On September 25, BMO issued a note on Starbucks (NASDAQ: SBUX) titled “U.S. Store Base Undergoes Its Own Social Distancing.” Within, they reiterate their $140 12-month price target and outperform rating. This comes after they updated their Starbuck’ U.S store overlap, “and found its Trade Area Transformation program has created a meaningful reset lower of its U.S. store overlap.”

Starbucks currently has 36 analysts covering the stock with an average 12-month price target of $131.11, or a 15% upside. Out of the 36 analysts, 11 have strong buy ratings, 10 have buy ratings, 14 have hold ratings and a single analyst has a strong sell rating. The street high sits at $148 while the lowest price target comes in at $95.

BMO Capital Markets says that their evaluation of Starbucks store locations suggests that the U.S store overlap trajectory has reversed in the last several years, as the percentage of Starbucks stores that have at least one other location in a one-mile radius has fallen to the lowest level in 5 years.

With Starbucks “materially” lowering their density of locations, BMO believes that this means they are now better positioned for long-term same-store sales growth. In 2019, 64.5% of Starbucks stores had another store located within a one-mile radius, a metric that has slipped down to 62.1% in 2021. While the actual number of stores declined to 2.2 stores versus the 3.6 stores in 2019.

Because of the stores within a mile radius falling, BMO says “We gain confidence in our view that margins will prove stronger than anticipated and drive upside to earnings estimates over time-based.”

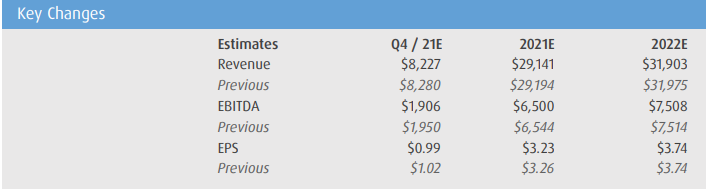

Below you can see BMO’s updated fourth quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.