Sigma Lithium (TSXV: SGML) is headed to arbitration over a term sheet it signed with LG Energy Solution in 2021.

The company this evening indicated that it, along with its subsidiary Sigma Mineracao S.A., yesterday received a letter indicating the initiation of arbitration from the International Centre for Dispute Resolution of the American Arbitration Association. The arbitration is reportedly in relation to a breach of certain provisions under a term sheet it entered into with LG Energy Solution in 2021 for the purchase of lithium concentrate.

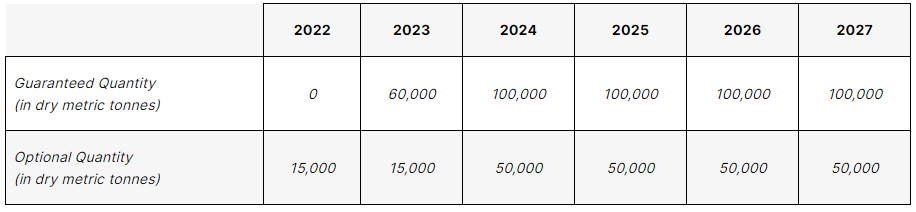

The agreement in question, which was announced by Sigma on October 5, 2021, is a binding term sheet for an offtake agreement that was to occur on a “take or pay” basis. The agreement, which was for a set period of six years, was to see Sigma supply 60,000 tonnes per year year of battery grade sustainable lithium concentrate beginning in 2023, with that offtake to grow to 100,000 tonnes per year beginning in 2024.

The agreement was said to be subject to the execution of mutually acceptable definitive documentation to implement the offtake arrangement – something Sigma now says was never entered in to. The original release however says that the offtake is “intended to be legally binding on both Sigma Lithium and LGES, and is subject to, among other things, completion of the negotiation of definitive written agreement(s), which are to be consistent with the agreed terms contained in the binding term sheet.”

That “legally binding” context appears to be what LG is now willing to attempt to dispute over.

READ: Sigma Lithium Receives LOI For Development Bank Financing Of Facility Expansion

Sigma believes the claims are “completely without merit” and says it will defend interests in the matter. At the same time, the company claims that it maintains a good rapport with LG Group, whom had a trading affiliate on site earlier this month for the purpose of beginning a commercial relationship.

Sigma Lithium last traded at $17.06 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.