Silver Tiger Metals (TSXV: SLVR) has completed a pre-feasibility drill program at its flagship El Tigre project in the Sonora state of Mexico, with the last of the results from the program released this morning. The results are said to continue to demonstrate the near surface, consist mineralization that exists at the project.

Highlights from the results include:

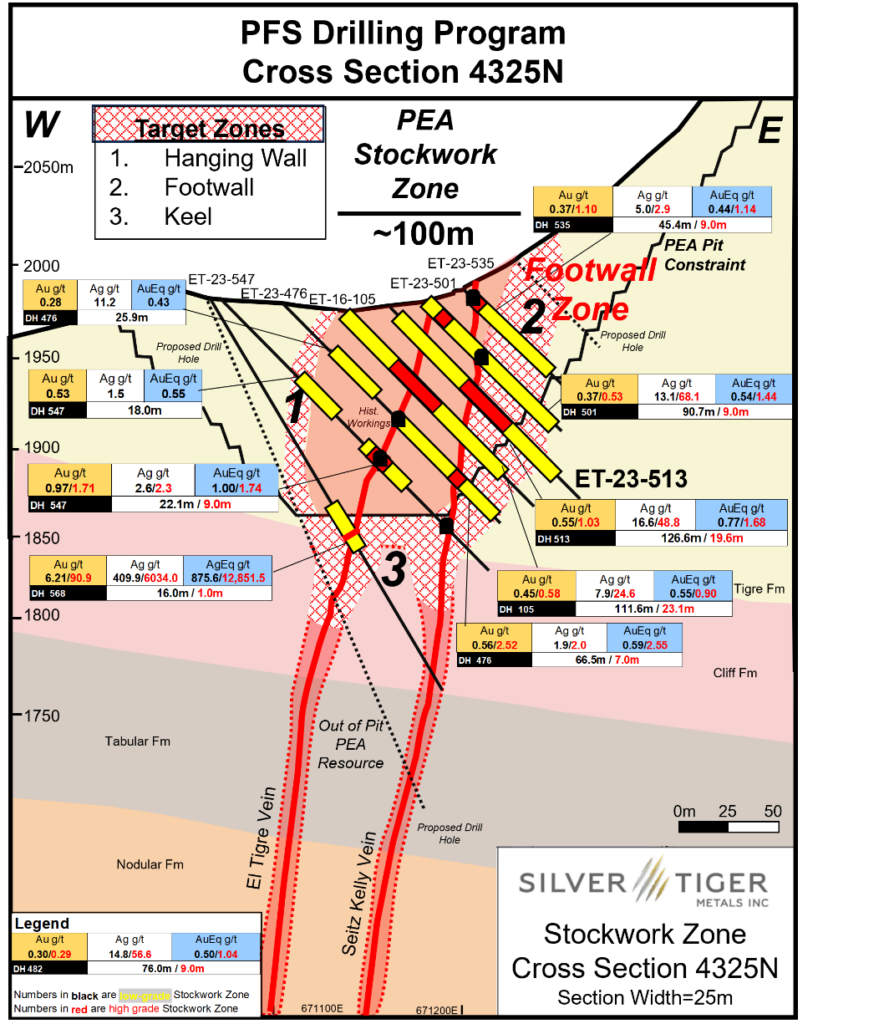

- ET-23-513: 0.55 g/t gold and 16.6 g/t silver over 126.6 metres from a depth of 7.4 metres

- Including 1.03 g/t gold and 48.8 g/t silver over 19.6 metres from a depth of 94.0 metres

- ET-23-531: 0.29 g/t gold and 75.7 g/t silver over 23.4 metres from a depth of 121.4 metres

- Including 1.20 g/t gold and 791.4 g/t silver over 2.2 metres from a depth of 140.0 metres

- ET-23-555: 0.57 g/t gold and 12.2 g/t silver over 69.1 metres from a depth of 79.9 metres

- ET-23-562: 0.46 g/t gold and 3.5 g/t silver over 118.7 metres from a depth of 55.9 metres

The pre-feasibility drill program saw a total of 24,550 metres drilled in aggregate, with the intent of expanding and upgrading the mineral resource estimate for the project, as well as for the purpose of conducting metallurgical testwork and geotechnical studies. The program is estimated to have expanded known mineralization by 10 to 15%, and is expected to have upgraded a significant portion of inferred resources to the indicated category.

READ: El Tigre: From Historic Mine to Next Great Silver Producer

“As we progress to a PFS in September 2024, this release marks the last of the promising drill results from the PFS Drilling Program. These results further de-risk the project and, coupled with the advantageous geotechnical and metallurgical results, increase the confidence and size of the El Tigre Project,” commented CEO Glenn Jessome.

A pre-feasibility study is currently expected to be released in the second half of 2024.

Silver Tiger Metals last traded at $0.19 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.