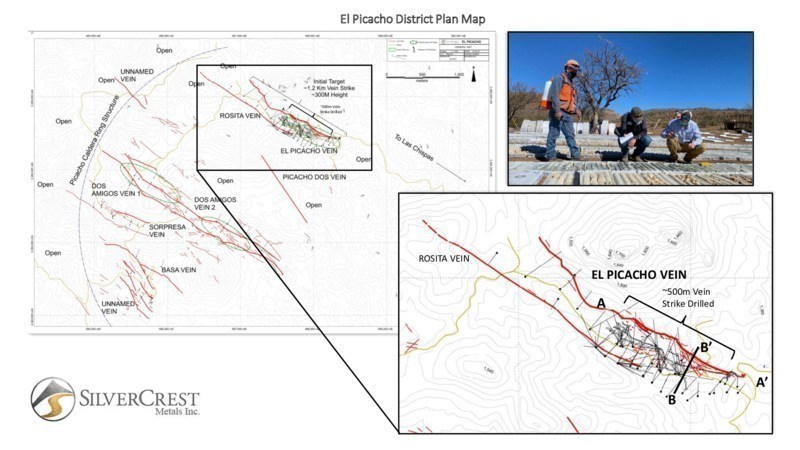

SilverCrest Metals (TSX: SIL) (NYSE: SILV) this morning reported drill results from its initial drill program at the El Picacho Property in Sonora, Mexico. Highlights from the program include 7.25 metres of 40.49 g/t gold and 260.4 g/t silver, or 3,297 g/t silver equivalent in hole PI-20-006.

Results from a total of 42 drill holes were released this morning, representing roughly 11,420 metres of drilling. Of the 42, 21 reported an average intercept of 4.1 metres of 8.14 g/t gold and 49.7 g/t silver, or 660 g/t silver equivalent at the El Picacho Vein. Notably, a vein that is nearly parallel to El Picacho was also intercepted on the property, expanding the mineralized footprint.

While the property as a whole is 7,060 hectares in size, the drill program was largely contained to an area 500 metres wide along vein strike and 300 metres down dip from surface. In total there is believed to be approximately 13.6 kilometres of vein strike on the property, hosted in a number of low-sulphidation epithermal veins. 1.7 kilometres of underground workings are present on the main El Picacho Vein.

There are currently three drill rigs operating on the property, with further expansion planned on the property for 2021 as the company focuses on the Picacho, Picacho HW, and other veins on the property under its $42 million exploration budget across all properties for the fiscal year. Notably, the property has a historic resource of 364,381 tonnes containing 100,060 ounces of gold and 473,052 ounces of silver at 8.54 g/t and 40.38 g/t, respectively.

Full results from the program released this morning can be found here.

SilverCrest Metals last traded at $11.57 on the TSX.

Information for this briefing was found via Sedar and SilverCrest Metals. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.