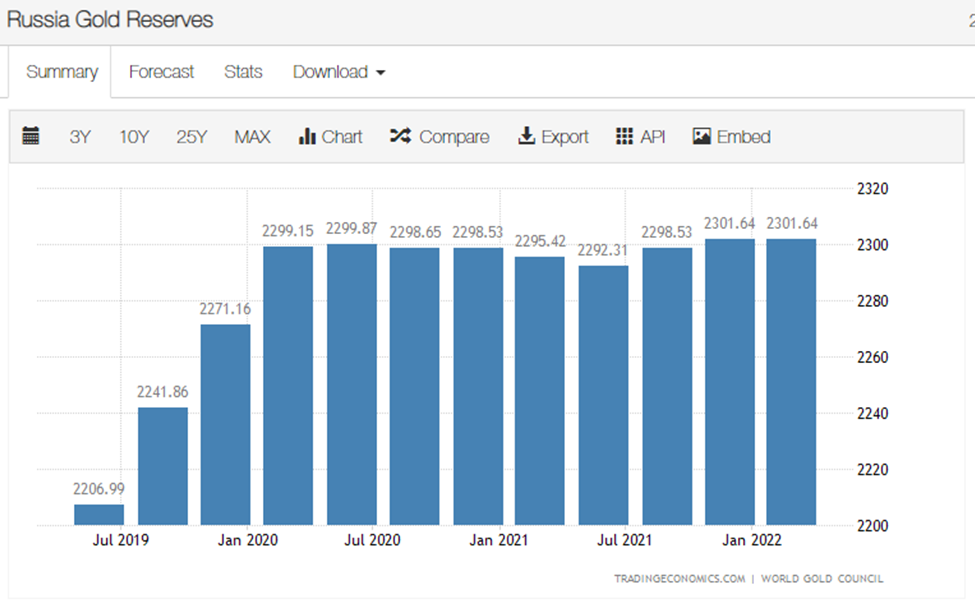

Around 10% of the global gold output comes from Russia, making the country the second-largest producer in the world. In Q1 2022, the country’s gold reserves are virtually unchanged from Q4 2021–sitting at 2,301.64 Tonnes.

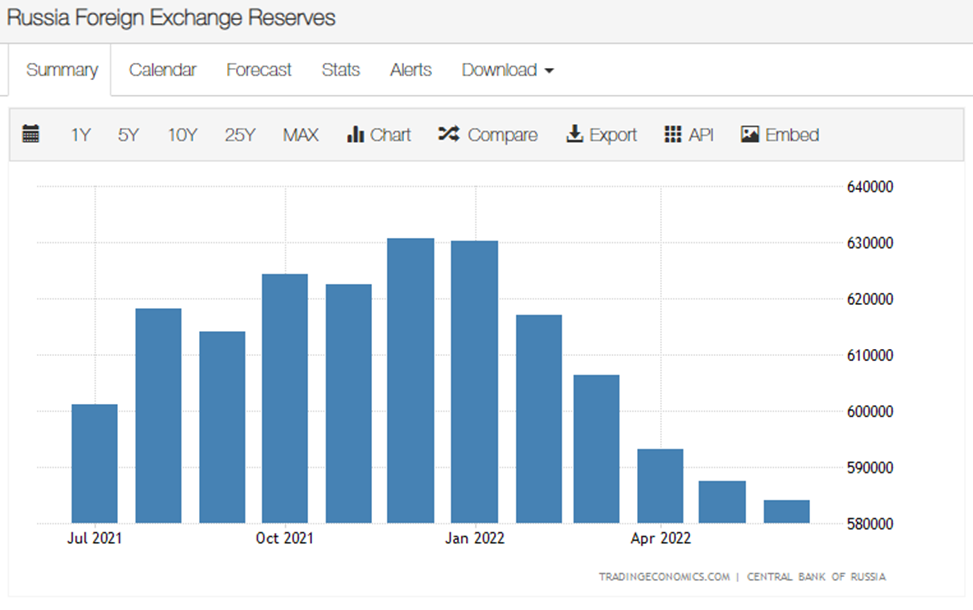

Meanwhile, Moscow’s foreign exchange reserves fell throughout the first half of the year, coming from a record high of US$630.6 billion at the start of the year down to US$584.1 billion in June 2022.

Nevertheless, the country’s reserves have seen a consistent growth in the last five years, which many have been pointing out as sustaining Russia’s war with Ukraine.

Information for this briefing was found via Twiitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.