On April 4th, Starbucks (Nasdaq: SBUX) announced that its founder, Howard Schultz, who left an active role in 2018, will be returning as its CEO and as a director on the Board of Directors. Additionally, Schultz announced that the firm would be suspending its $20 billion buyback program, writing, “This decision will allow us to invest more into our people and our stores — the only way to create long-term value for all stakeholders.”

Starbucks currently has 37 analysts covering the stock with an average 12-month price target of US$112.52, or a 28% upside to the current stock price. Out of the 37 analysts, 9 have strong buy ratings, 10 have buys, 17 analysts have hold ratings and 1 analyst has a strong sell rating on the stock. The street high sits at US$136, which represents a 55% upside to the current stock price.

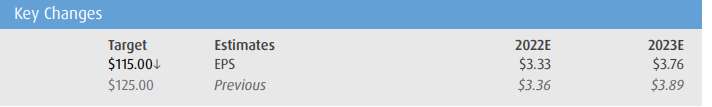

In BMO’s note they reiterate their outperform rating but lower their 12-month price target from US$125 to US$115, saying that the stock buyback suspension shows a clear message on priorities.

Though BMO calls this suspension a surprise they reassure investors by writing, “we do not believe it is indicative of meaningful long-term fundamental issues, but rather a reprioritization of resources as Mr. Schultz works to improve employee relations.”

They add that the U.S sales environment should remain strong and will likely see improved mobility, while the company will see cost headwinds and COVID-related challenges in its second-largest market of China. Though they do expect that the company will successfully navigate the cost issues over time and that China trends will recover “at some point.”

BMO lowered its price target, mainly due to them having to lower its earnings per share estimate as a result of the buyback suspension. They lowered their 2022 earnings per share estimate by $0.03 while reducing their 2023 earnings per share estimate by $0.13 as they do not expect the repurchases to resume in 2023.

Lastly, BMO believes that the risk/reward on Starbucks shares is weighted favorably and remains positive on the longer-term fundamentals. They write, “At ~23x P/E on our depressed FY23 estimate and with expectations for lowered guidance, a China recovery seemingly written off until FY23, still favorable US sales dynamics, and the return of an impactful leader, we remain Outperform-rated on SBUX.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.