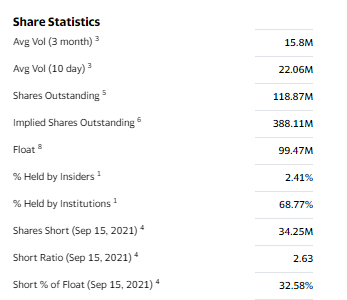

Shares of SmileDirectClub, Inc. (NASDAQ: SDC), creator of a clear aligner medtech platform for teeth straightening, soared around 25% in early October as the company suddenly became a hot topic among Reddit investors. Its key attribute seems to be a high level of short interest; the 34.25 million shares shorted as of mid-September represents about a third of the float.

Otherwise, the “dentistry-light” play must surmount a number of challenges which appear to be structural, not transitory. First, SmileDirect faces significant competitive pressures. Align Technology, Inc. (NASDAQ: ALGN) incentivizes dentists to market its clear aligner to potential customers with the resources to access dental services. Another competitor, Dentsply Sirona Inc. (NASDAQ: XRAY) now offers a low-cost option that allows customers to chat with one of its dentists on a virtual basis.

Second, these competitive pressures are affecting SmileDirect’s financial results. Revenues in 2Q 2021 declined sequentially by US$26 million, or 14%, from 1Q 2021 levels. Similarly, adjusted EBITDA fell to a loss of US$22.5 million in the second quarter from a gain of US$4.9 million in the previous period. The company’s cash balance plummeted more than US$60 million to US$377 million in 2Q 2021 alone.

| (in thousands of U.S. dollars, except for shares outstanding) | 2Q 2021 | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 |

| Revenue | $162,587 | $188,802 | $172,577 | $156,459 | $94,409 |

| Adjusted EBITDA | ($22,476) | $4,918 | $7,165 | $3,021 | ($20,288) |

| Operating Income | ($53,200) | ($27,829) | ($19,200) | ($27,765) | ($74,019) |

| Operating Cash Flow | ($31,013) | ($28,338) | ($14,800) | $16,621 | ($15,444) |

| Cash – Period End | $376,648 | $434,545 | $316,724 | $373,045 | $388,971 |

| Debt – Period End | $770,679 | $772,191 | $436,374 | $447,719 | $454,666 |

| Shares Outstanding (Millions) | 387.9 | 387.2 | 386.3 | 385.9 | 385.5 |

Third, SmileDirect’s valuation looks quite elevated based on either of these key parameters. The company’s enterprise value (EV) is about US$2.8 billion, yet its adjusted EBITDA over the trailing twelve months is negative US$7.4 million. In addition, revenue over the last twelve months totaled US$680 million, so that the company’s EV-to-revenue ratio is about 4.1x, a high figure for a company which has difficulty growing.

Finally, oral care is a good business, but not one that is grow rapidly enough to justify “growth stock” multiples for key participating companies. Indeed, the consulting firm Grand View Research estimates the global oral care market totaled around US$31.7 billion in 2020 and projects it to increase at an average 5.9% annual pace over the 2021-2028 period.

U.S. Medicare does not cover most dental care, dental procedures, or supplies. Democrats in the U.S. are hoping to pass spending legislation which would change this. If the Democrats, which narrowly controls both the House of Representatives and Senate were to succeed in this goal, dental-related stocks, including SmileDirect, could rally.

SmileDirect may be another in a growing line of stocks which has been lifted solely by chatter on Reddit without any seeming regard for its valuation or growth prospects. Investors may want to consider using the rally to lighten up on their positions.

SmileDirectClub, Inc. last traded at US$5.54 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.